- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

India Agritech Market Seen Soaring ~13.50% Growth to Reach USD Million by 2033, Projects UnivDatos

Author: Shalini Bharti, Research Analyst

May 8, 2025

Key Highlights of the Report:

Increasing Mobile Access: Smartphones and internet connectivity are increasing in rural India, and the customers have shifted more to agritech solutions.

Digital agriculture: The Government of India’s schemes, such as PM-KISAN and AgriStack, are helping in furthering the cause of digital in the agriculture domain..

Precision Farming Outlook: The adoption of precision farming techniques and practices with IoT-based devices is boosting growth since the agriculture industry focuses on sustainability.

Market Drivers: Healthy spending by the private sector in agritech and a growing startup culture are propelling the scalability of various agritech solutions to increase the market size.

Region-wise Preferences: The agritech industry is more developed in the southern and Western regions of India due to better-developed digital facilities and favorable government policies.

According to a new report by UnivDatos, The India Agritech Market is expected to reach USD Million in 2033 by growing at a CAGR of 13.50% during the forecast period (2025-2033F). The primary growth drivers of the India Agritech are the increase in the adoption of phones and the internet in rural areas, which assist farmers in enhancing their productivity through the usage of technologies. Adding to this, PM-KISAN and AgriStack schemes from the government help in supporting the farmer financially and adopting digital agriculture. Also, challenges such as climate change have made consumers require increased production of foods from sustainable and ever-efficient farming methods, hence the implementation of precision farming technologies, IoT, and AI solutions. Moreover, focusing on increased attractiveness for private investment and the development of a diversified agritech startup market are also contributing factors to growth.

On April 1, 2025, Dexian India announced a groundbreaking investment in agritech to empower Indian farmers. Dexian India is looking to make a big splash in AgriTech with BIHAN, a new platform that integrates 70+ external datasets from users across 47,000+ villages to provide actionable insights on government schemes, market prices, and agri-assets mapping.

Key Schemes for Agritech in India

The Digital Agriculture Mission has been formulated as a common platform for supporting different digital agriculture ventures. These include the development of infrastructure for Digital Public Infrastructure (DPI), conducting the Digital General Crop Estimation Survey (DGCES), and providing support to Information Technology initiatives taken by the Central Government, State Governments, and Academic and Research Institutions.

The scheme is built on two foundational pillars:

Agri Stack

Krishi Decision Support System.

Also integrated within the mission, the tasks of ‘Soil Profile Mapping’ will also make it possible to support and develop digital services that will help farmers to receive information within the agricultural industry in a timely and error-free manner.

AgriStack: Kisan ki Pehchaan

To begin with, let it be understood that AgriStack is conceptualized as the digital public infrastructure for farmers that will integrate services and scheme delivery. It comprises three key components:

Farmers' Registry

Geo-referenced village maps

Crop Sown Registry

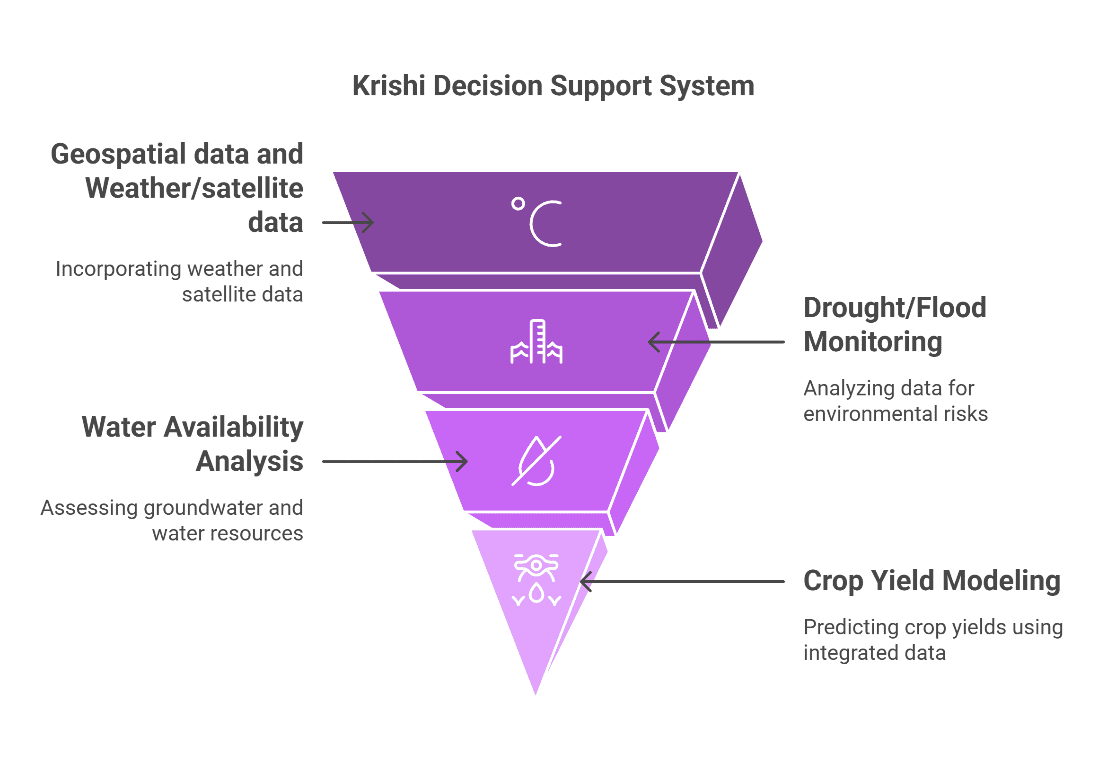

Krishi Decision Support System

Specifically for the farmer, the Krishi Decision Support System (DSS) shall provide crop data, soil data, weather data & water data with geospatial integration.

Soil Profile Mapping

Under the mission, detailed soil maps are proposed for a sample area of about 142 million hectares of agricultural land of the country, of which mapping has already been done for 29 million hectares of soil profile inventory.

According to the report, the impact of Agritech has been identified to be high for the West India area. Some of how this impact has been felt include:

West India is expected to grow with a significant CAGR during the forecast period due to the growth of the market. The Government has been actively promoting the sector across major states such as Maharashtra and Gujarat in West India, and the cropping system is diverse too. The region has well-established market relations and mostly institutional support, encouraging digital and mechanized farming. This region is being targeted by companies as a place for the development of smart irrigation and supply chain platforms. Moreover, lack of water is also fueling demand for technology-driven supplies and products. There a diverse agro-climatic conditions existing in the western part of India that can cater to various agritech advancements.

As per the Ministry of Agriculture & Farmers Welfare, on December 5, 2024, Gujarat became the first State in the country to generate Farmer IDs for 25% of the targeted number of farmers in the State. This breakthrough represents a significant step towards creating a comprehensive standards-driven digital agriculture ecosystem as a part of the ‘Agri Stack initiative’ of the Government of India.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis By Technology, By Deployment, By Application, By Region/Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Get a Callback

Related News

Subscribe to our newsletters

By submitting this form, I understand that my data will be processed by Univdatos as indicated above and described in the Privacy Policy. *