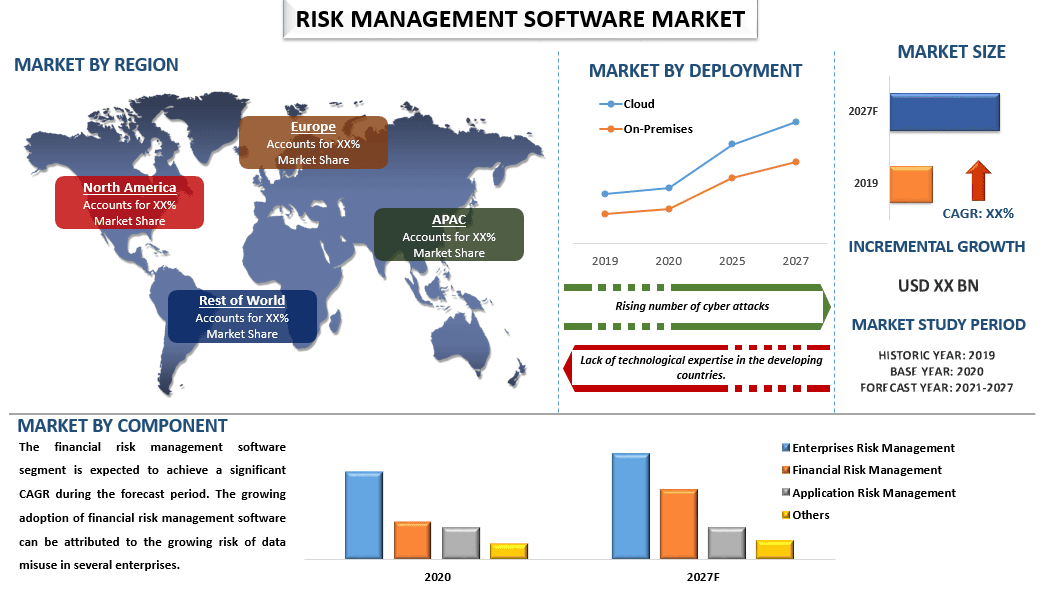

Emphases on, Component (Enterprise Risk Management, Financial Risk Management, Application Risk Management); Deployment (On-Premises, Cloud); End-User (Consumer Goods, Transport and Logistics, Healthcare, Retail, Manufacturing, Food and Beverage, Others) and Region/Country.

Risk Management Software Market is expected to grow at a CAGR of 9% During the forecast period. The risk management software helps organizations measure levels of risk in ongoing projects and processes and generate meaningful insights and action plans for mitigating risk. The growth of the risk management software market can be attributed to the increasing adoption of digitization for various applications across multiple verticals such as retail, manufacturing, energy and utilities, government, and BFSI. The software helps in creating a clear strategy for risk-based auditing, as it makes it more systematic and organized. Furthermore, the risk management software helps in maintaining consistency and providing clear communication. Moreover, the increasing amount of critical organizational data and increasing cases of personal information theft, increasing acceptance by financial institutions, emerge as the major driver of market growth.

The Major companies in the market are IBM, NAVEX, Inc., Logicmanager, Inc., MetricStream., Qualys, Inc., RSA Security LLC., SAP, SAS Institute Inc. , Servicenow, CENTRL, Inc.

Insights Presented in the Report

“Amongst component, the financial risk management software category accounted for the majority share in the market in 2020”

Based on component the market is segmented into enterprise risk management, financial risk management, application risk management, and others the financial risk management software category accounted for the majority share in the market in 2020. The financial risk management software is accepted by organizations across the world to reduce their losses incurred due to the risks in their business operations, which is expected to propel the growth of global financial risk management software market. Furthermore, the rise in technological advancement and continuous changes in government and corporate regulations and policies are expected to boost the financial risk management software market growth.

“Amongst deployment, the cloud segment is expected to witness the highest CAGR during the forecast period”

Based on deployment, the market is segmented into cloud and on-premises. The cloud segment is expected to achieve a considerable CAGR during the forecast period. The growing demand of cloud services can be attributed to the cost-effectiveness of cloud services. As companies can eliminate unnecessary hardware or rigid on-premises assets and easily right-size computing resources according to their unique business requirements. Furthermore, the integration of cloud-based solutions and services helps organizations to reduce their operational cost significantly as they can be accessed from anywhere.

“North America to witness significant growth during the forecast period”

The North America market is expected to dominate the risk management software market and is expected to continue to maintain domination throughout the forecast period. The growth in the region can be attributed to the presence of leading risk management software providers. Furthermore, the rise of cybersecurity threats, for instance, A U.N. report claimed that North Korean hackers stole more than USD 50 million between 2020 and mid-2021 from three cryptocurrency exchanges. The rapid adoption of risk management software by different banks and the FinTech industry to manage different types of risks, and the presence of prominent key players. Furthermore, early adoption of advanced digital technologies and high investments in adopting them. The presence of numerous manufacturing plants and big retail chains drives the adoption of risk management software.

Reasons to buy this report:

Customization Options:

The global risk management software market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

1. Market Introduction

2. Research Methodology Or Assumption

3. Market Synopsis

4. Executive Summary

5. Global Risk Management Software Market Revenue (usd Bn), 2019-2027f

6. Market Insights By Component

7. Market Insights By Deployment

8. Market Insights By End-user

9. Market Insights By Region

10. Risk Management Software Market Dynamics

11. Risk Management Software Market Opportunities

12. Risk Management Software Market Trends

13. Policy & Regulatory Framework

14. Demand And Supply-side Analysis

15. Value Chain Analysis

16. Competitive Scenario

17. Company Profiled

18. Disclaimer

Research Methodology for The Global Risk Management Software Market Analysis (2021-2027)

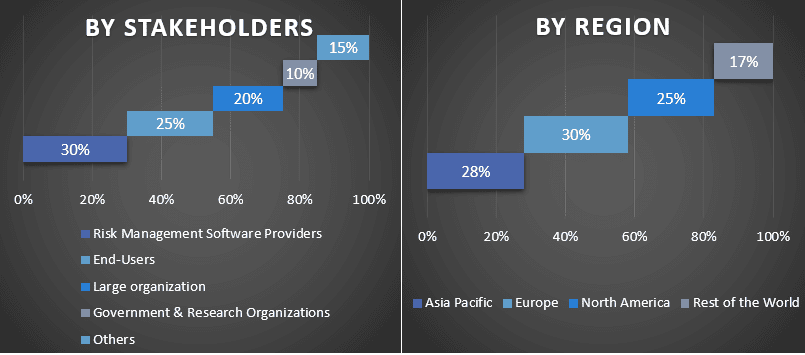

Analyzing the historical market, estimating the current market, and forecasting the future market of the global risk management software market were the three major steps undertaken to create and analyze the adoption of risk management software in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global risk management software market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the risk management software market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the risk management software market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as component, deployment, and end-user. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the risk management software market. Further, we conducted factor analysis using dependent and independent variables such as various component, deployment, and end-user of risk management software. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the risk management software market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global risk management software market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., top-down/bottom-up approach were applied to arrive at the market forecast about 2027 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment of the global risk management software market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of offering and technique in the global risk management software market.

The main objective of the global risk management software market study

The current & future market trends of the global risk management software market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

Customers who bought this item also bought