Burgeoning Demand for Electric Vehicles and Increased Vehicle Production, Favorable Government Policies in the Aerospace Industry Propel Growth of the Shrink Fit Machine Market in the Asia Pacific Region!

Author: Himanshu Patni

30 December 2023

The Asia Pacific region would exhibit the highest CAGR during 2022-2030 owing to the rapid growth rate in the automotive industry in the last couple of years. As the region covers the country such as China, India, and Japan, and South Korea that have favorable technological infrastructure, with the leading automotive and industrial machinery companies such as Maruti Suzuki, BYD, and Toyota, Hyundai respectively, which are the major manufacturers of ICE vehicle and electric vehicles in the region, that to cater the demand for the shrink-fit machine. For instance, in September 2022, according to the report published by International Energy Association have reported, in China the total market share for electric vehicles was 5% in 2020, which increased to 16% in 2021. Additionally, favorable government policies in regions such as India, China, and Japan have one of the primary reasons why the Asia-Pacific region is experiencing fast growth in the shrink-fit machine market and its manufacturing competencies, particularly in the automotive and aerospace industries. These industries are among the most significant users of shrink-fit machines, given their need for high-precision metal parts, which are made possible using these machines. Defense and Aerospace continue to be strong pillars for India and key government structures along with Make in India to succeed. Government regulations have focused on the implementation of superior technologies in the defense sector, as a result improving the capacity of domestic manufacturing.

Access sample report (including graphs, charts, and figures) – https://univdatos.com/get-a-free-sample-form-php/?product_id=44649

The Defense Ministry has set a goal of 70% self-reliance in weaponry by 2027, creating large possibilities for players inside the industry. Moreover, as per data provided by 80 companies, an FDI inflow of over USD 463.55 million has been registered in the defense and aerospace sector as of June 2020. India has a competitive advantage over different countries due to the low-cost manufacturing of components. With low labor costs, the presence of resources, and supporting government rules, the country provides massive boom opportunities in the aerospace industry. the sector, subsidized by using the government’s “Make in India” policies, promotes global players to invest in the manufacturing process and optimize it. Therefore, with all the growing factors the demand for the shrink-fit machine market is going to increase in the coming years.

Further, the Asia Pacific Shrink Fit Machine Market is expected to grow at a strong CAGR during the forecast period (2022-2030). Asia Pacific is anticipated to emerge as the fastest-growing shrink-fit machine market primarily owing to the growing automotive industry. Furthermore, the rapid massive transformation of the automotive industry in China and India has increased the vehicle production that is being run on gasoline and batteries catering to the demand for the shrink-fit machine as manufacturers focused to manufacture lightweight vehicles. Additionally, the government policies and initiatives in the region aim to promote industry 4.0. This has further propelled the demand for the shrink-fit machine market.

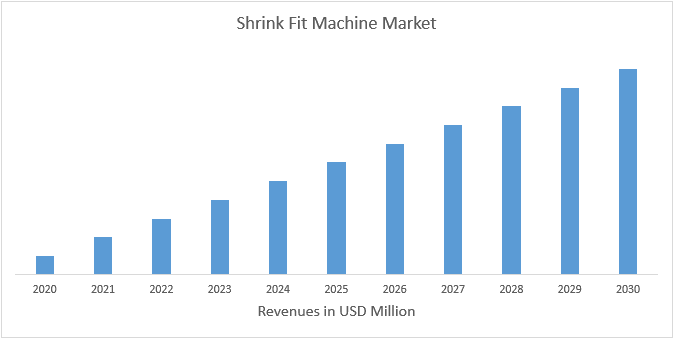

FIG. 1 Asia Pacific Shrink Fit Machine Market Revenue (2021-2030)- USD Mn

For a detailed analysis of the Global Shrink Fit Machine Market browse through – https://univdatos.com/report/shrink-fit-machine-market/

Based on type, the market is categorized into Less than 10KW, 10-20KW, and more than 20KW. The more than 20KW category has dominated the market in the historic year and is expected to see the same trend in the forecast period. The major factors that push the segment for high demand are the growing various industries such as aerospace, automotive, and manufacturing where heavy-duty workloads have been carried out and the segment possesses high power and ability to handle heavy work. Moreover, the use of greater than 20kw shrink-fit machines lets in for quicker heating and cooling times, resulting in better throughput rates. This is vital for high-volume production runs in industries along with automotive and manufacturing. The usage of excessive-power machines also ensures a high level of accuracy and repeatability in the production system. For instance, in December 2020, according to the report published by Indian Brand Equity Foundation, the Indian aerospace & defense (A&D) market is projected to reach ~USD 70 billion by 2030, driven by the burgeoning demand for advanced infrastructure and government thrust. Therefore, the growing aerospace and defense industry continued the domination of more than 20KW segment.

Based on application, the market is segmented into the aerospace industry, automotive, general metal processing, and medical Industries. Among these segments, the automotive industry has the largest market share in the historic period and is expected to show the same trend in the forecast period as the automotive industry is a significant consumer of shrink-fit machines, and it is the largest end-user of this technology. Shrink fit machines are used in various applications in the automotive industry, such as the manufacturing of engine blocks, suspension components, brake systems, transmission parts, and exhaust systems. The demand for shrink-fit machines in the automotive industry is primarily driven by the increasing demand for high-performance and lightweight vehicles. Moreover, the burgeoning adoption of electric vehicles worldwide due to the volatile price of fuel and the various government around the world’s stringent regulations to control pollution. The production of EVs requires specialized parts that are lightweight and have high strength. Shrink-fit machines offer a cost-effective and efficient way to manufacture these parts. For instance, in 2021, according to the international energy agency(IEA), Consumers spent USD 120 billion on electric car purchases in 2020, a 50% increase from 2019, which breaks down to a 41% increase in sales and a 6% rise in average prices. Moreover, in February 2023, according to a report published by the U.S. Bureau of Labor Statistics, the consumer demand for EVs has risen significantly from 22000 EVs on the road in 2011 to a little over 2 million in a decade till 2021. Therefore, the growing automotive industry plays an important role in the shrink-fit market.

Global Shrink Fit Machine Market Segmentation

Market Insight, by Type

· Less than 10KW

· 10-20KW

· More than 20KW

Market Insights, by Application

· Aerospace Industry

· Automotive

· General Metal Processing

· Medical Industry

Market Insight, by Region

· North America

o U.S.

o Canada

o Mexico

o Rest of North America

· Europe

o Germany

o UK

o France

o Italy

o Spain

o Rest of Europe

· APAC

o China

o Japan

o India

o South Korea

o Rest of APAC

· Rest of the World

Top Company Profiles

· Haimer GmbH

· BILZ WERKZEUGFABRIK GmbH & Co. KG

· Guhring, Inc.

· Diebold

· MST Corporation

· Zoller

· Lyndex-Nikken

· Falcon Toolings

· Kelch GmbH

· D’ANDREA S.p.A.

Get a call back