“Hyper-Personalization in Banking: Tailoring Financial Services to Customer Needs”

Overview

The process of customising banking services and products to each customer’s unique needs is known as hyper personalization. It entails comprehending the particular needs and preferences of the customer and then configuring products and services accordingly. This can be achieved by providing a dedicated relationship manager who is aware of the customer’s unique needs or by using data analytics to identify customer trends.

The banking sector has been steadily advancing technologically over the past ten years thanks to banks’ significant investments in going digital. The majority of these investments in digital technology have been focused on omni-channel convergence, big data, analytics, customer journey mapping, user experience, chatbots, and other self-service capabilities. In the Financial Services (FS) sector, cloud adoption is still in its infancy, and Financial Institutions (FIs) are advancing their cloud migration plans gradually. Most banks today offer digital services that enable their clients to perform basic banking tasks online or through a mobile app. This movement reduced the number of people entering bank branches and helped banks reduce costs and maximise capital investments.

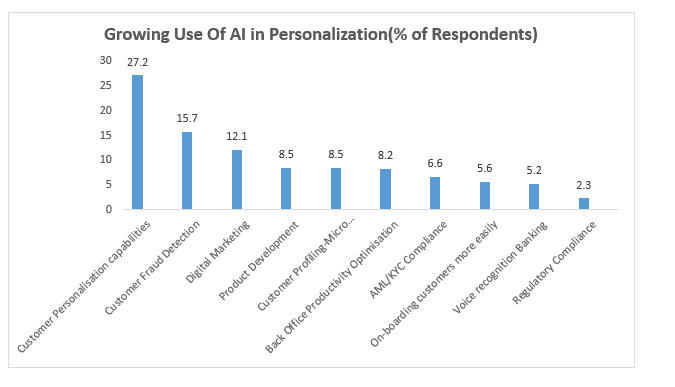

Source: The Economist Intelligence Unit

Benefits of Personalization in Financial Services

Need of Hyper-Personalization

In this digital age, banks cannot simply get away with universally applicable experiences. Customers are increasingly focusing on technology, such as apps or social media platforms where they can control what information is shared when chatting with new people, and away from face-to-face interactions. In this way, the need for and importance of hyper-personalized customer service are both increased. The way that customers interact with businesses has changed recently, and they now demand a more personalised experience. Banks can now collect and analyse customer data more effectively and efficiently than ever before thanks to technological advancements, which enables them to offer a more individualised experience. Customers are increasingly looking for customised banking services and products. Banks can increase revenue, lower costs, and increase customer retention by implementing personalization.

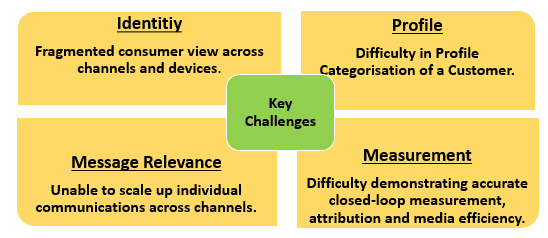

Key Challenges

Ways Through which Banks can Increase Hyper-Personalization in Banking

• By Utilizing the Existing Data.

• Using Insights to Innovate the Product & Services.

• Implementation of Right Technologies.

• Nurturing Strong Customer Relationship.

• Using Analytics Efficiently.

Conclusion

Marketers of financial services must comprehend the consumer’s point of view in order to provide them with individualised, direct forms of marketing communication. Marketers in the financial services sector can benefit from greater customer loyalty and rapid market share growth by utilising the appropriate technology, strategies, and insights. Financial services organisations will need to think about solutions that can help deliver more individualised customer experiences while maintaining compliance and upholding public trust as public concern and the number of regulatory mandates continue to rise. Organizations can change their focus to the customer and maintain industry competition by putting the right measurement tool in place.

Author: Divyansh Tiwari