Transforming the Financial Landscape: The Power of AI in Banking and Financial Services

Overview

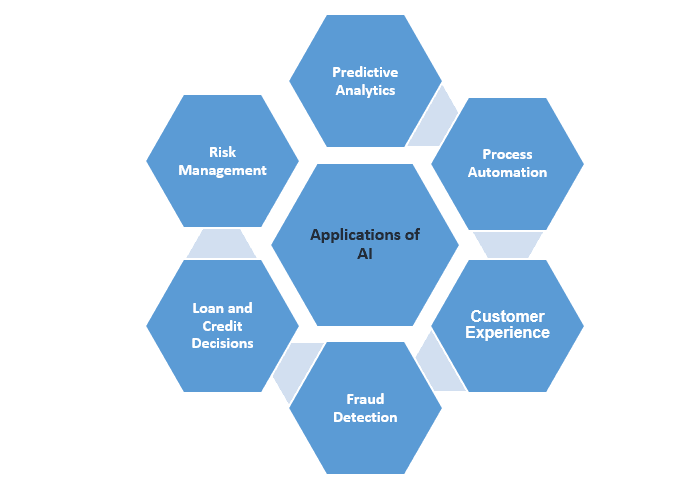

Almost every industry, including banking and finance, has been significantly disrupted by artificial intelligence. The industry is now more customer-centric and technologically relevant thanks to the inclusion of AI in banking apps and services.

By increasing productivity and making decisions based on data that is incomprehensible to a human agent, AI-based systems can help banks cut costs. Additionally, intelligent algorithms can quickly detect false information.

The adoption of AI by financial institutions (FIs) will accelerate as technology advances, user acceptance rises, and regulatory landscapes change. By providing customers with 24-hour access to their accounts and financial advice services, banks can greatly enhance the customer experience and streamline laborious processes using AI.

Applications of AI in Banking and Finance

Example

U.S. Bank is using AI in both its middle- and back-office applications

U.S. Bank unlocks and analyses all relevant data on customers via deep learning to help identify bad actors. It’s been using this technology for anti-money laundering and, according to an Insider Intelligence report, has doubled the output compared with the prior systems’ traditional capabilities.

As per as the Research Report of “UnivDatos Market Insights” the market for fraud prevention and detection is steadily growing, as shown by the above chart. Its value will have greatly increased from $14.37 billion in 2016 to $41.50 billion in 2022.

Benefits of AI

Recent Developments

· MoMo, a fintech company with a presence in Vietnam, has unveiled a super-app that combines payment processing with financial transaction processing into a single self-contained online commerce platform. MoMo uses NVIDIA GPUs running in Google Cloud to increase the effectiveness of the platform’s chatbots, know-your-customer (eKYC) systems, and recommendation engines.

· Anti-fraud Regtech Luzerner Kantonal bank AG (LUKB), a Swiss retail banking organisation, has chosen Net Guardians to strengthen its fraud prevention system. As a result of the software’s ability to create precise profiles of bank customers, it can identify suspicious transactions and other activities with great accuracy.

Future of AI in Financial Services

Almost every industry is being impacted by digital technology, which is not only changing those industries but also how businesses operate. To succeed in this technologically advanced world, every industry is currently researching options and putting strategies into practice.

In order to provide services like mobile banking, e-banking, and real-time money transfers, the banking industry has increased its presence in the retail, IT, and telecom sectors. These cutting-edge features give customers access to banking at their fingertips, but they cost the banking sector money.

Artificial intelligence’s main objective in the banking sector is to help customers by prioritising their options. Artificial intelligence also contributes to the satisfaction of customers with the bank’s services. The bank benefits from AI or machine intelligence in its understanding of customer expectations.

Conclusion

The potential of AI in FinTech is still evolving as we move into a completely new digital era. One thing is certain brands need to leverage the power that artificial intelligence offers. Organizations should be watchful about what new features they can avail with the help of Artificial Intelligence.

Author: Divyansh Tiwari