Foreign investments and their impact on the local economy

Overview

Foreign investment refers to the investment in domestic corporations and assets of another country by an overseas investor. Massive international corporations can look for new opportunities for the economic process by gap branches and increasing their investments in different countries.

Foreign direct investments embrace long physical investments created by an organization in a very foreign country, appreciate opening plants or getting buildings.

How Foreign Investment Works

Foreign investment is seen as a catalyst for economic growth in the future. Foreign investments are made by individuals, however, are most frequently endeavours pursued by companies and corporations with substantial assets wanting to expand their reach.

As the economic process increases, additional and more corporations have branches in countries around the world. for a few international corporations, the gap between new producing and production plants in very different countries is engaging owing to the opportunities for cheaper production and labour costs.

Additionally, these massive corporations frequently look to try and do business with those countries wherever they’ll pay the smallest amount of taxes. they will try this by relocating their home base or components of their business to a rustic that’s state or has favourable tax laws geared toward attracting foreign investors.

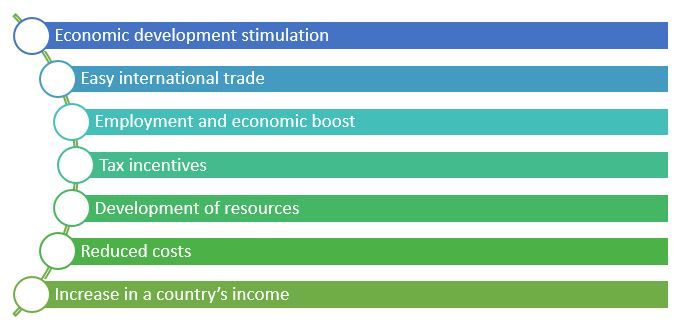

Benefits of foreign direct investment in the local economy

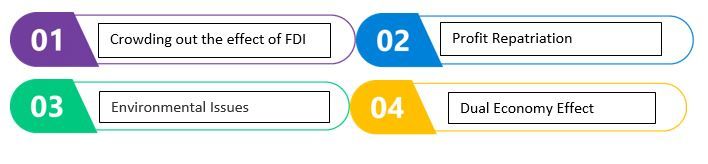

Negatives effect of foreign direct investment in the local economy

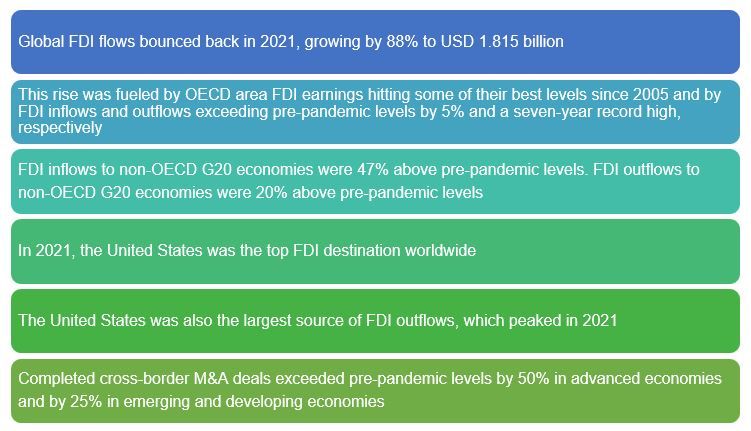

Global FDI flows in 2021

Foreign direct investment: Growth Drivers

Foreign direct funding (FDI) is an effective device for increase and development and is prime to improving prosperity globally and boosting the worldwide economy. Building on its preceding paintings on the subject, the Global Agenda Council on Global Trade and FDI has been analysing approaches to inspire extra FDI in each evolved and growing country.

Global FDI prospects for 2022

This year, the enterprise and funding weather has modified dramatically because the conflict in Ukraine has led to a triple disaster of excessive meals and gasoline fees and tighter financing. Other elements clouding the FDI horizon consist of renewed pandemic impacts, the chance of extra interest price rises in essential economies, terrible sentiment in monetary markets, and a capacity recession.

Despite excessive profits, funding via way of means of multinational businesses in new tasks foreign places changed into nevertheless one-5th beneath pre-pandemic ranges an ultimate year. For growing countries, the cost of greenfield bulletins stayed flat.

Signs of weak points are already rising this year. Preliminary statistics for the primary region suggest greenfield task bulletins are down 21% globally, cross-border M&A pastime down 13%, and global task finance offers down 4%.

“UNCTAD foresees that the increasing momentum of 2021 can’t be sustained and that international FDI flows in 2022 will possibly move on a downward trajectory, at the great closing flat,” the document underlines. “However, even though flows have to continue to be exceedingly solid in cost terms, a new task activity is possible to go through extra from investor uncertainty.”

Inward investment and Outward Investment

An inward investment includes an outside or overseas entity both making an investment in or shopping the products of a local economy. It is overseas cash that comes into the home economy. Inward funding stands in assessment to outward funding, which is an outflow of funding capital from local entities to overseas economies.

FDI inflows, 2020-2021 (in USD billion)

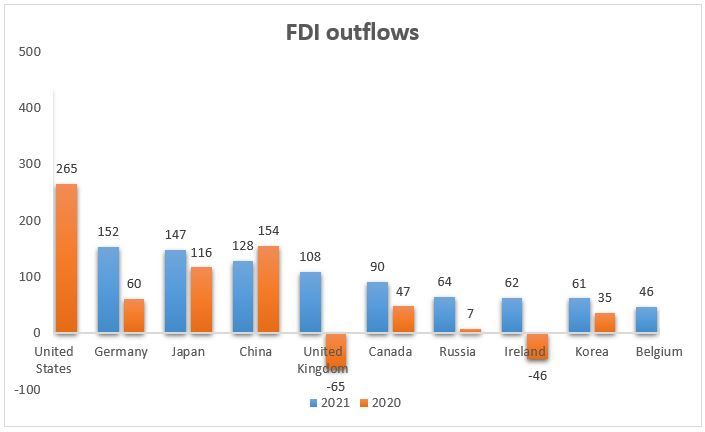

FDI outflows, 2020-2021 (in USD billion)

Conclusion

In conclusion, FDI improves the stability sheet by raising the value of the companies’ assets. The agencies’ profits soar, and labour productivity will rise. Earnings per capita will rise, and consumption will improve. Sales of taxes increase, and government spending goes up. The GDP will rise, and because of a lag effect, the GDP will also rise the following year. Furthermore, investment returns peak after a certain number of years and have a gestation period.

FDI will boom funding within side the economy, main to a boom in earnings and employment. While it’s far a right away gain for the country, on occasion, it’s far apprehended that the overseas buyers will make the most of a country’s herbal assets and provide much fewer paintings as such industries are capital incentives in nature. Besides, the displacement of the populace is a large motive for social unrest.

Thus on occasion, the loss because of FDI could be extra than the gain. It is recommended to make a cost-gain evaluation earlier than making such funding within side the economy.