Author: Vikas Kumar

28 February 2024

INTRODUCTION

The global transition towards sustainable and environmentally friendly transportation reaches a significant milestone with the introduction of electric buses. In response to the challenges posed by pollution and climate change, the utilization of electric buses has become a crucial measure in enhancing the cleanliness and efficiency of public transportation systems.

Unlock Insights: Receive a Sample Research Report on the Electric Buses Market: https://univdatos.com/get-a-free-sample-form-php/?product_id=40435

Electric buses are powered by electric motors and derive energy from rechargeable batteries. This innovative technology aims to reduce carbon emissions, noise pollution, and dependence on fossil fuels. Extensive research delves into the worldwide trends of electric bus adoption, conducts a market analysis by highlighting key players in the industry, and examines the regional factors that influence this transformative market.

According to the report published by the UnivDatos Market Insights the Global Electric Buses market is USD 39.15 billion and is expected to reach USD 155.70 billion by 2030 at a CAGR of 19.8%.

Transport electrification is not only about cars.

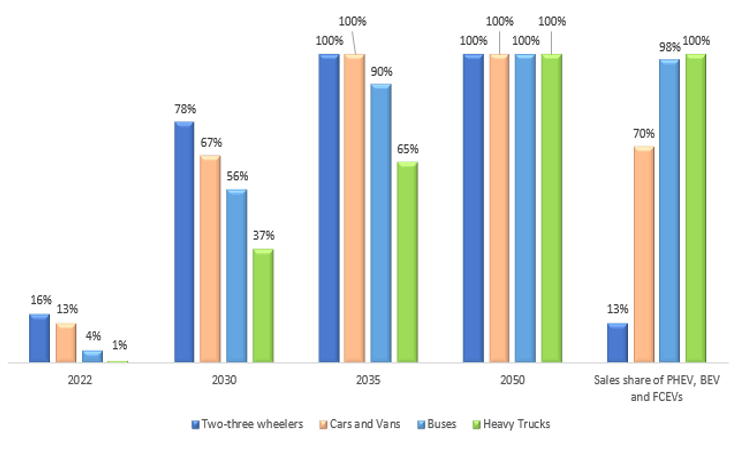

Fig 1. Electrification is already widespread among two-/three-wheelers. Milestones of electric vehicles from 2022 to 2050.

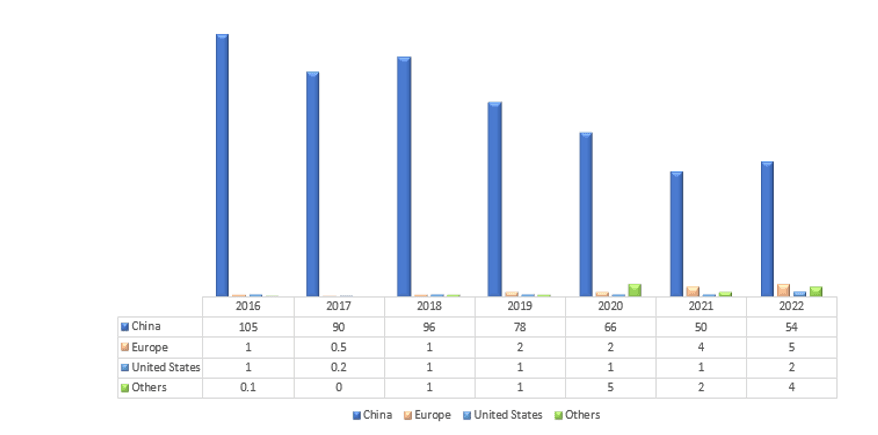

Fig 2. Electric bus registrations and sales share by region, 2016-2022

In the year 2022, the worldwide sales of electric buses and medium- to heavy-duty trucks amounted to nearly 66,000 and 60,000 units respectively. These figures correspond to approximately 4.5% of total bus sales and 1.2% of total truck sales. It is worth mentioning that the adoption of electric buses has witnessed a significant rise in areas where governments have made commitments to reduce emissions in public transportation, particularly in densely populated regions. As an example, Finland is expected to see electric bus sales account for more than 65% of the total by 2022.

China continues to dominate the manufacture and sales of electric (and fuel cell) trucks and buses. In 2022, 54000 new electric buses and an estimated 52000 electric medium- and heavy-duty trucks were sold in China, accounting for 18% and 4% of overall sales in China, and approximately 80% and 85% of global sales, respectively. Furthermore, Chinese brands dominate the bus and truck markets in Latin America, North America, and Europe.

Adoption trends across the globe

Fig 3. Global Adoption Trends across the Globe in the Electric Buses Market

Asia Leading the Charge:

Asia has emerged as a pioneer in the widespread adoption of electric buses, primarily due to the rapid growth of urban areas and growing environmental consciousness. China continues to dominate the market for electric buses and trucks, with a staggering share of over 80% in global electric bus sales and more than 85% in global electric vehicle sales as of 2022. The influential presence of Chinese companies like BYD, Yutong, and Zhongtong have significantly influenced and shaped the global electric bus market.

Moreover, the Chinese government has implemented strong policies and incentives to promote the adoption of electric vehicles, including electric buses. These policies include subsidies, tax breaks, and the establishment of charging infrastructure, making electric buses an attractive option for fleet operators and public transportation authorities.

For instance, in 2022 there will be a maximum subsidy of 50,400 yuan per vehicle for non-fast-charging BEV buses; 36,400 yuan for fast-charging BEV buses; and 21,300 yuan for PHEV (including extended-range) buses.

Europe’s Commitment to Sustainability

The electric bus revolution has been wholeheartedly embraced by Europe, showcasing a resolute commitment to sustainability and the preservation of the environment. European Union (EU) members have taken proactive measures to reduce carbon footprints, resulting in the extensive deployment of electric buses. In February 2023, the EU proposed ambitious CO2 standards for most new trucks, coaches, and urban buses. These standards aim to achieve a 90% reduction in emissions by 2040 for trucks and coaches, and 100% zero-emission city bus sales by 2030. Prominent players in the industry, such as VDL Bus & Coach, Irizar, and Volvo Buses, are instrumental in driving the growth of the electric bus market in Europe.

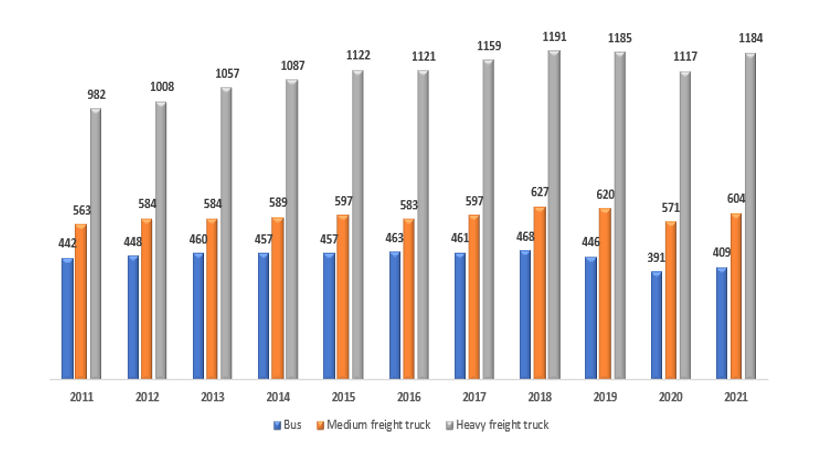

Fig 4. CO2 emissions from trucks and buses, 2000-2021 (Mt Co2)

North America Catching Up

Despite the relatively slower pace of electric bus adoption in North America compared to other regions, there is a discernible shift towards electrification. Cities in the United States and Canada are increasingly channeling investments into electric bus fleets as part of their commitment to addressing climate change concerns. In 2022, the US government announced significant funding for zero-emission buses and trucks through the Inflation Reduction Act, encompassing comprehensive programs focused on vehicle acquisition, infrastructure development, and training. Additionally, proposed Greenhouse Gas Emissions standards are set to encourage the widespread adoption of zero-emission trucks and buses starting from 2027. Noteworthy companies such as Proterra and New Flyer are at the forefront of driving the electric bus movement in North America.

Emerging markets and developing economies showing interest

Electric bus policies are gaining traction in emerging markets and developing economies as viable and fair transportation options. Noteworthy policy examples in 2022 include Ghana’s aim to have 16% of bus sales be electric by 2030, Vietnam’s encouragement of electrification in new and existing bus terminals by 2030, and Panama’s goal of having 33% electric buses in its fleet by 2030.

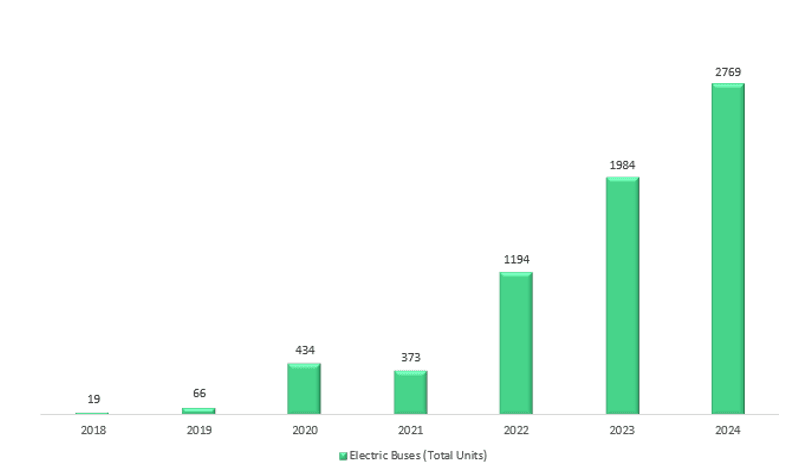

Fig 5. India Sales of Electric Buses, 2018-2024(till January)

Top Electric Bus Companies

BYD

BYD Motors is a worldwide recognized leader in electric vehicle innovation. They are one of the leading manufacturers of electric buses, with a strong presence in a variety of sectors. The company has made tremendous progress in the electric vehicle market, particularly with its BYD K-series battery electric buses. These buses use BYD’s proprietary lithium iron phosphate battery technology.

Volvo Group

Volvo Group, a global automotive pioneer, demonstrates its commitment to sustainability and innovation through its vehicle portfolio, which includes everything from passenger cars to all-electric buses. This includes the 7900 Electric, a zero-emission option that blends in with the city center thanks to safe operation features, dynamic steering, and other technology that make it an agile bus for urban environments.

Explore the Comprehensive Research Overview, Including a Table of Contents, on the Electric Buses Market: https://univdatos.com/report/electric-buses-market

Proterra

Proterra, headquartered in California, is a leading American manufacturer of electric buses. Known for its advanced battery technology and durable electric vehicles, Proterra has secured contracts with several cities and transit agencies in North America. The company’s focus on efficiency and reliability has contributed to its success in the electric bus market.

Zhengzhou Yutong Bus Co

Yutong is a global pioneer in the electric bus industry. The company’s yearly sales reach 30,000 units, with over 12,000 of them being new energy vehicles (NEVs). The company’s total NEV sales numbers show that it has delivered more than 170,000 to the Chinese market, where it has a 28.2% share.

VDL Bus & Coach

VDL Bus & Coach, based in the Netherlands, is a prominent European player in the electric bus segment. The company has a strong presence in the market, providing electric buses with cutting-edge technology. VDL’s emphasis on sustainable mobility solutions aligns with the growing demand for eco-friendly transportation in Europe.

Get a call back