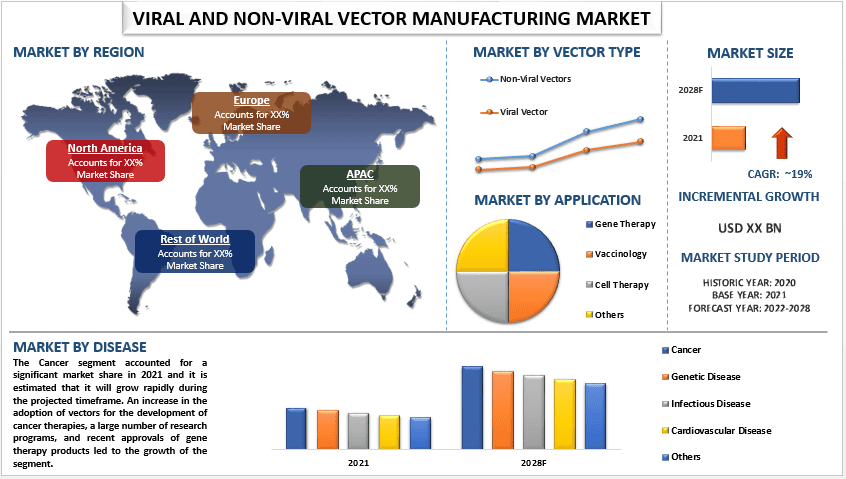

Emphasis on Vector Type (Viral Vector, Non-Viral Vectors); Disease (Cancer, Genetic Disease, Infectious Disease, Cardiovascular Disease, Others); Application (Gene Therapy, Vaccinology, Cell Therapy, Others); and Region/Country

The viral and non-viral vector manufacturing market is expected to register a CAGR of approx. 19% over the period of 2022-2028. Viral vector manufacturing refers to the process of producing viral particles (typically viruses that have been modified) used as a delivery system for therapeutic genes. Non-viral vector manufacturing refers to the production of non-viral particles (such as nanoparticles, liposomes, or plasmids) used for gene delivery. Both methods aim to deliver therapeutic genes to target cells, but non-viral methods are generally considered safer and less immunogenic. The growing demand for viral and non-viral vector manufacturing can be attributed to the increasing government and private funding for research, and the rising demand for vector manufacturing for use in both basic and applied research are the key factors which boost the adoption of inorganic growth strategies among key industry players around the globe. For instance, In May 2022, AGC Biologics announced that it is adding viral vector suspension technology and capacity for the development and manufacturing of gene therapies at its commercial-grade campus in Longmont, Colo. Owing to the glaring statistics the increasing funding for research leads to higher demand for viral and non-viral vector manufacturing across the globe and would contribute to the growth of the market in the forthcoming period as well. Furthermore, the viral and non-viral vector manufacturing market is anticipated to grow on account of advancements in gene therapy. In addition, Increased demand for personalized medicine increasing demand for vector manufacturing drives the market growth. However, some of the restraints in the market including the high cost of production and strict regulatory guidelines and approval processes are impeding the growth of this market all over the world.

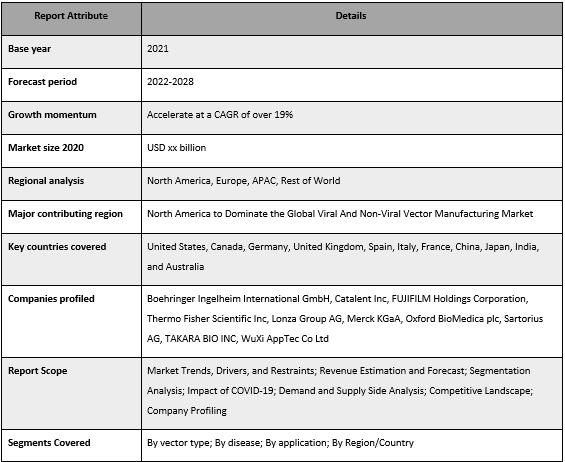

Boehringer Ingelheim International GmbH, Catalent Inc, FUJIFILM Holdings Corporation, Thermo Fisher Scientific Inc, Lonza Group AG, Merck KGaA, Oxford BioMedica plc, Sartorius AG, TAKARA BIO INC, and WuXi AppTec Co Ltdare some of the key players in the market. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products/technologies.

Insights Presented in the Report

“Amongst vector type, the non-viral vectors category is expected to witness significant market share during the forecast period”

Based on the vector type, the viral and non-viral vector manufacturing market is segmented into viral vector and non-viral vectors. The non-viral vectors segment accounted for a significant market share in 2021 and it is estimated that it will grow rapidly during the projected timeframe. Non-viral vectors are considered safer than viral vectors, as they do not contain live viruses and are less likely to cause immune reactions or other adverse events. they are typically easier to produce than viral vectors, which can help reduce the cost of production and can be used in a wide range of applications, including gene therapy, vaccine development, and research.

“Amongst disease, the cancer category is expected to witness considerable CAGR during the forecast period”

Based on the disease, the market is fragmented into cancer, genetic disease, infectious disease, cardiovascular disease, and others. The cancer segment grabbed a considerable market share in 2021, and it is expected to grow at a significant CAGR during the forecast period. An increase in the adoption of vectors for the development of cancer therapies, a large number of research programs, and recent approvals of gene therapy products led to the growth of the segment.

Viral And Non-Viral Vector Manufacturing Market Report Coverage

“Amongst application, the vaccinology category is expected to witness significant CAGR during the forecast period”

Based on the application, the market is fragmented into gene therapy, vaccinology, cell therapy, and others. The vaccinology segment grabbed a considerable market share in 2021, and it is expected to grow at a significant CAGR during the forecast period. Vectors can be used to develop vaccines against a wide range of pathogens, including viruses, bacteria, and parasites. The COVID-19 pandemic has increased the demand for vaccines, leading to increased interest in vector-based vaccine development.

“North America to witness significant growth during the forecast period”

For a better understanding of the market adoption of viral and non-viral vector manufacturing, the market is analyzed based on its worldwide presence in the countries such as North America (U.S., Canada, and Rest of North America), Europe (Germany, France, Italy, Spain, U.K., and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, and Rest of APAC), and Rest of World. North America constitutes a major market for the viral and non-viral vector manufacturing industry owing to the growing search and development as well as growing investment in the biotechnology sector. Moreover, the growing elderly population as well as the large patient population, including individuals with rare diseases and cancer who may benefit from vector-based therapies, increasing the demand for viral and non-viral vector manufacturing market. For instance, in 2021, According to the World Health Organization (WHO), the number of people aged 60 years and older is projected to double by 2050, with North America having a significant share of this ageing population. Owing to these glaring statistics the increase in the demand for healthcare services, including vector-based therapies is one of the major factors expanding the growth of the market. Additionally, a favourable regulatory environment for the development and commercialization of vector-based therapies well-developed healthcare infrastructure provides a favorable environment for the development and commercialization of vector-based therapies in the region.

Reasons to buy this report:

Customization Options:

Global viral and non-viral vector manufacturing market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

1. Market Introduction

2. Research Methodology Or Assumption

3. Market Synopsis

4. Executive Summary

5. Impact Of Covid-19 On The Viral And Non-viral Vector Manufacturing Market

6. Global Viral And Non-viral Vector Manufacturing Market Revenue, 2020-2028f

7. Market Insights By Vector Type

8. Market Insights By Disease

9. Market Insights By Application

10. Market Insights By Region

11. Viral And Non-viral Vector Manufacturing Market Dynamics

12. Viral And Non-viral Vector Manufacturing Market Opportunities

13. Viral And Non-viral Vector Manufacturing Market Trends & Insights

14. Demand And Supply Side Analysis

15. Value Chain Analysis

16. Pricing Analysis

17. Strategic Insights

18. Competitive Scenario

19. Company Profiled

20. Disclaimer

Research Methodology for the Global Viral and Non-Viral Vector Manufacturing Market Analysis (2022-2028)

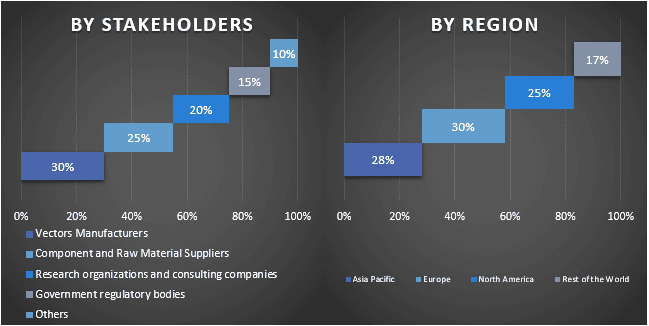

Analyzing the historical market, estimation of the current market, and forecasting the future market of the global viral and non-viral vector manufacturing market were the three major steps undertaken to create and analyze the adoption of viral and non-viral vector manufacturing in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global viral and non-viral vector manufacturing market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the viral and non-viral vector manufacturing market through company internal sources such as annual report & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the viral and non-viral vector manufacturing market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments included in the report as the vector type, disease, and application. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the viral and non-viral vector manufacturing market. Further, we conducted factor analysis using dependent and independent variables such as the increasing government and private funding for research, and the rising demand for vector manufacturing for use in both basic and applied research, etc. globally. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the viral and non-viral vector manufacturing market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global viral and non-viral vector manufacturing market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., top-down/bottom-up approach was applied to arrive at the market forecast about 2027 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment of the global viral and non-viral vector manufacturing market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of vector type, disease, and application in the global viral and non-viral vector manufacturing market.

The main objective of the Global Viral and Non-Viral Vector Manufacturing Market Study

The current & future market trends of the global viral and non-viral vector manufacturing market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

Customers who bought this item also bought