Rising Infrastructure Structure Propelled the Growth of the Offshore Wind Market. Europe to lead the growth!

Author: Vikas Kumar

14 November 2023

Numerous big businesses are striving for market share in the fiercely competitive European offshore wind sector. Smaller businesses and startups, however, can enter the industry and support its expansion. The European offshore market is expected to continue to grow in the coming years driven by a surge in offshore infrastructure.

Europe is home to some of the world’s most favorable conditions for offshore wind power generation, including strong winds, deep waters, and a high demand for renewable energy. In recent years, there has been a growing trend towards the use of offshore wind power in Europe. This is because offshore wind power is a highly efficient and cost-effective way to generate renewable energy, and it can help reduce Europe’s dependence on fossil fuels and mitigate the effects of climate change. Offshore wind power is typically generated using large wind turbines that are installed on offshore platforms or foundations. These turbines can be placed in a variety of locations, including shallow waters near the coast and deeper waters further offshore. In Europe, offshore wind power is typically generated in the North Sea, which is home to some of the world’s most favorable conditions for offshore wind power market. The North Sea is home to several offshore wind farms, which are typically located in shallow waters near the coast. For instance, in April 2022, to make the offshore wind farms in the North Sea into what Belgium’s energy minister called “Europe’s biggest green power plant,” nine European nations have committed to increasing their capacity there by eight times before 2050.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=48853

For instance, in 2022, In Europe, there were 19.1 GW of new wind installations (16.7 GW onshore and 2.5 GW offshore). Despite the poor economic climate and supply chain issues, 2016 was a record year for installations in Europe, up 4% from the previous year. However, installations were 12% below our realistic 2021 expectations scenario and much below the rates necessary to achieve Europe’s climate and environmental goals.

- The most onshore wind farms were established in Germany, Sweden, and Finland. The UK had about half of the offshore installations, and France put in its first sizable offshore wind farm.

- Over the years 2023 to 2027, it is anticipated that Europe will develop 129 GW of new wind farms, of which the EU-27 will install 98 GW. Over the period 2023–2027, 75% of the additional capacity will be added onshore. Over the years 2023–2027, we predict the EU to add 20 GW of new wind farms annually. To reach its 2030 goals, the EU should be constructing new wind farms at a rate of over 30 GW annually.

- In the EU-27 plus the UK, wind energy supplied a record 17% of demand, up 2% from 2021. The wind conditions were substantially better, especially in northern Europe, and when combined with strong installations, particularly in Sweden and Finland, generation in the EU-27 plus the UK increased by more than 9% from 2021 to 22.

- With the exception of one unusual year in 2021, when generation was lower than in 2020, wind energy generation in Europe has been increasing gradually from 370 TWh in 2018 to 489 TWh in 2022. The demand for energy decreased from 2,960 TWh in 2018 to 2,830 TWh in 2022 at the same time. Lockdowns caused by the COVID-19 outbreak in 2020 and the war in Ukraine in 2022 contributed to this in part.

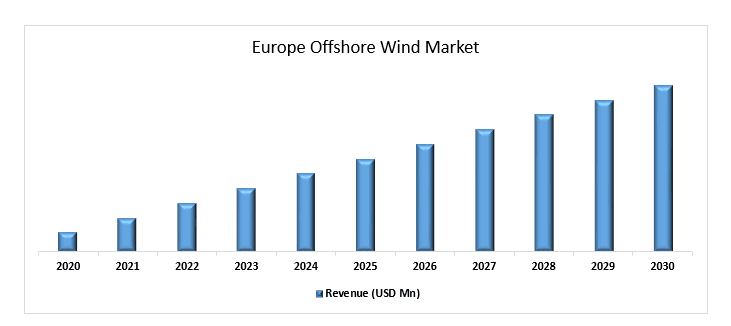

Europe Offshore Wind Market Revenue (2020-2030)- USD Mn

Based on component, the market is segmented into turbines, electrical infrastructure, substructure, and others. The turbine segment held an extensive share of the offshore wind market in 2022. The turbine segment is further classified into nacelle, rotors and blades, and tower. Turbines are placed on the tower and are mainly responsible for harnessing wind energy to produce power. Major companies are working on supplying and constructing turbines to enhance the productivity of the wind farm. For instance, in May 2021, the third and final phases of the Dogger Bank offshore wind farm’s contracts for turbine supply, service, and warranty have been finalized, according to a statement from GE Renewable Energy.

Based on location, the market is segmented into shallow water (up to 30 m), transitional water (30 m to 60 m), and deep water (> 60 m). Shallow water is expected to have an influential growth rate in the forecasted period. As shallow water is comparatively easier, the establishment of electrical infrastructure while setting up a wind turbine. Due to comparatively less wind speed available in shallow water, turbines with less MW capacity are installed in this region.

Click here to view the Report Description & TOC https://univdatos.com/report/offshore-wind-market-2/

Global Offshore Wind Market Segmentation

Market Insight, by Installation

- · Fixed Structure

Market Insight, by Component

- Turbines

- Electrical Infrastructure

- Substructure

- Others

Market Insight, by Region

- North America

- The U.S.

- Canada

- Rest of North America

- Europe

- Germany

- The U.K.

- France

- Spain

- Italy

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- Rest of the World

Top Company Profiles

- Siemens Gamesa Renewable Energy, S.A

- Vestas

- Goldwind

- Ørsted A/S

- E.ON SE

- General Electric

- Shanghai Electric

- Doosan Enerbility.

- DEME

- Envision Group

Get a call back