The Growing Emphasis on Safety And Fuel Efficiency In Vehicles Propelled the Growth of the Automotive Steel Wheels Market in the APAC Region!

Author: Himanshu Patni

12 August 2023

The growing emphasis on safety and fuel efficiency in vehicles is boosting the growth of the automotive steel wheels market in the Asia Pacific region in several ways. First, the increased demand for fuel-efficient vehicles is driving demand for lightweight wheels, which are an effective way to reduce fuel consumption and emissions. Steel wheels are a lightweight alternative to aluminium wheels, and they are becoming increasingly popular in the Asia Pacific region due to their fuel efficiency benefits. Second, the growing emphasis on safety in the region is leading to an increased demand for steel wheels that are designed to improve vehicle stability and handling. Steel wheels are known for their strength and durability, and they are an effective way to improve the overall performance and safety of a vehicle. This has led to an increased demand for steel wheels in the region, particularly in markets where safety is a high priority.

Access sample report (including graphs, charts, and figures):https://univdatos.com/report/automotive-steel-wheels-market/get-a-free-sample-form.php?product_id=43460

Overall, the growing emphasis on safety and fuel efficiency in vehicles is driving the growth of the automotive steel wheels market in the Asia Pacific region. By providing a cost-effective and durable alternative to aluminum wheels, steel wheels are an attractive option for consumers who are looking to improve the performance and safety of their vehicles while also reducing fuel consumption and emission.

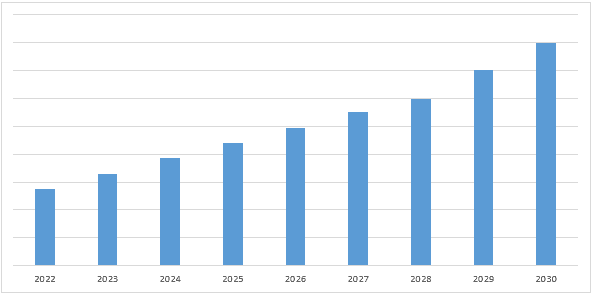

Further, the APAC Automotive Steel Wheels Market is expected to grow at a strong CAGR of 6.0% during the forecast period (2022-2028). Advancements in manufacturing technology are enabling manufacturers to produce steel wheels that are stronger, lighter, and more durable than ever before. This has led to an increased demand for steel wheels in the Asia Pacific region, as consumers seek to upgrade the performance and safety of their vehicles. Meanwhile, China constitutes to be the largest market in the APAC region, accredited to rising expenditure on automotive steel wheels technology and surging sales of automotive steel wheels devices, while Japan is the second largest player.

- Automotive Steel Wheels Market Revenue (2020-2030)- USD Mn

For a detailed analysis of the Global Automotive Steel Wheels Market browse through – https://univdatos.com/report/automotive-steel-wheels-market/

Based on vehicle type, the market is segmented into heavy commercial vehicle, light commercial vehicle, and passenger vehicles. Amongst these, the passenger vehicle segment has a significant share of the automotive steel wheels market because steel is a cost-effective and durable material that is well-suited for use in vehicles. Steel wheels are strong and able to withstand the demands of automotive use, and they are also relatively inexpensive compared to other materials such as aluminium or magnesium. In addition, steel wheels are widely available and can be produced using a variety of production techniques, making them a flexible and practical choice for automotive manufacturers.

By rim size, the market is segmented into 13-15 inches, 16-18 inches, 19-21 inches, and more than 21 inches. Among these, the 13-15 inches segment is one of the largest and most popular segments of the automotive steel wheels market, and it has a significant share of the market because this size wheel is well-suited for a wide range of passenger vehicles.13-15 inches wheels are typically used on smaller passenger vehicles, such as compact cars and subcompact cars. These vehicles tend to have smaller wheel wells and lower ground clearance, which makes 13-15 inches wheels a practical choice because they can be sized to fit the available space without compromising the vehicle’s performance or safety.

Global Automotive Steel Wheels Market Segmentation

Market Insight, by Vehicle Type

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Vehicle

Market Insights, by Rim Size

- 13-15 Inches

- 16-18 Inches

- 19-21 Inches

- More than 21 Inches

Market Insights, by Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Market Insight, by Region

- North America

- U.S.

- Canada

- Rest of North America

- Europe

- Germany

- UK

- Italy

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- Rest of the World

Top Company Profiles

- Schneider Electric

- Siemens

- ABB

- Samsung

- Honeywell International

- Robert Bosch GmbH

- LG Electronics

- ASSA ABLOY

- ACUITY BRANDS, INC.

- Cisco Systems, Inc.

Get a call back