- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Revolutionizing Finance: The Latest Trends in Financial Services Application Software

Author: Himanshu Patni

November 17, 2023

Introduction:

In today’s fast-paced digital age, the financial services sector is undergoing a profound transformation, and at the heart of this evolution lies cutting-edge financial services application software. These software solutions are revolutionizing the way financial institutions operate, enabling them to offer innovative services, streamline operations, and provide a more seamless experience for customers.

Access sample report (including graphs, charts, and figures) – https://univdatos.com/get-a-free-sample-form-php/?product_id=47847

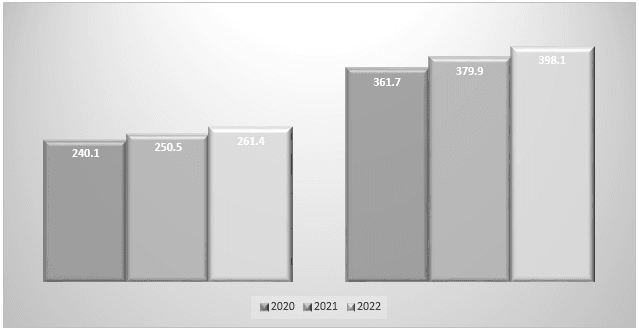

FIG1: Number of active online banking users worldwide in 2020 with forecasts from 2021 to 2024, by region.

There are some latest trends: –

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) have become indispensable tools for financial services providers. These technologies are being employed for risk assessment, fraud detection, and customer service. AI-driven chatbots, for example, can handle routine customer inquiries efficiently, freeing up human agents to focus on more complex tasks. ML algorithms analyze vast datasets to identify patterns and anomalies, helping institutions make informed decisions and mitigate risks.

Blockchain and Cryptocurrency Integration

Blockchain technology has moved beyond its association with cryptocurrencies like Bitcoin and is now being embraced by traditional financial institutions. It offers enhanced security, transparency, and efficiency in processes such as settlements and identity verification. Moreover, the rise of digital currencies has prompted financial services application software to incorporate cryptocurrency trading and management capabilities, enabling customers to invest and manage their digital assets more conveniently.

Cloud-Based Solutions

The shift towards cloud computing is transforming the financial services landscape. Cloud-based financial services application software provides scalability, flexibility, and cost-effectiveness. It allows institutions to adapt to changing market conditions rapidly and efficiently. Furthermore, the cloud enhances data security and disaster recovery capabilities, reassuring customers, and regulators alike.

Regulatory Compliance and Security

In an era of increased cyber threats and stringent regulations, financial institutions are prioritizing security and regulatory compliance. Financial services application software is incorporating advanced security features, such as biometric authentication and encryption, to protect sensitive customer data. Additionally, these solutions are designed to facilitate compliance with evolving regulatory frameworks, reducing the risk of fines and reputational damage.

ESG and Sustainable Finance

Environmental, Social, and Governance (ESG) considerations are increasingly important for both investors and financial institutions. Financial services application software is incorporating ESG analytics to help clients make sustainable investment decisions. This trend aligns with the growing demand for responsible and ethical investing options.

Click Here To View the Report Description & TOC – https://univdatos.com/report/financial-services-application-software-market-2/

Conclusion:

In conclusion, financial services application software is at the forefront of reshaping the financial industry. With AI, blockchain, personalization, cloud computing, security, open banking, RPA, and ESG considerations driving innovation, financial institutions are better equipped than ever to meet the evolving needs of their customers while navigating complex regulatory environments. As technology continues to advance, we can expect even more exciting developments in this dynamic sector, ultimately providing consumers with more accessible, secure, and personalized financial services. According to the UnivDatos Market Insights analysis, the surge in demand for workforce optimization solutions which will surge in the demand for financial services application software will drive the global scenario of the “Financial Services Application Software market” report, The global market was valued at USD 114.2 million in 2022, growing at a CAGR of 8.1 % during the forecast period from 2023 – 2030 to reach USD XX billion by 2030.

Get a Callback