- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

The surge in the Adoption of Fuel Cell Electric Vehicles, and the Growing Government Support Propelled the Growth of the Clean Hydrogen Market in the North America Region!

Author: Vikas Kumar

November 24, 2023

The North America region is projected to dominate the forecast period as the region has the highest number of automotive manufacturers and production units that cater to the demand for clean hydrogens market. The foremost factors attributed to the boom of the market are the increasing favorable government policies, technological advancements, investment by governments and private players, and economic growth. Further on, the region is the world’s biggest automobile market, and governments in many countries, including USA and Canada have been actively promoting the adoption of fuel-cell electric vehicles to reduce pollution and carbon emissions by providing rebates on cars and trucks. For example, USA introduced financial incentives and tax benefits for FCEV buyers, making them more attractive and affordable. In addition, there are further funding programs for purchasing fuel cell vehicles for fleet operation. Presently, The U.S. Department of Energy leads research efforts to make hydrogen-powered vehicles in the USA an affordable, environmentally friendly, and safe transportation option. Hydrogen is considered an alternative fuel under the Energy Policy Act of 1992 and qualifies for alternative fuel vehicle tax credits.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=43655

Moreover, persistent support by the government to decarbonize the industrial sector with the help of hydrogen and to support the development of low-carbon and renewable hydrogen, in addition, under the Advanced Technology Vehicles Manufacturing Loan Program, the United States also provides subsidies to advanced technology vehicle and alternative fuel infrastructure manufacturers for establishing, expanding, or refitting manufacturing facilities. On the consumer side, FCEV tax credits are available in the United States to increase market demand. The California Fuel Cell Partnership targets one thousand hydrogen refueling stations (HRSs) and one million FCEVs by 2030.

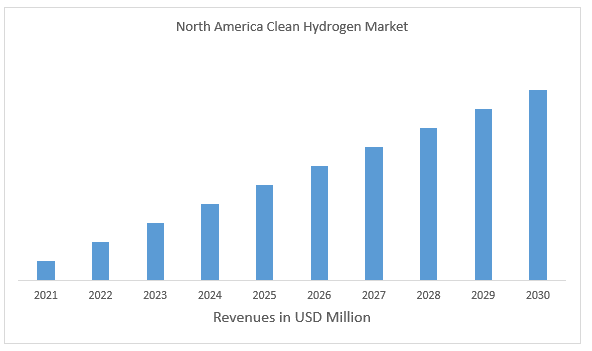

North America Clean Hydrogen Market Revenue (2022-2030)- USD Mn

Based on technology, the market is divided into alkaline electrolyzer, PEM electrolyzer, and SO Electrolyzer. Among these, the alkaline electrolyzer dominated the clean hydrogen and is expected to show the same trend in the forecast period. Alkaline electrolyzers are one of the most common types of technologies used in the production of hydrogen. These systems are usually composed of electrodes, a microporous separator, and an aqueous alkaline electrolyte of around 30% by weight KOH or NaOH solution. Moreover, alkaline electrolyzers provide valuable advantages over different forms of electrolysis technologies. They employ ample and inexpensive materials, including nickel-based catalysts, which make contributions to their affordability. This makes them a favorable preference for mass manufacturing and huge-scale hydrogen production, supporting the growing demand for clean energy solutions. Furthermore, alkaline electrolyzers have a high conversion efficiency, effectively splitting water into hydrogen and oxygen. This ensures minimal energy losses during the electrolysis procedure, leading to higher overall performance in producing clean hydrogen. For instance, in 2023, ThyssenKrupp Nucera introduced a new product name for its 20 MW alkaline electrolysis module, which will henceforth be called ‘scalum’. The launch of the new product name marks the next milestone in the long-term development of the ThyssenKrupp Nucera brand.

Based on end-users, the market is segmented into transport, power generation, industrial, and others. Among these, the transport segment has a high market share in 2022 and will dominate during the forecast period. This is due to the growing demand for hydrogen cars in recent years. Moreover, the demand for fuel-cell electric vehicles is driven by initiatives taken by governments of various countries to promote hydrogen cars as these cars produce only water vapor as exhaust, which is much cleaner than the carbon emissions produced by traditional gasoline-powered cars. Moreover, Hydrogen has a much higher energy density than gasoline, which means that hydrogen-powered cars can travel further on a single tank of fuel. This makes them an attractive option for long-distance travel. For instance, in 2022, according to the report published by MDPI, the sales of FCEVs increased year on year from 25,212 units in 2019 to 34,804 in 2020 to 51,437 in 2021.

Click here to view the Report Description & TOC https://univdatos.com/report/clean-hydrogen-market-2/

Global Clean Hydrogen Market Segmentation

Market Insight, by Technology

· Alkaline Electrolyzer

· PEM Electrolyzer

· SO Electrolyzer

Market Insights, by End-User

· Transport

· Power Generation

· Industrial

· Others

Market Insight, by Region

· North America

o U.S.

o Canada

o Rest of North America

· Europe

o Germany

o UK

o France

o Spain

o Italy

o Rest of Europe

· APAC

o China

o Japan

o India

o Australia

o Rest of APAC

· Rest of the World

Top Company Profiles

· Siemens Energy

· Air Liquide

· Engie

· Uniper SE

· Air Products Inc

· Cummins Inc

· Toshiba Energy System & Solution Corporation

· Nel ASA

· Linde plc

· Green Hydrogen System

Get a Callback