- Inicio

- Acerca de nosotros

- Industria

- Servicios

- Leyendo

- Contáctenos

¡El aumento de la capacidad de producción de baterías en toda la región ha impulsado el crecimiento del mercado de carretillas elevadoras eléctricas en APAC!

Autor: Himanshu Patni

24 de noviembre de 2023

La demanda de carretillas elevadoras eléctricas está aumentando debido al creciente número de fabricantes de baterías en todo el mundo con una alta capacidad de fabricación (GWh). La demanda de baterías de iones de litio para carretillas elevadoras eléctricas está aumentando rápidamente. Por esa razón, el desarrollo de cadenas de suministro de baterías nacionales, incluida la capacidad de fabricación de baterías, es cada vez más importante a medida que los países se esfuerzan por pasar de los vehículos de gasolina a los vehículos eléctricos. China es, con diferencia, el líder en la carrera de las baterías, con casi el 80% de la capacidad mundial de fabricación de baterías de iones de litio. Esto aumentará directamente la demanda de vehículos eléctricos y baterías. Además, la creciente capacidad de producción tendrá un impacto positivo directo en las ventas de vehículos eléctricos al satisfacer la demanda de los fabricantes de vehículos eléctricos. Por lo tanto, impulsará el crecimiento del mercado de baterías para vehículos eléctricos.

Acceda al informe de muestra (incluidos gráficos y figuras) – https://univdatos.com/get-a-free-sample-form-php/?product_id=46294

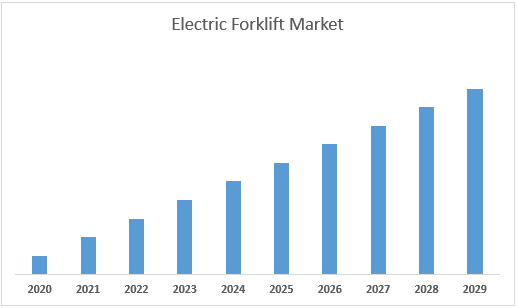

Además, se espera que el mercado de carretillas elevadoras eléctricas de APAC crezca a una fuerte CAGR del 15,4% durante el período de pronóstico (2022-2030). Se prevé que APAC surja como el crecimiento más rápido en la industria de los vehículos eléctricos. Además, los fabricantes de APAC están invirtiendo en investigación y desarrollo para producir productos innovadores y tecnológicamente avanzados. Estos nuevos productos están diseñados para satisfacer los requisitos específicos de las diferentes industrias y tienen como objetivo mejorar la eficiencia, la fiabilidad y la seguridad.

Ingresos del mercado de carretillas elevadoras eléctricas de APAC (2020-2030)- USD Mn.

Según la clase, el mercado se segmenta en clase 1, clase 2 y clase 3. Entre estos, el segmento de clase 3 tiene una alta cuota de mercado en 2022. Como estas carretillas elevadoras eléctricas ofrecen menores costos operativos en comparación con sus contrapartes de motor de combustión interna, ya que requieren menos mantenimiento y tienen menores gastos de energía. Su diseño compacto y maniobrable permite una mayor productividad en espacios reducidos, lo que permite un manejo eficiente de los materiales y un flujo de trabajo mejorado. Las empresas reconocen cada vez más los beneficios ambientales de la adopción de carretillas elevadoras eléctricas sobre sus contrapartes de motor de combustión interna. Un caso destacado que impulsó la adopción de carretillas elevadoras eléctricas de clase 1 fue el lanzamiento de la serie de carretillas elevadoras eléctricas Linde E20-E35 a principios de 2022.

· Según el tipo de producto, el mercado se segmenta en contrapeso eléctrico y almacén. Entre estos, el segmento de contrapeso eléctrico tiene una alta cuota de mercado en 2022. Las crecientes preocupaciones ambientales y el enfoque en la sostenibilidad han llevado a las empresas a adoptar prácticas más ecológicas, incluida la transición a vehículos eléctricos, que ofrecen cero emisiones y una huella de carbono reducida en comparación con sus contrapartes de motor de combustión interna. Además, los avances en la tecnología de baterías han mejorado significativamente el rendimiento y la eficiencia de las carretillas elevadoras eléctricas, impulsando así el crecimiento del mercado de carretillas elevadoras eléctricas.

Para un análisis detallado del mercado global de carretillas elevadoras eléctricas, navegue por – https://univdatos.com/report/electric-forklift-market/

Segmentación del mercado global de carretillas elevadoras eléctricas

Perspectiva del mercado, por clase

o Clase 1

o Clase 2

o Clase 3

Perspectiva del mercado, por tipo de producto

o Carretilla elevadora contrapesada

o Almacén

Perspectiva del mercado, por uso final

o Fabricación

o Edificación y construcción

o Venta minorista y comercio electrónico

o Puertos

o Otros

Perspectiva del mercado, por región

· América del Norte

o EE. UU.

o Canadá

o Resto de Norteamérica

· Europa

o Alemania

o Reino Unido

o Francia

o Italia

o España

o Resto de Europa

· Asia-Pacífico

o China

o Japón

o India

o Corea del Sur

o Resto de APAC

· Resto del mundo

Perfiles de las principales empresas

o Toyota Material Handling

o KION GROUP AG

o Jungheinrich AG

o MITSUBISHI LOGISNEXT CO.,LTD

o Hyster-Yale Materials Handling, Inc.,

o Crown Equipment Corporation

o Anhui Heli Co., Ltd

o Hangcha Forklift

o CLARK.

o Komatsu

Recibir una llamada