- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Southeast Asia's E-Commerce Market Expected to Grow 21.13% to Reach USD Billion by 2033, According to UnivDatos

Author: Shalini Bharti, Research Analyst

October 3, 2025

Key Highlights of the Report:

Competitive analysis reveals a strong market presence among players such as Shopee, Lazada, and Tokopedia, with live commerce and gamification emerging as major differentiators.

Regional knowledge indicates that Indonesia has the largest scale, followed by Vietnam, which is experiencing the highest CAGR based on the use of digital and government-sponsored cashless programs.

Segment analysis shows the best-performing categories as electronics, fashion, and beauty; mobile wallets and BNPL are the drivers of payment adoption.

Collaboration and joint ventures between the service of e-commerce systems, fintech companies, and logistics services are enhancing the efficiency of the supply chain and increasing customer coverage.

The future growth opportunities in the region are characterized by investment in infrastructure, AI-personalization, and cross-border trade.

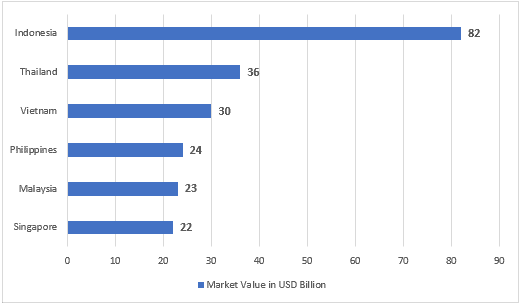

According to a new report by UnivDatos the Southeast Asia E-Commerce Market is expected to reach USD billion in 2033 by growing at a CAGR of 21.13% during the forecast period (2025- 2033F) due to the growing rates of internet and smartphone adoption, younger and more digital-minded people, higher levels of confidence in online payments, and government encouragement of digital economy developments. As per the International Trade Administration, U.S. Department of Commerce, the total internet economy for Southeast Asia is forecast to grow from USD 194 billion to over USD 330 billion by 2025, with Indonesia leading the rest of the region’s markets with an internet economy of over USD 82 billion in 2023. Also, online retail adoption is further propelled by rapid urbanization and the growing number of middle-class individuals, characterized by increased disposable incomes. The disjointed retailing landscape of the region also presents the opportunity for the e-commerce platform to intervene as a more convenient alternative.

Driver: Rising Internet and Smartphone Penetration

The high growth rate of the internet and smartphone adoption is the heart of the e-commerce market in Southeast Asia. Low-cost data services and affordable Smartphones have increased access to millions of new online customers in cities and towns. Also, the expansion enables consumers to shop at their convenience using mobile apps, view their product catalogs, and make payments easily. With the emergence of smartphones as the primary means of accessing digital transactions, e-commerce platforms benefit from increased interaction and transaction volume. Therefore, the outcome is that online retail adoption continues to increase, driving sustained market growth.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/southeast-asia-e-commerce-market?popup=report-enquiry

Fig: Internet economy size in Southeast Asia in 2023, by country (in Billion USD)

Source: The International Trade Administration, U.S. Department of Commerce

Segments that transform the industry

Based on type, the market is segmented into electronic; fashion; toys, hobbies, and DIY; beauty, health, personal, & household care; furniture; others. Among these, the electronic category held the dominant share of the e-commerce market in 2024. The growing digital adoption is creating a boom in demand for smartphones, laptops, and other smart devices. Also, competitive prices, warranties, and flash sales are conducted online, attracting millions of tech-savvy customers. The electronics market is also driven by the fast development of the online-exclusive stores and brand-owned markets in Southeast Asia. For example, on August 14, 2024, Samsung Electronics Philippines Co. announced the release of the new Samsung Shop App in selected markets within Southeast Asia and Oceania, as part of its mission to enhance and streamline the online shopping experience for Samsung users and fans. Purchases of electronic products continue to be made online in large numbers in the Southeast Asia and Oceania region.

Region that transforms the industry

Vietnam is expected to grow at a significant CAGR during the forecast period (2025-2033) in Southeast Asia, with a young, digitally engaged population and a high adoption of mobile-first. Furthermore, the growing government initiative to adopt a cashless system, coupled with the increasing popularity of mobile wallets, is prompting consumers to shift away from cash-on-delivery payments toward digital forms of payment. Moreover, Vietnamese consumers are increasingly selecting products due to competitive pricing and the influx of cross-border trade, especially from China. As logistics and consumer confidence continue to improve, Vietnam is emerging as a strategic hub for regional e-commerce growth. As an example, on September 3, 2025, AnyMind Group, a BPaaS company focused on marketing, e-commerce, and digital transformation, stated that it completed its acquisition of the Vietnam-based live and social commerce agency Vibula, initially announced on April 25, 2025. Additionally, the deal unlocks various strategic synergies between Vibula and the AnyMind Group, combining Vibula's expertise in live commerce operations with AnyMind's proprietary technology platforms.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis of By Type, By Payment Method, by Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Get a Callback

Related News

Subscribe to our newsletters

By submitting this form, I understand that my data will be processed by Univdatos as indicated above and described in the Privacy Policy. *