- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

India’s Thriving Tourism Industry is expected to drive the Vodka and Gin Market in the East India!

Author: Himanshu Patni

July 30, 2023

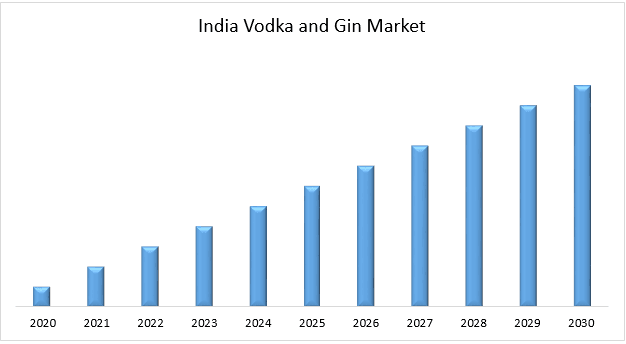

The East India Vodka and Gin is expected to grow at a strong CAGR of 7.5% during the forecast period (2022-2030). East India consists of states such as West Bengal, Chhattisgarh, Assam, Arunachal Pradesh, and others. The region is expected to grow with the highest CAGR during the forecast period, along with the rising adult population in the region. Furthermore, the increasing collaboration of industries in the region has also become an attributing factor for the market growth of the alcohol industry in the region.

Access sample report (including graphs, charts, and figures):https://univdatos.com/report/india-vodka-and-gin-market/get-a-free-sample-form.php?product_id=43291

These factors will also be contributing to the growth of the vodka and gin market in India. For instance, in February 2022, Devans Modern Breweries, maker of Godfather beer and other malt spirits, expanded its presence to the Northeast. The Jammu-based company, operating in the Indian alcoholic beverage market for about 60 years, added 10,000 KL manufacturing and bottling capacity of beer by tying up with a brewery at Namsai in Arunachal Pradesh.

For a detailed analysis of the India Vodka and Gin Market browse through– https://univdatos.com/report/india-vodka-and-gin-market/

Based on type, the market is segmented into vodka and gin. The vodka category is to witness higher CAGR during the forecast period owing to the rising urbanization and increasing disposable incomes of the Indian population have led to a shift in consumer preferences towards premium spirits. Moreover, the rising popularity of cocktail culture and the prevalence of mixology in bars and restaurants have further boosted the demand for vodka as a key ingredient in trendy cocktails.

On the basis of the distribution channel, the market is bifurcated into offline distribution channel and online distribution channel. Among these, the offline distribution channel dominated the market share in 2022. This is mainly due to the regulatory environment, consumer behavior, trust and reliability, and social and cultural factors. In many states in India, the sale of alcohol online is either heavily regulated or not allowed at all. For example, in Maharashtra, online sales of alcohol is prohibited, while in Delhi, online sales is allowed but is subject to strict regulations. This has led to a greater reliance on offline distribution channels such as liquor shops and bars. Moreover, the offline distribution of alcohol is a significant source of revenue for the states. In the fiscal year 2020-21, the state of Maharashtra collected over 70,000 crore rupees in excise taxes on alcohol, according to government data.

India Vodka and Gin Market Segmentation

Market Insight, by Type

- Vodka

- Gin

Market Insights, by Distribution Channel

- Offline Distribution Channel

- Online Distribution Channel

Market Insight, by Region

- North India

- East India

- West India

- South India

Top Company Profiles

- Bombay Spirits Company LTD

- Diageo plc

- Nao Spirits & Beverages Pvt Ltd

- Radico khaitan Limited

- Bacardi Limited

- Beam Suntory, Inc.

- Allied Blenders and Distillers Private Limited

- United Brewries

- Carlsberg Breweries A/S

- Anheuser-Busch InBev

Get a Callback