India 2-Wheeler Market : Current Analysis and Forecast (2024-2032)

$3999 – $6999

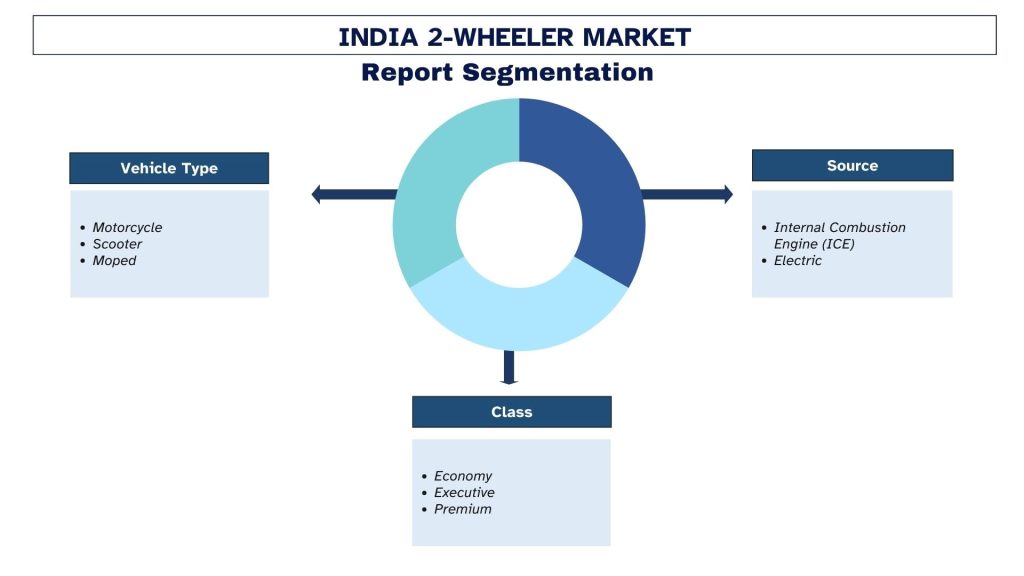

Emphasis on Source Type (ICE (Internal Combustion Engine, E2W (Electric 2-Wheeler)), ICE 2W Vehicle Type (Motorcycle, Scooter, Moped, Performance Bike, Other), ICE 2W Vehicle Class (Economy, Executive, Premium, Other)

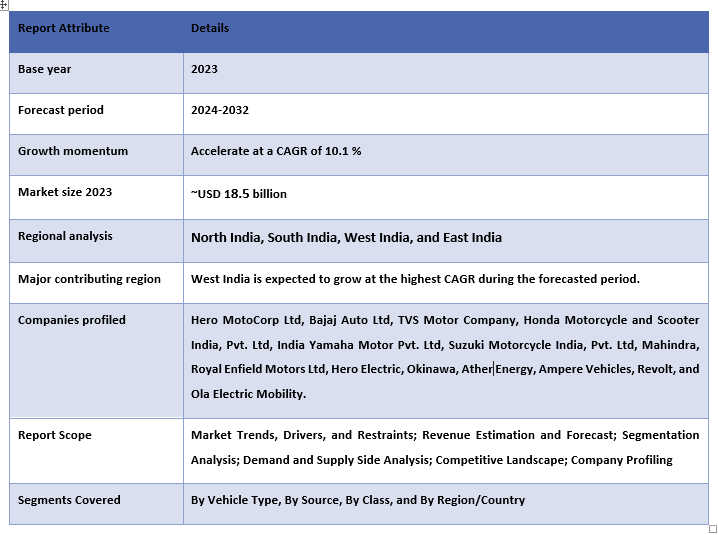

| Published: | Mar-2020 |

|---|---|

| Pages: | 81 |

| Table: | 32 |

| Figure: | 47 |

| Report ID: | UMAU20178 |

Report Description

India 2-Wheeler Market Size & Forecast

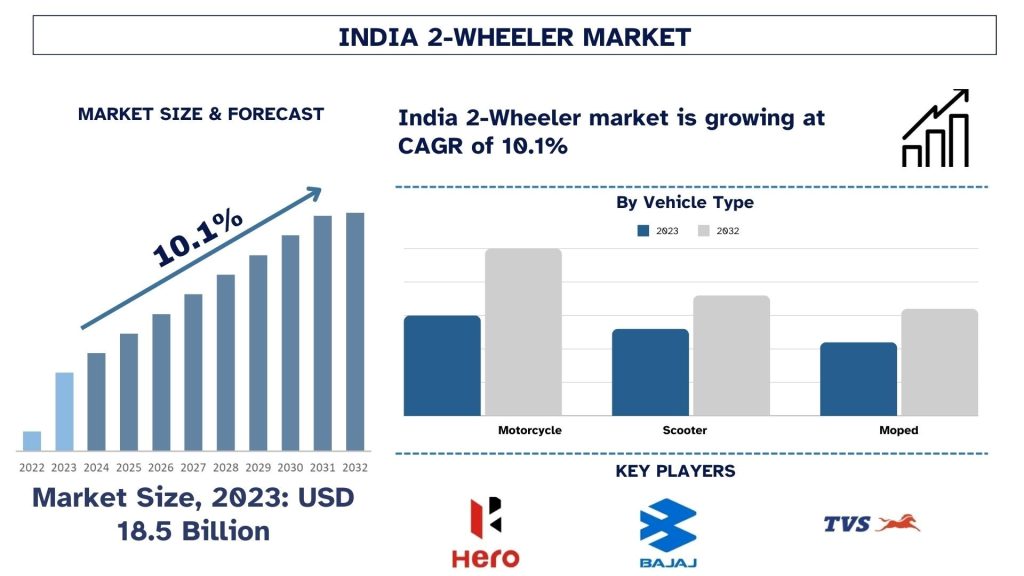

The India 2-Wheeler market was valued at approximately USD 18.5 Billion in 2023 and is expected to grow at a robust CAGR of around 10.1% during the forecast period (2024-2032) owing to the rising urbanization, affordability, increasing disposable income, and the shift towards electric mobility.

India 2-Wheeler Market Analysis

Key factors influencing the growth of India’s two-wheeler market are favorable macroeconomic and demographic trends, increasing workforce participation, improvement in rural income/disposable income, and rising government and private sector initiatives for EV adoption. India is a massive market for two-wheelers which accounts for 70% of the 200 million total vehicles running across the length and breadth of this huge nation. This common man’s commute is also responsible for over 20% of the total CO2 emissions, and about 30% of the particulate emissions in urban areas (PM2.5). Since this segment is bound to grow further, there is an urgent need to switch to a cleaner mode, mainly in the urban areas, as 7 of the 10 most polluted cities across the world are in India.

India 2-Wheeler Market Trends

This section discusses the key market trends influencing the India 2-Wheeler segments as identified by our research experts.

Motorcycle Vehicle Type Transforming Industry

Based on vehicle type, India’s 2-wheeler market has been segmented into Motorcycles, Scooter, and Moped. The motorcycle was the largest segment in 2023. The average number of two-wheelers per 1000 people in India is 31. The urban market for two-wheelers is largely penetrated with nearly 57 of every 100 youths that earn an income to support the ownership of a two-wheeler. The Indian 2-wheeler industry is dominated by 3 major players, which account for more than 80% share in the industry.

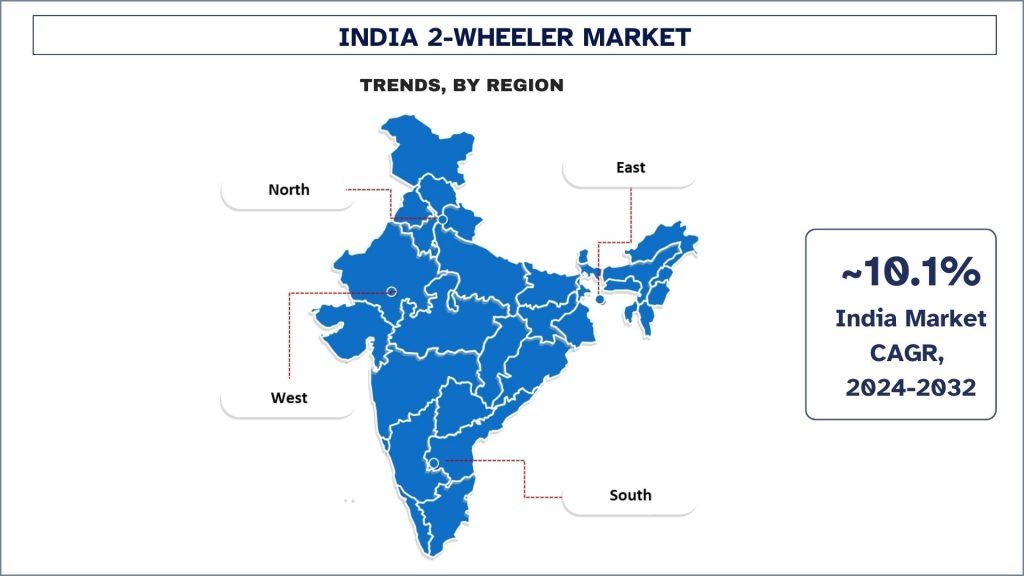

North India Dominated the Market in 2023

India is a massive market for two-wheelers which accounts for 70% of the 200 million total vehicles running across the length and breadth of this huge nation. This common man’s commute is also responsible for over 20% of the total CO2 emissions, and about 30% of the particulate emissions in urban areas (PM2.5). Since this segment is bound to grow further, there is an urgent need to switch to a cleaner mode, mainly in the urban areas, as 7 of the 10 most polluted cities across the world are in India. For instance, 2-Wheeler penetration in states like Delhi is much higher than the pan-India penetration due to the relatively higher degree of urbanization in the states. With urbanization expected to rise progressively, around 89 million people are estimated to be added to India’s urban spaces over the next decade (78 million people are estimated to have been added over the last decade), which could potentially be one of the most defining changes likely to transpire the 2-Wheeler Market over the forecast period.

India 2-Wheeler Industry Overview

India 2-Wheeler is competitive, with several India and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market are Hero MotoCorp Ltd, Bajaj Auto Ltd, TVS Motor Company, Honda Motorcycle and Scooter India, Pvt. Ltd, India Yamaha Motor Pvt. Ltd, Suzuki Motorcycle India, Pvt. Ltd, Mahindra, Royal Enfield Motors Ltd, Hero Electric, Okinawa, Ather Energy, Ampere Vehicles, Revolt, and Ola Electric Mobility.

India 2-Wheeler Market News

For instance, in 2024, Honda R&D India Pvt. Ltd., a subsidiary of Honda Motor Company, has inaugurated its new Solution R&D Centre located in Bengaluru, Karnataka. The new R&D centre will be working towards the development of the brand’s upcoming electric motorcycles and scooters. Honda is all set to introduce its maiden electric two-wheelers for India this year, and the new R&D centre is likely to play a key role in the same.

India 2-Wheeler Market Report Coverage

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

India 2-Wheeler can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs; hence, feel free to connect with us to get a report that completely suits your requirements.

Frequently Asked Questions (FAQ)

Ans: The India 2-Wheeler market was valued at USD 18.5 Billion in 2023 and is expected to grow at a CAGR of 10.1% during the forecast period (2024-2032).

Ans: The growth of the India 2-Wheeler market is driven by increasing urbanization, affordability, increasing disposable income, and the shift towards electric mobility.

Ans: The motorcycle segment has the largest India 2-Wheeler share by vehicle type.

Ans: Emerging trends in India's two-wheeler market include the rapid adoption of electric vehicles (EVs), on-demand mobile services, and the integration of smart technologies like IoT and connected dashboards. Additionally, innovative financing options such as subscription models and micro-financing are making two-wheelers more accessible to a wider audience.

Ans: North India is expected to dominate the market in 2023. Q1: What is India 2-Wheeler current size and growth potential?

Q2: What are the driving factors for the growth of India 2-Wheeler?

Q3: Which segment has the largest share of the India 2-Wheeler by Vehicle Type?

Q4: What are the emerging technologies and trends in India 2-Wheeler?

Q5: Which region will dominate the India 2-Wheeler Market?

You can also purchase parts of this report. Do you want to check out a section wise

price list?

Research Methodology

Research Methodology for the India 2-Wheeler Market Analysis (2024-2032)

Analyzing the historical market, estimating the current market, and forecasting the future market of the India 2-Wheeler market were the three major steps undertaken to create and analyze the adoption of India 2-Wheeler in major regions. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, numerous findings and assumptions were taken into consideration to validate these insights. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the India 2-Wheeler market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the India 2-Wheeler market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of India 2-Wheeler, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report, such as vehicle type, source, class, and region. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the India 2-Wheeler market. Further, we conducted factor analysis using dependent and independent variables such as vehicle type, source, class, and India 2-Wheeler regions. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the India 2-Wheeler market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above three steps, we arrived at the current market size, key players in the India 2-Wheeler market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2032 for different segments and sub-segments across the major markets. The research methodology adopted to estimate the market size encompasses:

The industry’s market size, in terms of revenue (USD) and the adoption rate of the India 2-Wheeler across the major markets domestically

All percentage shares, splits, and breakdowns of market segments and sub-segments

Key players in the India 2-Wheeler in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs), including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

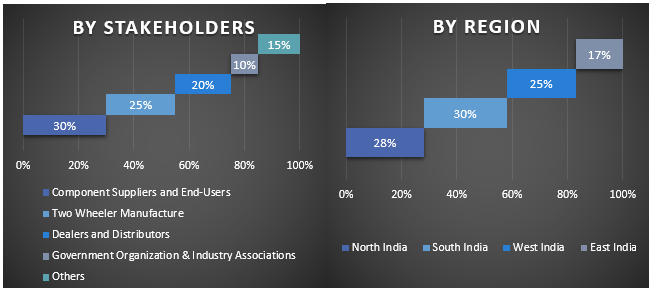

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the India 2-Wheeler. Data was split into several segments and sub-segments after studying various parameters and trends in the vehicle type, source, class, and regions of the India 2-Wheeler market.

The main objective of the India 2-Wheeler Market Study

The current & future market trends of the India 2-Wheeler were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the India 2-Wheeler market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of vehicle type, source, class, and regions.

- Define and analyze the regulatory framework for the India 2-Wheeler

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the India 2-Wheeler market for the major regions.

- Major regions studied in the report include North India, West India, South India and East India

- Company profiles of the India 2-Wheeler market and the growth strategies adopted by the market players to sustain in the fast-growing market.

- Deep dive regional level analysis of the industry