Emphasis on Type (Towable RVs (Travel Trailers, Travel Trailers-Fifth Wheels, Folding Camping Trailers, Truck Campers)); End Use (Commercial and Personal), and Country

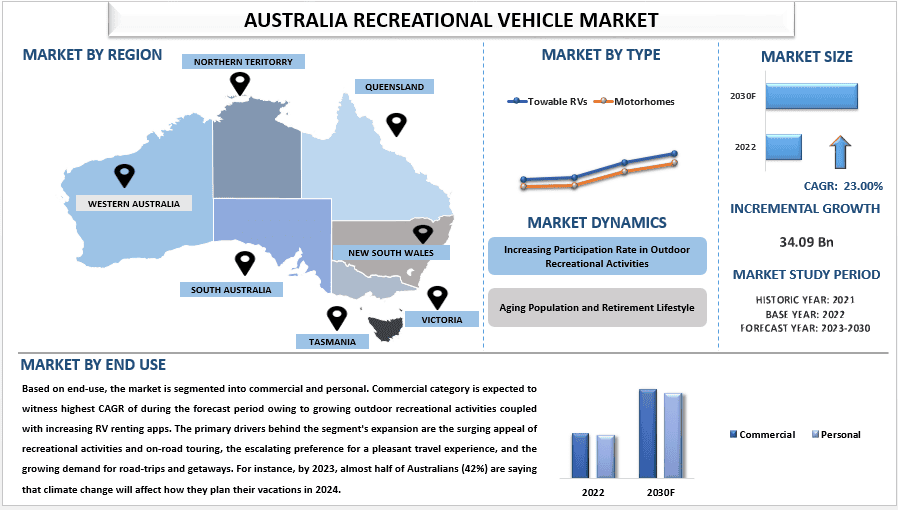

The Australia recreational vehicle market was valued at USD 7,703.7 million in 2022 and is expected to grow at a CAGR of 23.00% during the forecast period (2023-2030). The global outbreak of COVID-19 had a profound effect on international travel, resulting in a rise in domestic tourism and regional trips across Australia. Due to the closure or limitation of international borders, Australians shifted their focus towards discovering local destinations, in search of distinctive and unforgettable experiences within their own country. The pandemic has sparked a renewed interest in the rise of regional travel and road trips. During the pandemic, Australians were eager to uncover the hidden treasures and natural marvels of their homeland. Recreational vehicles emerged as the ideal choice, enabling adventurers to venture to secluded spots while adhering to social distancing guidelines and reducing interactions with others.

Some of the prominent regional destinations that attracted RV travelers during this time included the Gibb River Road in Western Australia, the Great Ocean Road in Victoria, and the expansive Nullarbor Plain spanning Western and South Australia. These paths showcased stunning scenery, varied wildlife, and thrilling opportunities for exploration, catering to RV enthusiasts in search of Australia’s rural charm.

Moreover, RV sharing platforms such as Camplify and SHAREaCAMPER have emerged to meet the increasing demand for regional travel and domestic tourism. These platforms offer a convenient and cost-effective way for travelers to access recreational vehicles. Camplify, for instance, has experienced a notable rise in bookings during the pandemic, as more Australians have opted for RV travel as a safe and socially distanced way to explore their own country. The company’s “take rate,” or revenue from transactions, was 25% during the financial year ending June 2021. The company racked up 30,651 bookings, enabling it to more than double its revenue to USD 6.1 million. Camplify also expanded its gross transaction value over the year by 171 percent to USD 23.6 million. By allowing RV owners to list their vehicles for rent, Camplify provides travelers with a wide range of options, enabling them to enjoy the freedom and flexibility of RV travel without the need to purchase a vehicle upfront. Similarly, SHAREaCAMPER has also seen a surge in demand, as more Australians look to rent RVs for domestic and regional travel. This platform connects RV owners with potential renters, promoting the sharing economy and giving travelers access to high-quality RVs for their Australian adventures.

Some of the major players operating in the market include Jayco Inc. (Thor Industries Inc.), Winnebago Industries, Avida RV, Forest River Inc., JB Caravans, Road Star Caravans, Tourism Holdings Limited, Sunliner, Thor Industries Inc., and Maverick Campers & Caravans. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products/technologies.

Insights Presented in the Report

“Amongst type, the towable recreational vehicle segment dominated the market in 2022.”

Based on type, the market is bifurcated into towable RVs and motorhomes. Among these, the towable recreational vehicles segment has dominated the market in the historic period and is expected to dominate in the forecast period due to the safer and more flexible way to explore their own country. Additionally, the increasing number of recreational parks in Australia that provide camping amenities has contributed to the growing need for towable RVs. For instance, in 2022, as stated in the Caravan Industry Association of Australia (CIAA) report, 20,498 recreational vehicle units were brought into the country to meet the industry’s requirements.

“Amongst end use, the commercial segment witnessed highest CAGR in 2022.”

Based on end-use, the market is segmented into commercial and personal. The commercial category is expected to witness the highest CAGR of during the forecast period owing to growing outdoor recreational activities coupled with increasing RV renting apps. The primary drivers behind the segment’s expansion are the surging appeal of recreational activities and on-road touring, the escalating preference for a pleasant travel experience, and the growing demand for road-trips and getaways. For instance, by 2023, almost half of Australians (42%) are saying that climate change will affect how they plan their vacations in 2024.

“Queensland region dominated the market for Australia Recreational Vehicle market in 2022.”

The Queensland region dominated the Australia recreational vehicle market and is expected to behave in the same fashion in the forecast period. Queensland, renowned for its breathtaking shorelines, lush rainforests, and varied terrains, has emerged as a coveted spot for RV enthusiasts seeking to immerse themselves in the state’s natural splendor. The demand for recreational vehicles (RVs) has seen a notable rise in the past few years, driven by various factors. The major factor contributing to this uptick in demand is the growing preference for domestic and international tourism and travel across Australia. For instance, Queensland welcomed a record 26.0 million visitors to the state (up 25.0 per cent over the year). Among these visitors, Queensland welcomed a record number of holiday visitors (11.3 million, up 24.3 per cent over the year). Total visitation was in line with 2019 levels (up 0.2 per cent) and holiday visitation was 12.6 per cent higher. Moreover, domestic travel by 25.96 million in 2022 increased by 0.2% from 2019, has created a favorable demand for the recreational vehicles in the region. Moreover, advancements in RV technology and design have made these vehicles more appealing to a wider range of consumers.

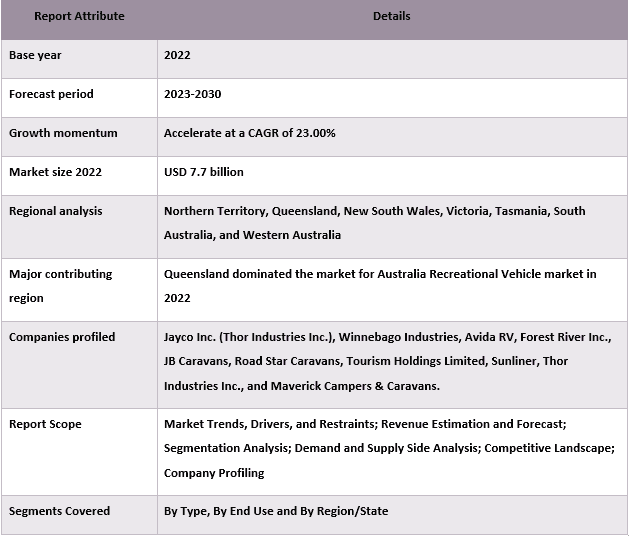

Australia Recreational Vehicle Market Report Coverage

Reasons to buy this report:

Customization Options:

The Australia Recreational Vehicle market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to contact us to get a report that completely suits your requirements.

1. Market Introduction

2. Research Methodology Or Assumption

3. Market Synopsis

4. Executive Summary

5. Australia Recreational Vehicle Revenue, 2020-2030f.

6. Market Insights By Type

7. Market Insights By End User

8. Market Insights By Region

9. Australia Recreational Vehicle Dynamics

10. Australia Recreational Vehicle Opportunities

11. Australia Recreational Vehicle Trends

12. Demand And Supply-side Analysis

13. Value Chain Analysis

14. Pricing Analysis

15. Competitive Scenario

16. Company Profiled

17. Disclaimer

Research Methodology for the Australia Recreational Vehicle Market Analysis (2023-2030)

Analyzing the historical market, estimating the current market, and forecasting the future market of the Australia Recreational Vehicle market were the three major steps undertaken to create and analyze the adoption of Australia recreational vehicle in major regions. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the Australia recreational vehicle market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the Australia Recreational Vehicle market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Australia recreational vehicle market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report such as type, and end use. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Australia recreational vehicle market. Further, we conducted factor analysis using dependent and independent variables such as type and end use of the Australia recreational vehicle market. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the Australia Recreational Vehicle market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the Australia Recreational Vehicle market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2030 for different segments and sub-segments across the major markets in Australia. The research methodology adopted to estimate the market size encompasses:

Market Size and Share Validation

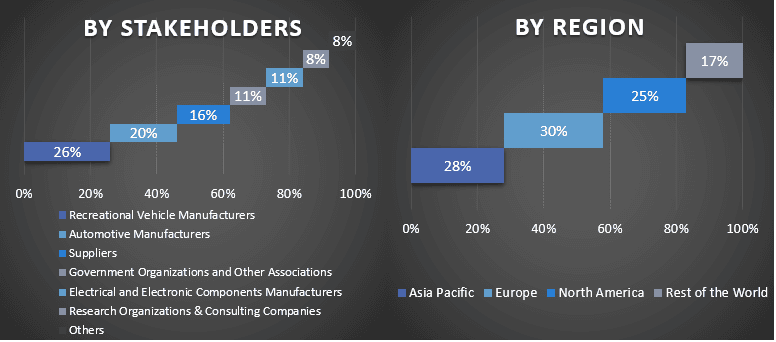

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the Australia Recreational Vehicle market, data was split into several segments & sub-segments after studying various parameters and trends in the areas of type and end use in the Australia recreational vehicle market.

The main objective of the Australia Recreational Vehicle Market Study

The current & future market trends of the Australia Recreational Vehicle market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

Q1: What is the current market size and growth potential of the Australia Recreational Vehicle market?

Q2: What are the driving factors for the growth of the Australia Recreational Vehicle Market?

Q3: Which segment has the largest share of the Australia Recreational Vehicle market by Type?

Q4: What are the emerging technologies and trends in the Australia Recreational Vehicle market?

Q5: Which region will dominate the Australia Recreational Vehicle market?

Q6: Who are the key players operating in the Australia Recreational Vehicle market?

Customers who bought this item also bought