“Unlocking Financial Innovation: Exploring the Advantages and Challenges of Open Banking”

Overview

An Open Banking is a system which enables banks to make their application programming interfaces (APIs) more accessible to outside developers of new apps and services, giving customers more alternatives for financial transparency. Additionally, this technology will favourably alter how clients around the world do their financial transactions.

Open banking will enable third parties to build better personal financial management (PFM) applications but will also put pressure on incumbent banks to improve their own offerings. Open banking services are driving competition in the banking industry, requiring incumbent banks to improve their financial services or partner with fintech’s.

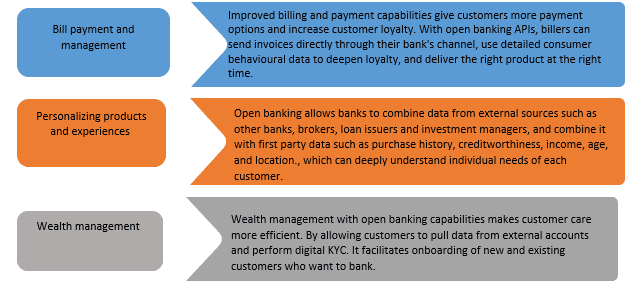

Used cases of Ope Baning

Pros and Cons of Open Banking

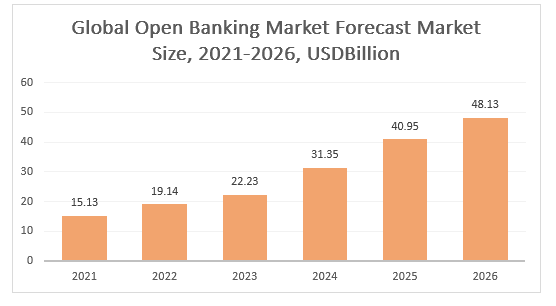

Market Growth of Open Banking

The global open banking market size is expected to grow from $15.13 billion in 2021 to $19.14 billion in 2022, at a compound annual growth rate (CAGR) of 26.5%. The global open banking market share is expected to grow to $48.13 billion by 2026 at a CAGR of 25.9%.

North America was the largest region in the open banking market in 2021. Asia Pacific is projected to be the fastest growing region in the global open banking market during the forecast period.

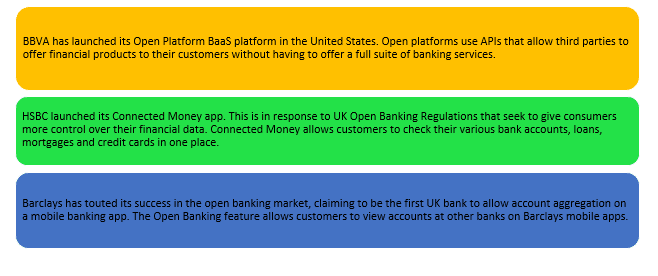

Recent Innovations in Open Banking

Conclusion

Open banking challenges traditional banking methods. Their goal is to bring innovation to the financial sector and create customer-centric systems while maintaining the highest security standards. Open banking is still relatively new, but it’s already benefiting businesses, consumers, and financial institutions.

Businesses now have access to more cost-effective payment services that improve conversion rates and help move money faster. Consumers benefit from improved payment flows, increased security. They receive and enjoy innovative financial solutions. Open banking gives consumers more control over their finances and more choices.

Open banking also has some drawbacks. Some traditional banks struggle to keep up with modern technology. User confidence in the new system remains relatively low, and face-to-face interactions between financial services providers and consumers have declined.

Author: Suryansh Verma