Guardians of Digital Fortresses: Ensuring Cybersecurity in the Banking Industry

Cybersecurity is an arrangement of technologies, protocols, and methods designed to prevent damage, hacking, data theft, malware, viruses, and unauthorised access to networks, devices, programmes, and data.

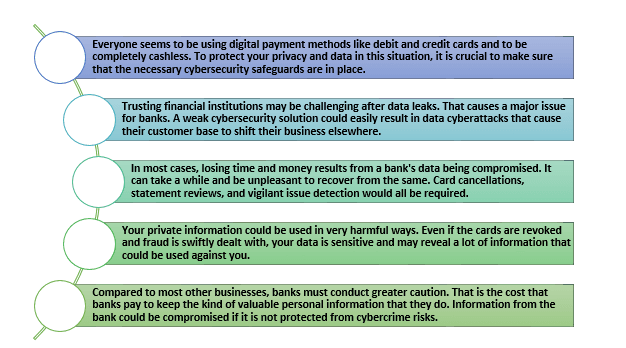

To protect customer information and money from criminals, banks need cybersecurity. When there are security problems, not only can customers be harmed, but the bank itself may also suffer irreparable reputational damage, reduce legal costs, and be subject to regulatory fines. People use digital payment methods like debit and credit cards to conduct transactions, and these methods need to be secured by cybersecurity.

Current Status of Cybersecurity in Banks:

The government notified Parliament on August 2, 2022: Indian banks reported 248 successful cyberattacks by hackers and criminals between June 2018 and March 2022.

11,60,000 cyberattacks were reported by the Indian government in 2022. It is predicted to increase by three times from 2019. India has been a target of significant cyberattacks, including the phishing attempt that almost led to a fraudulent transaction worth $171 million against the Union Bank of India in 2016. Union Bank of India was the victim of a cyberattack that involved online banking and caused a substantial loss. One of the officials opened a questionable link after falling for the phishing email, which gave the malware access to the system. Using fake RBI IDs, the attackers gained access to the system.

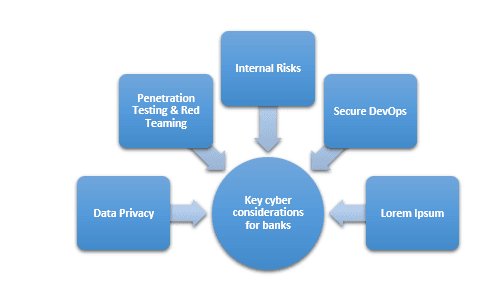

Why Cybersecurity is Important in Banking?

Threats for Cybersecurity in Digital Banking:

· Unencrypted data: When data is left unprotected, hackers or other cybercriminals can immediately use it, resulting in a significant risk to the financial institution. This is one of the most frequent risks faced by banks.

· Malware: Since the majority of digital transactions are made via computers and mobile devices, end-to-end user devices must be safeguarded.

· Third-party services: To better serve their customers, many banks and financial institutions rely on third-party services provided by other suppliers. However, the bank that hired these companies will suffer greatly if they don’t have strict cybersecurity measures.

· Spoofing: When a user submits their login information on a website that appears and functions like the real banking website, the URL used by the cybercriminals is used to steal the user’s login and use it later.

· Phishing: It is the practice of pretending to be a reliable entity in an electronic conversation in order to obtain sensitive information, such as credit card numbers, for illegal purposes.

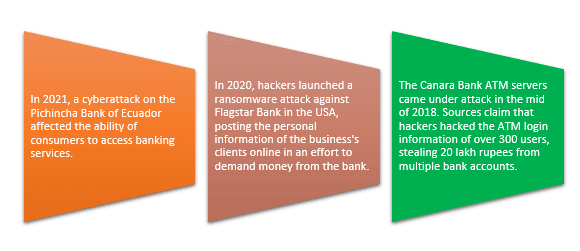

Examples of cybersecurity attacks in banks:

When using them cyberattacks technique, cybercriminals target a variety of corporate sectors and geographical areas. Here are a few current threats to cyber security:

Conclusion:

Cybersecurity is an issue for all businesses. Digital banking must maintain the highest level of cybersecurity. The financial & Banking sector has been increasingly digitalized, making cybercriminals more likely to attack it. Therefore, a flawless cybersecurity system is required that doesn’t affect the protection of client data and financial institution funds.

Author: Sakshi Gupta