- Accueil

- À propos de nous

- Industrie

- Services

- Lecture

- Contactez-nous

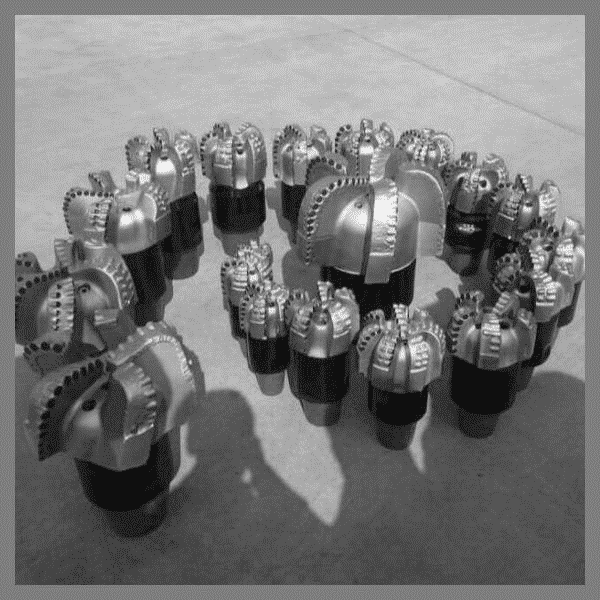

Le marché des trépans PDC devrait connaître une croissance importante. L'AALMOA devrait être en tête de la croissance !

Auteur: Himanshu Patni

15 avril 2022

Le marché des trépans PDC devrait croître à un TCAC d'environ 5 % au cours de la période de prévision. Des facteurs tels que l'augmentation de l'activité d'exploration et l'accent mis sur le développement de nouveaux gisements de pétrole et de gaz devraient stimuler le marché des trépans PDC. Les activités de forage, en particulier la longueur forée, devraient stimuler la demande de trépans PDC. En outre, les principaux acteurs investissent dans de nouveaux sites de forage offshore, ce qui devrait encore stimuler la croissance du marché. Par exemple, en 2020, Royal Dutch Shell a soumis des plans pour des activités sismiques et des forages exploratoires dans sa licence West Harrison Bay dans la mer de Beaufort, juste au large de la réserve nationale de pétrole en Alaska, aux États-Unis. Dans son plan quinquennal, la société suggère de mener des études sismiques pour mettre à jour les données géologiques et finaliser la conception des puits et des réservoirs en 2021-22, puis de commencer et d'étendre les forages exploratoires en 2023-24.

Au début de l'année 2020, pendant la pandémie de Covid-19, la majorité des pays et des régions ont connu un confinement national. Cela a eu un impact sur la demande globale de pétrole et de gaz. Selon l'U.S. Energy Information Administration, une baisse de près de 9 % de la demande globale de pétrole et de gaz a été constatée dans le monde en 2020 pour la première fois depuis la récession mondiale de 2009. La majeure partie de la baisse a été observée dans le secteur industriel, où les pays avaient imposé la fermeture des usines de fabrication pour réduire la propagation de la Covid-19. Cependant, la demande de pétrole et de gaz devrait revenir à la normale après 2020.

Pour une analyse détaillée de l'impact de la Covid-19 sur le marché, consultez la page suivante : https://univdatos.com/report/pdc-drill-bits-market/

Selon le type, le marché est divisé en corps de matrice et corps en acier. Parmi ceux-ci, la catégorie des corps de matrice devrait connaître une forte croissance au cours de la période de prévision et devrait détenir une part de marché importante d'ici 2027. Les fraises fixes à corps de matrice contiennent du carbure de tungstène, ce qui améliore la résistance à l'usure et à l'érosion. Dans les applications à volume de fluide élevé ou à forte teneur en sable, les fraises à corps de matrice offrent une durée de vie plus longue et de multiples passages. Grâce à ces avantages, les trépans à corps de matrice devraient connaître un TCAC plus élevé au cours de la période de prévision.

Selon la taille, le marché est divisé en moins de 9 mm, 9-14 mm, 15-24 mm et plus de 24 mm. Parmi ceux-ci, la tranche 15-24 mm devrait connaître la croissance la plus rapide au cours de la période de prévision. Ceci est principalement dû à sa forte utilisation pour le forage de formations moyennement dures et dures avec un taux de pénétration (ROP) plus élevé, ce qui est l'un des principaux facteurs de croissance du marché des 15-24 mm. En outre, les études pétrolières et hydrothermales dans les formations géologiques profondes conduisent à la fabrication de nouveaux matériaux pour les trépans capables de forer à une température plus élevée, dans des champs géologiques plus abrasifs et plus durs. Ces matériaux innovants, les processus de frittage et la conception, récemment mis au point pour améliorer la dureté et la résistance à la rupture des trépans, nécessitent également de nouvelles stratégies d'évaluation de la qualité.

Sur la base de l'application, le marché a été classé en terrestre et offshore. En 2020, l'onshore détenait une part importante du marché. Ceci est principalement dû à l'optimisme associé à la reprise des prix du pétrole brut, les projets onshore devraient enregistrer une croissance significative au cours de la période de prévision. Ceci, à son tour, devrait stimuler la demande de trépans PDC.

Demandez un échantillon du rapport en consultant la page suivante : https://univdatos.com/get-a-free-sample-form-php/?product_id=19223

Pour une meilleure compréhension de l'adoption du marché des trépans PDC, le marché est analysé en fonction de sa présence mondiale dans des pays tels que l'Amérique du Nord (États-Unis, Canada, reste de l'Amérique du Nord), l'Europe (Allemagne, France, Espagne, Royaume-Uni et reste de l'Europe), l'Asie-Pacifique (Chine, Japon, Inde, Australie et reste de l'Asie-Pacifique) et LAMEA (Brésil, Mexique, Arabie saoudite, ÉAU et reste de la région LAMEA). Au cours de la période de prévision, la région LAMEA devrait connaître une croissance lucrative en raison de l'augmentation des activités d'exploration pétrolière et gazière.

Parmi les principaux acteurs opérant sur le marché, on peut citer Baker Hughes Company, Halliburton Company, Landrill Oil Tools Co. Ltd, NOV Inc., Rockpecker Limited, Sandvik AB, Schlumberger Limited, Schoeller-Bleckmann Oilfield Equip AG, Ulterra Drilling Technologies LP et Weatherford International PLC.

Segmentation du marché des trépans PDC

Aperçu du marché, par type

- Corps de matrice

- Corps en acier

Aperçu du marché, par taille

- Moins de 9 mm

- 9-14 mm

- 15-24 mm

- Plus de 24 mm

Aperçu du marché, par application

• Terrestre

• Offshore

APERÇUS DU MARCHÉ PAR RÉGION

- Marché des trépans PDC en Amérique du Nord

- États-Unis

- Canada

- Reste de l'Amérique du Nord

- Marché des trépans PDC en Europe

- Allemagne

- Royaume-Uni

- France

- Espagne

- Reste de l'Europe

- Marché des trépans PDC en Asie-Pacifique

- Chine

- Inde

- Australie

- Thaïlande

- Reste de l'Asie-Pacifique

- Marché des trépans PDC dans la région LAMEA

- Brésil

- Arabie Saoudite

- É.A.U.

- Mexique

- Reste de la région LAMEA

Principaux profils d'entreprises

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Landrill Oil Tools Co. Ltd

- NOV Inc.

- Rockpecker Limited

- Sandvik AB

- Schoeller-Bleckmann Oilfield Equip AG

- Ulterra Drilling Technologies LP

- Weatherford International PLC

Obtenir un rappel