Global Ethylene Market Seen Soaring 4% Growth to Reach USD 17.36 Billion by 2030, Projects Univdatos Market Insights

Author: Vikas Kumar

25 November 2023

Key Highlights of the Report:

- Companies are banking on the widespread adoption of ethylene in different industries, which include packaging, building, automobile, electronics, etc., increasing the demand for ethane as it is primarily used for ethylene synthesis and ethylene-based products globally.

- Globally, the prevalence of Low-Density Polyethylene kept on growing, presenting players of the segment with enormous growth potential with its versatile nature of usage and specifications that are incomparable with any other raw material out there.

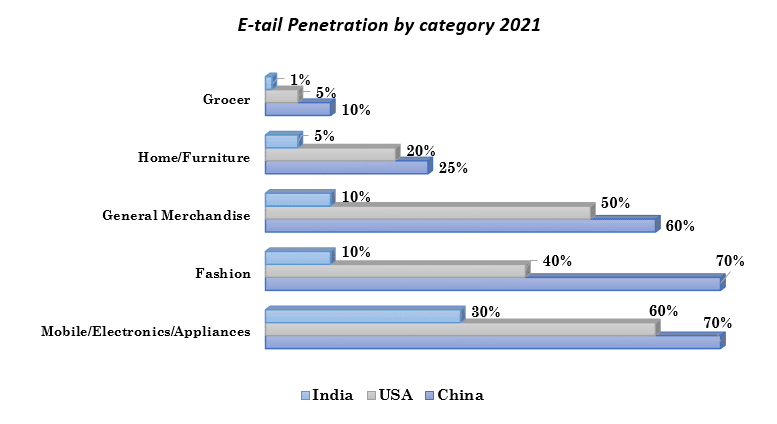

- The growing packaging industry with growing organized retail, branding, and rising e-commerce across the globe is widening the scope of ethylene-based product growth in the market.

According to a new report by Univdatos Market Insights, the Global Ethane Market, is expected to reach USD 17.36 Billion in 2030 by growing at a CAGR of almost 4%. Ethane is a by-product that is produced from the refinery of gas or from natural gas processing, the major demand for ethane comes from its single-end use as a feedstock at steam crackers for ethylene production. Furthermore, increasing use of Low-density Polyethylene (LDPE) because of its low-temperature flexibility, toughness, and corrosion resistance properties. In addition, they are non-toxic and non-contaminating and resistant to impact, dampness, chemicals, rip, and stress fracture. In recent years, the demand for LDPE has risen dramatically due to its application in many industries, such as manufacturing packaging, garbage bins, floor tiles, mailing envelopes, and dropper bottles, which in turn is raising the demand for the ethane in the market. Moreover, the use of low-density polyethylene in the market is growing due to the electrical insulating qualities that have resulted in its growing utilization in a variety of end-use sectors across the world. The report suggests that the Increasing Adoption of Ethylene-Based Products in the Packaging Industry is one of the major factors driving the Global Ethane Market during the forthcoming years. The ethane market has been classified into ethylene synthesis, acetic acid synthesis, refrigerant, and others (fuel for automotive, detergent, and scientific research). The ethylene synthesis holds most of the market share and generates the largest demand for ethane. The primary region for the rising demand for ethylene is the burgeoning demand for Polyethylene. The polyethylene category can be further bifurcated into HDPE and LDPE, with LDPE expected to witness higher adoption during the forecast period. This is mainly due to the increasing use of films and sheets in the packaging industry. LDPE is used in the production of food and non-food packaging and is rising. Furthermore, growing e-commerce across the globe has skyrocketed the demand for the packaging industry, which has raised the demand for ethylene, which in turn has driven the demand for ethane and ethane-based products higher across the globe.

Apart from this, ethane is a naturally occurring refrigerant that does not have any adverse effects on the ozone layer as compared to the commonly used refrigerants that are made from chlorofluorocarbons (CFCs) and hydrofluorocarbons (HFCs). Ethane-based refrigerants are significantly being used to reduce global warming and reduce ozone layer depletion, with the demand for air conditioning is rising exponentially due to rapid urbanization and industrialization across the globe. Hence, all these factors are contributing to the growth of the market. A wide range of investments and strategic alliances have been adopted in this area, thus suggesting huge potential. Some of the recent investments and strategic alliances are:

- In March 2023, Braskem Idesa announced the start of the construction of a USD 400 million ethane terminal in the Mexican port of Coatzacoalcos, with a partnership with Dutch liquid storage logistics firm Advario.

- In Jan 2023, Qatar announced one of the largest investments of USD 6 billion in the petrochemical sector and its first direct investment after more than a decade. The Ras Laffan Petrochemicals complex, expected to begin production in 2026, consists of an ethane cracker with a capacity of 2.1 million tonnes of ethylene per year. The 435-acre project site also contains two polyethylene trains with a combined output of 1.7mn tonnes per year of high-density polyethylene (HDPE) polymer products and will raise Qatar’s overall petrochemical production capacity to almost 14 million tonnes per year

- In May 2023, GAIL India Ltd. announced its plan to build a USD 4.9 billion ethane cracker in West India. According to the top refiners of India, it is estimated that the demand for petrochemicals could triple by the year 2040, hence compelling the companies operating in this space to make big investments to set up new facilities to increase their readiness for fulfilling the future demand that is anticipated.

Global consumption of ethane is forecasted to expand soon, where a majority of demand and consumption is primarily driven by the growing needs of emerging markets. The demand for ethane will primarily be driven by the traction of polyethylene-based consumables, increasing PET fibers, bottle and packaging demand, and increasing requirements for PVC used in construction.

Download Strategic Sample PDF Here- https://univdatos.com/get-a-free-sample-form-php/?product_id=46347

“Mainland China is expected to account for a high percentage of new ethylene demand through 2027 with its growing middle class and rapidly developing infrastructure.”

Ethylene Production Sustainability Trends is Quickly Gaining Momentum in the Market

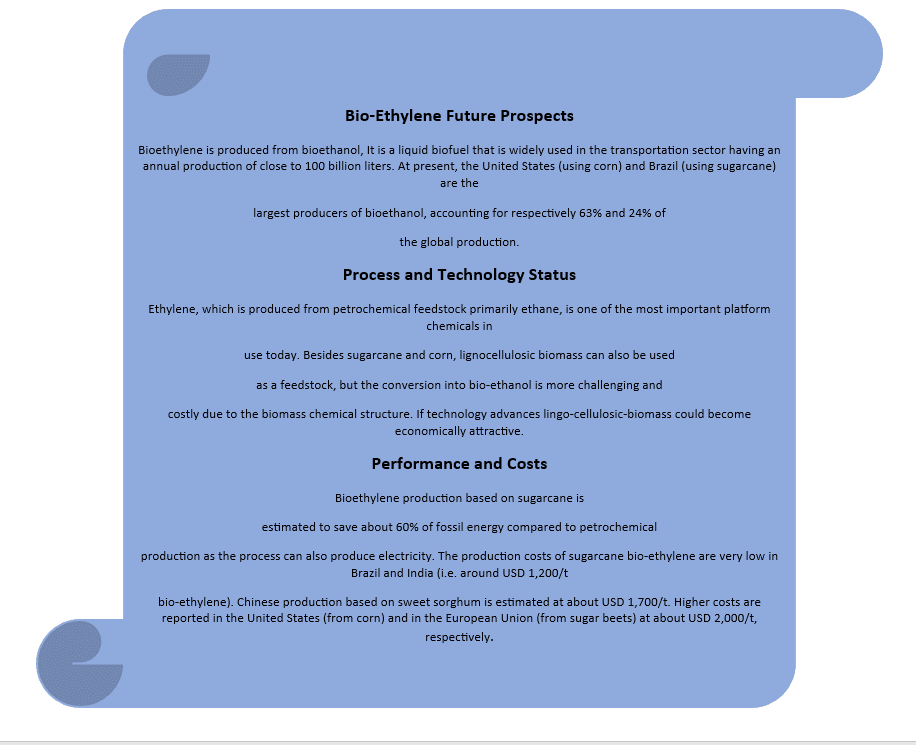

Ethane’s principal value still lies in the global use of ethane as a petrochemical feedstock, where billions of dollars of capital expenditure are being spent on the development of ethane crackers to make ethylene. Furthermore, since ethane is a natural gas that has limited GHG gas emissions and as the world is facing the challenges of climate change and environmental degradation, sustainable ethylene production has emerged as a beacon of hope for an eco-friendly future. This innovative technology harnesses renewable energy sources like wind, solar, and biomass to produce bio-ethane, which is then used for ethylene synthesis, a crucial building block for plastics and other materials. With governments and corporations alike prioritizing sustainability and reducing carbon footprints, investments in sustainable ethylene production are gaining significant momentum. The demand is mainly driven by rising demand from industries such as packaging, automotive, and construction. As the race towards a greener future intensifies, sustainable ethylene production is poised to play a critical role in shaping a better tomorrow.”. In addition to these government initiatives, several energy and power companies are also taking increased participation to create a suitable environment for them, thus driving the growth of the segment in the forthcoming years.

For Detailed Analysis on the Report Please Click on the Link- https://univdatos.com/report/ethane-market

Conclusion

With production exceeding 140 million tons per year, Ethylene is by far the largest bulk chemical (in volume) used to produce around half of all plastics. Owing to the growth of emerging economies, the demand for Ethylene is projected to continue to rise, which in turn is benefitting the ethane industry and driving the demand higher for ethane in the market. Currently, almost all Ethylene is derived from petroleum derivatives, yet biomass can also be utilized to produce ethane and then used as feedstock to produce bio-Ethylene. Ethylene and bio ethylene are chemically identical, thus existing equipment and production capacity can be employed to produce plastics or other downstream commodities. As of now, the first bio-Ethylene plants in Brazil and India are responsible for approximately 0.3% of the global Ethylene capacity, with the largest plants yielding around 200 kt of bio-Ethylene per year. Notwithstanding, the global market for biopolymer production is rapidly expanding and multiple production plants are in the process of being constructed or planned (e.g. Seven crackers are under construction in the Gulf Coast Area and more have been announced).

Get a call back