“Millennial Impact: How Technology and Changing Preferences Reshape the Real Estate Market”

Typically, people born between the middle of the 1980s and the middle of the 1990s are considered millennials. Compared to prior generations, their introduction into the real estate market has been distinct. In general, millennials are waiting longer than their baby boomer parents to purchase their first homes. There are a lot of causes for this delay, but some of the most frequently cited ones are heavy student loan debt loads and the ongoing consequences of career stagnation brought on by the Great Recession.

How millennials utilize technology while buying a home

Millennials are more inclined than previous generations to take advantage of electronic advancements in the real estate sector, whether it’s perusing real estate listings online or applying for a mortgage through an app. Since listings are being snatched up swiftly, they can schedule showings and review property information quickly thanks to app notifications. In comparison to previous generations, most millennial homebuyers (99 percent, per NAR) use the internet during some part of the home-buying process. The Silent Generation did not use mobile devices nearly as much as millennials do.

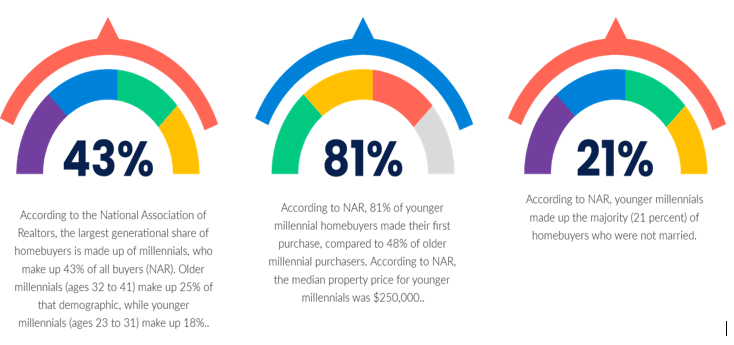

Key millennial homebuying statistics in 2022

Exhibit 1.

Note

According to a Bankrate analysis, the best cities for first-time homeowners in 2022 are Pittsburgh, Minneapolis, Cincinnati, Kansas City, and Buffalo.

According to Census data, there were 72.1 million millennials living in the United States as of 2019.

Does the property market have a peak?

Economists have expressed concern that the market may be reaching its peak soon as property prices continue to rise and mortgage rates increase in lockstep with rising interest rates.

According to ING’s senior international economist James Knightley, “the housing market is looking increasingly vulnerable with a price correction possible.” If prices did fall, a two-year stretch of some of the fastest price growth in decades would be reversed.

Due to a surge in demand from potential homeowners who were previously unable to enter the market because of pandemic limitations and a low supply as a result of supply chain delays, the market has been historically hot. However, economists anticipate a higher supply of properties to enter the market this summer.

This month, data from Realtor.com revealed that April 2022 had the smallest year-over-year reduction in housing supply since the end of 2019. Nevertheless, consumers have been facing a housing affordability crisis because of skyrocketing prices and an abnormally limited supply.

Millennials are changing the way real estate agents do their jobs.

In the past, giving crucial information about homes was what made realtors valuable. Since this information is now easily accessible, realtors’ worth now lies in their ability to negotiate deals, build lasting connections, and streamline the property buying process in the fast-paced, technological age.

The preference of millennials for text-based communication with realtors to make appointments and ask questions about homes has also been made possible by technology. Since requests for video tours and live streams are becoming popular, straightforward images frequently fall short as well.

Millennials are choosing the suburbs over the city.

More and more millennials are leaving the city. In contrast to urban and rural settings, a recent Zillow survey reveals that 47% of Millennial homeowners reside in the suburbs. The trend toward larger, more modern homes may be to blame for this change.

As we’ve demonstrated, a growing trend is people waiting to buy a starter house before moving on to something bigger and better. Apparently, millennials are discovering better opportunities outside of the metropolis. While more millennials than any other generation still reside in metropolitan areas, a third of them, according to the survey stated above. The migration to the suburbs may have intriguing repercussions for the rising cost of urban living.

Although millennials often receive criticism for their spending habits, buying daily lattes and avocado toast isn’t what prevents them from purchasing a home. The generation now between the ages of 26 and 41 is feeling the pinch just when they should be entering their financial prime, with the average U.S. home price now over $330,000 and decades-high inflation substantially outperforming salary improvements. As a result, many are delaying marriage and having children.

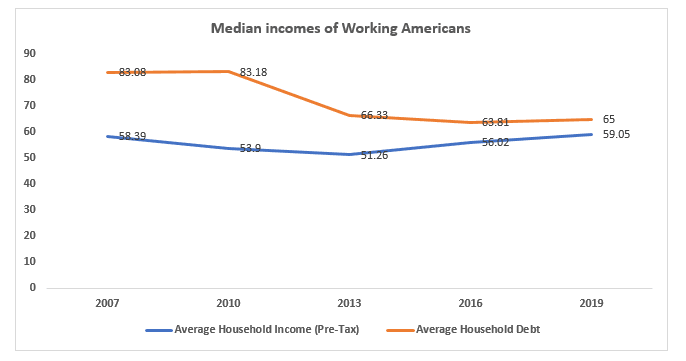

Millennials Had Less Money to Pay More Debt

After the Great Recession of 2008, the difference between the average household’s income and debt increased.

Exhibit 2.

According to the Economic Policy Institute, the decline in median incomes in 2008 was the biggest in a single year since 1967, and it persisted until 2012 when adjusted for inflation.

Student loans made up $211 billion of the $1.01 trillion in debt held by consumers between the ages of 18 and 29 in 2007, which was $40 billion more than the debt held by consumers between the ages of 30 and 39.

The following year saw substantial job losses for millennials who were already in the market, as the overall employment rate for people deemed to be of prime working age (those between the ages of 25 and 54) decreased by 2.2 million, according to the Bureau of Labor Statistics. Because of the tight labour market, millennials who had just graduated from college had few job prospects and minimal negotiating leverage, frequently having to compete with more experienced workers for entry-level positions.

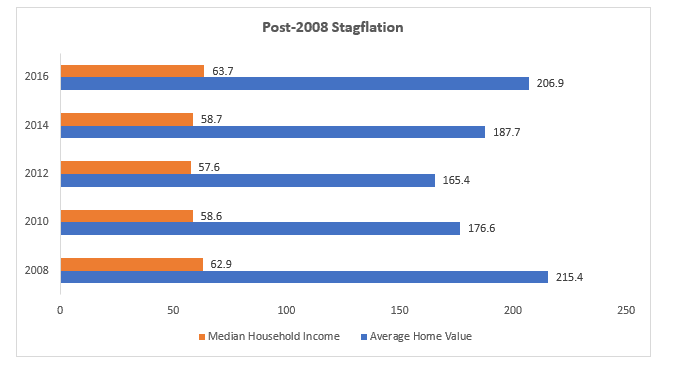

While incomes remained stagnant, home values skyrocketed.

The Great Recession set in just as many millennials reached the age at which their parents may have been considering homeownership, and mortgage rates rocketed up above 6%. The financial crisis had long-lasting impacts since median household incomes kept declining, falling to their lowest level in 2012 ($57,623). That only became worse as housing prices and daily living expenses recovered. Between 2012 and 2013, the median household income in the United States increased by a pitiful 3.5%, while property values increased by 6.5%. In 2020, only 47.9% of millennials in the United States were homeowners, per Apartment List’s analysis of census data. Home ownership among millennials reached 42% at age 30, compared to 48% for Gen Xers and 51% for baby boomers.

Exhibit 3

Conclusion

The housing market has been significantly impacted by millennials, and as the next generation of homebuyers enters the market, further changes could be in store. To put that evolution in perspective, it’s important to concentrate on the good contributions made by millennials. For instance, a focus on technology might lead to a simplified, more effective home-buying process. Additionally, more millennials relocating to the suburbs might help counteract the effects of rising housing costs in cities.

According to Gottlieb, growing up with social media is to blame for millennials’ quest for fast gratification in the property market. Even before the present supply chain issues, he observed, “They don’t appear to want to undertake improvements; they’d rather move in.” Previous generations were more receptive to renovating an older property and seeing the potential in something that wasn’t staged and professionally photographed, and this is leading to a wider gap in price, value, and days on market between older properties—even if they have great bones—compared with new construction.

Author: Sonu Kumar Sah