In many organizations, the constraint is not data access. It is synthesis.

Markets generate signals everywhere: inside your organization (sales data, CRM notes, supplier quotes) and outside it (competitor websites, news, public filings, trade data, policy updates, investor decks, job postings, and tender notices). The real gap is rarely “information.” It is turning scattered signals into a clear view of the market and turning that view into decisions you can defend.

That is where secondary research shines.

What secondary research really means

Secondary research is the systematic use of existing information to answer a business question, without generating new data through surveys, interviews, or field experiments.

Two words matter: systematic and existing. Good secondary research is not a collection of links. It is a method. You define the decision you need to make, identify what evidence would answer it, select credible sources, and build a coherent story supported by validation and cross-checks.

When secondary research is the fastest path to clarity

Secondary research is often the right first move when teams need direction quickly, especially in unfamiliar markets or categories.

It is effective for market entry and expansion, where leaders need clarity on which geographies are growing, where regulation is supportive or restrictive, whether adoption is real versus hype, and what routes to market actually work (direct, partner-led, tender-led, distributor-led).

It is equally valuable for competitive and category scans. The goal is not “a list of companies.” The goal is understanding who is positioned how, what they sell, what they claim, what they are investing in (hiring, partnerships, product launches), and what signals suggest they are truly prioritizing.

Secondary research also supports category sizing and demand estimation. The reliability depends on category transparency and the availability of credible proxies; in opaque markets, sizing is best framed as a range with clearly stated assumptions and sensitivity bands. The objective is not only “how big is the market,” but what drives it, what constrains it, how segments behave differently, and what portion is realistically serviceable.

For investors and strategy teams, it becomes the foundation for an investment thesis: value chain structure, margin pools, tailwinds, and the risks that could break the story.

And in procurement, secondary research is extremely practical. It helps build a credible supplier and category landscape: who can supply what, where, at what scale, with what certifications, and what risk signals exist even before the first call is made.

Where the data comes from

Decision-grade secondary research uses a mix of sources. A useful way to think about it is four buckets.

- Company and commercial signals: Annual reports, earnings commentary, investor presentations, product brochures, case studies, partner announcements, hiring patterns. These tell you how companies want to be perceived and what they are building toward, but they should be treated as directional, not definitive.

- Industry and market intelligence: Trade associations, analyst notes, industry journals, conference material, tender portals, project databases. These help you understand market structure, demand drivers, and competitive dynamics, but they still require validation.

- Government, regulators, and public institutions: Policy documents, regulatory filings, national statistics, customs summaries, public project plans. These are critical when market access, compliance, incentives, or tariffs can make or break the opportunity. Official data can lag fast-moving markets, so triangulation matters.

- Independent datasets and market proxies: Trade flows, pricing indices, commodity trackers, standards references, IP databases, litigation records. These often provide strong anchors for triangulation, especially when marketing claims are louder than facts.

A strong study rarely depends on a single bucket. It combines them so conclusions hold even if one source is incomplete or wrong.

Validation and triangulation: the difference between “information” and “intelligence”

Sources disagree. That is normal.

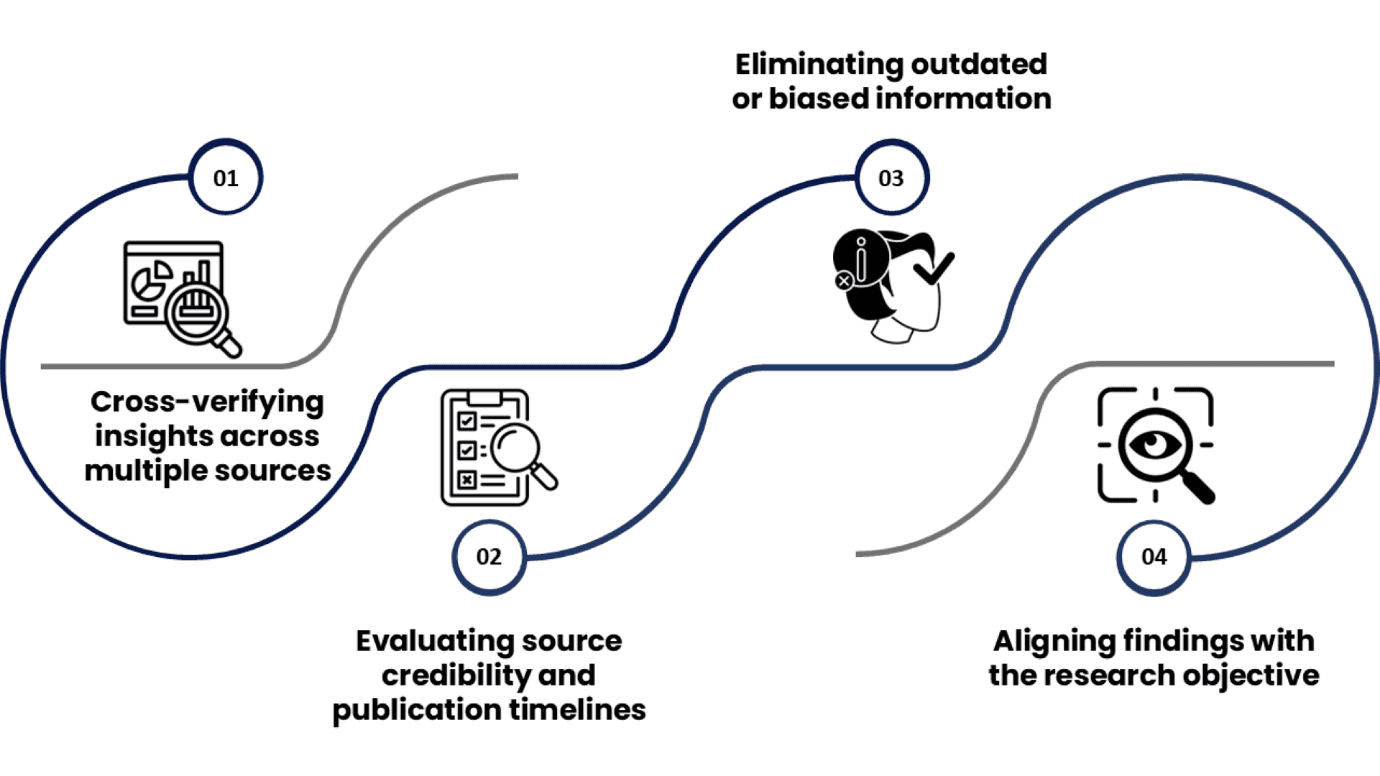

Credible secondary research depends on how you validate. A simple checklist goes a long way:

Are definitions aligned (revenue vs shipments vs capacity, installed base vs pipeline)?

Are units consistent (MW vs MWh, FY vs CY, local currency vs USD)?

Is scope comparable (global vs regional vs single-country, channel included or excluded)?

Do at least 2 to 3 independent sources point in the same direction?

Can the numbers be cross-checked with proxies (import volumes, project counts, installed assets, customer base)?

Are assumptions written down clearly, with sensitivity ranges?

Is confidence labeled (high, medium, low) on the most important conclusions?

Public and licensed sources should also be used responsibly, with respect for applicable terms and restrictions. The goal is not to extract everything possible. The goal is to build a reliable, compliant evidence base.

Benefits, and where secondary research stops being enough

Secondary research is powerful because it is fast, cost-efficient, and broad. It helps teams avoid building strategy on gut feel, align stakeholders on the same evidence base, and create a reusable foundation for proposals, monitoring, and decision-making.

But it has limits. Secondary research often cannot reliably reveal true pricing and discounting behavior, contract terms, margins, internal buyer decision processes, or how buyers will react to a specific value proposition. Public signals can be incomplete, biased toward success stories, or lagging reality.

Secondary research is not enough when you need willingness-to-pay, buyer journey validation, product-market fit testing for a narrow segment, or sensitive operational insights that emerge only in conversations or site context. In those cases, secondary research should sharpen what to test via primary research, not pretend to replace it.

Why UnivDatos: Turning Information into Usable Insights

Many teams can collect information. The differentiator is whether the output is decision-grade and reusable.

At UnivDatos, we take a deliverable‑led approach:

We start with the decision you are trying to make.

We build traceable models and structured datasets, not just descriptive slides.

We triangulate across multiple source buckets.

We package outputs so your team can reuse and update them.

Whether you need to understand a market, size a category, analyze competitors, build a supplier universe, or shape an investment thesis, our secondary analysis research services are the perfect fit to accelerate your momentum.

Tell us what you’re exploring, and we’ll craft a research plan that fits your needs.

Get connected with us today to learn how to turn your data into decisions and your decisions into success!