MIDDLE EAST REAL ESTATE MARKET SEEN SOARING 6.1 % GROWTH TO REACH USD 2,264.89BILLION BY 2030, PROJECTS UNIVDATOS MARKET INSIGHTS

- Himanshu Patni

- June 26, 2024

- BUILDING MATERIAL AND CONSTRUCTION, NEWS

- Middle East Real Estate Market, Real Estate Market

- 0 Comments

According to a new report by Univdatos Market Insights, the middle east real estate market is expected to reach USD 2,264.89 Billion in 2030 by growing at a CAGR of 6.1%. The Middle East has long been considered one of the most lucrative regions for real estate investment. With its rapidly growing economies, increasing population, and substantial government spending, the region offers ample opportunities for investors looking to capitalize on its booming property market. In this article, we will delve into the current state of the Middle East real estate market, exploring its various segments, trends, and future prospects.

Demand for Real Estate in MENA:

The demand for real estate in the Middle East is driven by several factors, including economic growth, urbanization, and a rising middle class. As the region continues to experience rapid industrialization and infrastructure development, the need for residential, commercial, and industrial spaces has increased significantly. Additionally, the increasing number of expatriates working in the region has fueled the demand for high-end luxury properties.

Types of Properties

The Middle East real estate market offers various types of properties, including residential, commercial, and luxury real estate. Residential properties, such as apartments and villas, are in high demand, driven by population growth and strong investment potential. Commercial properties, including office spaces and retail outlets, are also prominent in the market, catering to the region’s growing business and retail sectors. Additionally, the luxury real estate segment, characterized by high-end properties and amenities, attracts affluent individuals from the Middle East, Asia, and Europe. The market also features different property ownership regimes, such as long-term leases and foreign ownership restrictions in some Gulf Cooperation Council (GCC) countries.

For More Detailed Analysis in PDF Format, Visit- https://univdatos.com/get-a-free-sample-form-php/?product_id=55347

The most popular types of properties in the Middle East real estate market include:

Residential Properties: Such as apartments, condominiums, villas, and landed houses, which are in high demand due to population growth and investment potential.

Commercial Properties: Including office spaces and retail outlets, catering to the region’s growing business and retail sectors.

Luxury Real Estate: Characterized by high-end properties and amenities, attracting affluent individuals from the Middle East, Asia, and Europe.

These property types collectively contribute to the dynamic and diverse nature of the Middle East real estate market, offering investment opportunities across various segments.

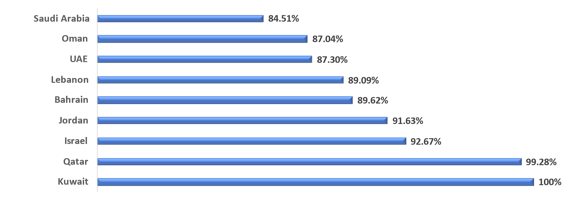

FIG #: Middle East countries: Urbanization in 2021

Increasing urbanization:

Urbanization has been one of the primary drivers of the real estate sector in the MENA region, particularly over the past few decades. As cities in the area have grown rapidly, so has demand for housing, commercial space, and other types of property. This surge in demand has led to increased investment in new developments, including both residential and office spaces. Moreover, governments across the region have implemented policies aimed at attracting foreign investment and promoting economic diversification, further fueling the growth of the real estate market. The rise of e-commerce and the growing popularity of online shopping have also contributed to the need for more warehousing and logistics facilities, which in turn has driven up demand for industrial properties. All these factors combined have made the MENA real estate market an attractive destination for investors seeking strong returns.

Conclusion:

In conclusion, the Middle East real estate market is a dynamic and rapidly growing sector, driven by strong demand fundamentals and significant investment opportunities. The market encompasses various property types, and the cost of properties varies depending on the type and location. With continued population growth and economic development, the real estate market in the Middle East is poised for further expansion and investment opportunities.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2023−2030.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by property type.

Competitive Landscape – Top Key Vendors and Other Prominent Vendors