إحداث ثورة في التجارة: تطور خدمات الشراء الآن والدفع لاحقًا (BNPL)

ما هي خدمة BNPL؟

خدمة BNPL وتسمى أيضًا الشراء الآن والدفع لاحقًا هي خيار دفع يمكنك من خلاله إجراء عملية شراء دون الحاجة إلى الدفع من جيبك الخاص. بشكل عام، تقوم بالتسجيل في مؤسسة تقدم هذه الخدمة تقوم بالدفع عند إجراء عملية الشراء.

ومع ذلك، بمجرد أن يسدد المُقرض المبلغ نيابة عنك، سيتعين عليك سداد المبلغ خلال فترة محددة. بالمقارنة بالقرض الشخصي، لا يتم فرض أي فائدة بموجب خطة BNPL. يمكنك إما دفعها كمبلغ دفعة واحدة، أو يمكنك دفعها من خلال أقساط شهرية متساوية بدون فوائد. إذا فشلت في دفع المبلغ خلال فترة السداد المحددة، فيحق للمُقرض فرض فائدة على المبلغ المستحق عليك. أي تأخير قد يؤثر على درجة الائتمان الخاصة بك بشكل كبير.

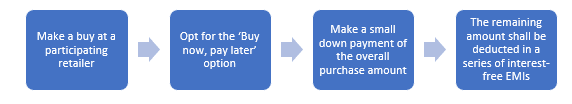

كيف تعمل خدمة BNPL؟

يتشارك مزودو خدمة BNPL في نفس نموذج التشغيل، مع كون شروط العقد هي المحدد الوحيد. عادة ما يبدو الأمر هكذا:

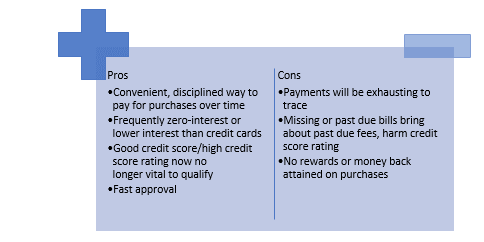

إيجابيات وسلبيات الشراء الآن والدفع لاحقًا

تطور خدمة BNPL

على مدار العام الماضي، رأينا المزيد من موردي BNPL بالإضافة إلى عمالقة الدفع الراسخين (مثل PayPal - Pay in 4 وAmex - plan It) يقدمون خدمات BNPL للعملاء في أي متجر يقبل الشبكة الأساسية (مثل MasterCard أو Visa أو البورصة أو PayPal).

ولكن مع بدء تزايد الاعتراف بخدمة BNPL واستخدامها بشكل كبير، مع وجود أكثر من 7 ملايين حساب نشط في أستراليا اليوم، رأى أصحاب رؤوس الأموال أخيراً التهديد الذي كان يظهر: ليس فقط الانخفاض في استخدام/إيرادات MasterCard ولكن الأهم من ذلك هو بناء مشاركة العملاء وثقتهم العالية مع لاعبي BNPL الجدد هؤلاء.

السؤال الرئيسي هو من هم هؤلاء الذين سيغلفون مقترحات القيمة المضافة الخاصة بهم، مثل توصيات المنتج وتتبع الطلبات وبرامج الولاء للعملاء وخدمات الرؤى للتجار لتقديم أفضل تجربة تسوق؟

مع التشبع في الصناعات الأساسية، يسعى موردو BNPL إلى فئات جديدة (مثل الصحة والسفر والمدفوعات الحكومية) وشرائح العملاء التي سينمو فيها - ليس فقط من وجهة نظر المتسوق ولكن أيضًا من منظور الأعمال. الشركات الصغيرة والمتوسطة هي واحدة من قطاعات التركيز الرئيسية على مدار الأشهر القليلة الماضية مع إطلاق منتجات B2B جديدة.

بالتوازي مع ذلك، اعتمد موردو BNPL طرقًا متخصصة مع مقترحات أسعار خاصة بالفئة والتركيز على أن يصبحوا خيار الدفع المفضل/قائد الفئة. يجب عليهم أن يضطروا إلى تنويع ليس فقط المنتجات والخدمات ولكن أيضًا للوصول إلى مصادر إيرادات جديدة وزيادة أهميتها المستقبلية حيث أدت إلى اعتماد نماذج شراكة مختلفة.

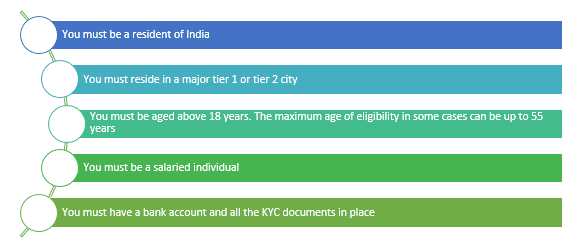

معايير الأهلية للشراء الآن والدفع لاحقًا في الهند

معايير الأهلية التي قد تستوفيها للاستفادة من تسهيلات الشراء الآن والدفع لاحقًا هي:

التراجعات الأخيرة في سوق BNPL

ازدهرت صناعة BNPL خلال فترة انخفاض أسعار الفائدة، واختبر العديد من الموردين تقييمات عالية في فترة زمنية قصيرة جدًا. في عام 2021، تم تقييم عمالقة BNPL Affirm وKlarna بـ 47 مليار دولار و46 مليار دولار على التوالي. على الرغم من أن مزودي BNPL يواجهون حاليًا مشكلة بسبب الارتفاعات المفرطة في التقييم، فمن المؤكد أن صناعة التمويل القصيرة موجودة لتبقى.

في حين أن الشركات الناشئة في BNPL تفوز حاليًا بسباق تمويل نقاط البيع، فإنها تحتاج إلى دمج التقنيات المناسبة لتناسب الإشراف التنظيمي والاحتفاظ بنفس الراحة، وإلا فإنها قد تخاطر بفقدان حصتها في السوق للبنوك التي تدخل سوق تمويل نقاط البيع.

التغييرات الرئيسية على مدار الـ 12 شهرًا الماضية

الاتساق الوحيد في أنماط الحياة هو البثق وأيضًا وصل وتيرة التبادل داخل مؤسسة BNPL إلى مستويات جديدة. في حين أن عامي 2019 و2020 يسيطر عليهما تقنيات "الاستيلاء على الأراضي" لشركات BNPL للاستفادة من حصة السوق في قطاعات المستهلكين "الراسخة" والصناعات الجذابة مثل الموضة والبيع بالتجزئة والتحسينات المحلية، فقد رأينا جيلاً حاليًا من التطور داخل منطقة BNPL وتأثيرًا أوسع داخل مؤسسة العروض الاقتصادية في عام 2021.

الخلاصة

يبدو تمويل الشراء الآن والدفع لاحقًا مثيرًا للاهتمام أيضًا في حال لم تتمكن من دفع جميع فواتيرك على الفور أو لم تكن ترغب في ذلك. تعمل هذه القروض على تحسين أهليتك الائتمانية دون فرض أسعار فائدة عالية عليك، ولكن لديها خطة تعويض، لذلك لا ينتهي بك الأمر في كومة من الديون المستمرة. ولكن تذكر، إذا كانت الفاتورة تستحق أقل وما هي العواقب إذا لم تتمكن من دفعها.

قد يكون مستقبل BNPL مشرقًا للغاية. لأن هذه الفكرة ستجذب المزيد من العملاء وتجعلهم يشترون العنصر المحدد على الفور. يقدم معظم الدائنين الذين يقدمون هذه الميزة استرداد EMI مجاني.

قد يكون هذا بديلاً مفضلاً للعمولات في المستقبل، خاصة للعديد من الشباب. لكنه لا يزال مثل الرهن العقاري الذي يتعين على المشتري سداده في النهاية.

يحذر الدائنون الذين يقدمون هذا المزود حاليًا بشأن تقديم هذه الميزة حيث لا يمكن لجميع الأفراد سداد المبلغ خلال مبلغ القاعدة المحدد. مرئي، ولكن فقط إذا كان الكيان المحلي للمشتري يمكنه الاستفادة من المنشأة بشكل صحيح وإصدار الأرقام على الفور.

المؤلفة: ديبانشي سينغ