Brewing Ingredients Market: Current Analysis and Forecast (2021-2027)

$3999 – $7577

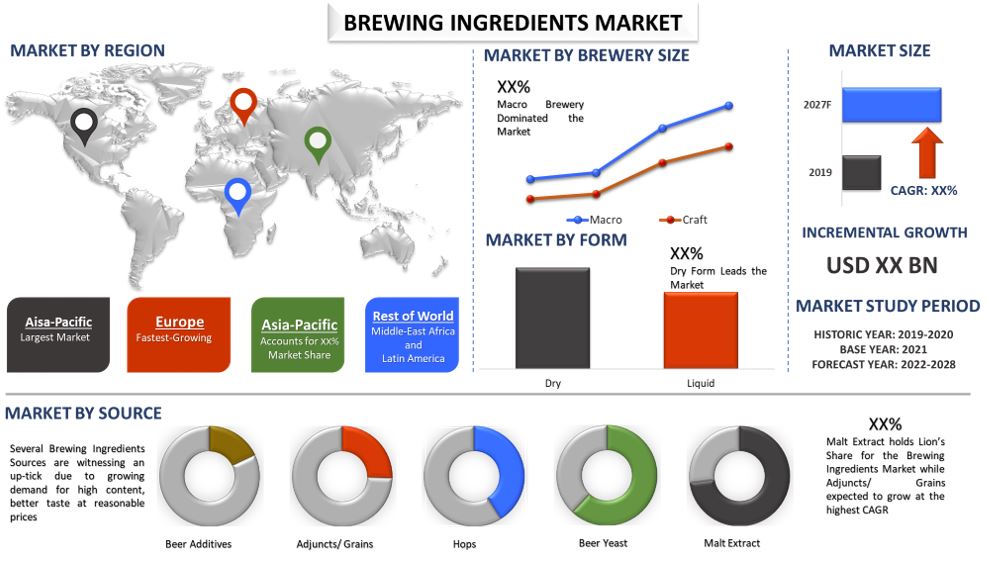

Emphasis on Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, Beer Additives); Brewery Size (Craft Brewery, Macro Brewery); Form (Dry, Liquid); Region and Country

| Published: | Aug-2021 |

|---|---|

| Pages: | 176 |

| Table: | 36 |

| Figure: | 74 |

| Report ID: | UMCG21365 |

| Geography: |

Report Description

Brewing Ingredients Market was valued at US$ 31 billion in 2020 and is expected to grow at a CAGR of 7% over the forecast period (2021-2027). Escalating demand for beers worldwide especially craft beers is a leading factor contributing to the market growth of the brewing ingredients. As per Brewers Association, the total value of the beer market was USD 94.1 billion in 2020. Also, the number of craft breweries in the United States increased from 4,803 in 2015 to 8,764 in 2002, revealed by the Brewers association owing to the emerging demand due to the lifestyle change, increased disposable income. Moreover, due to the rising awareness among end-users, emerging demand for healthier products in the food & beverage industry witnessed a sharp rise in recent years. Therefore, the consumers specially millennium are shifting towards alcohol-free beer and mocktails.

As per a survey by Heineken USA, 52% of respondents had increased the consumption of alcohol-free beer and mocktails. Another major factor for the increase in demand for zero-alcohol content beer is that it allows consumers to drink in moderation and regularly. The survey also shows that 42% of respondents were likely to choose an alcohol-free beer because it allows them to drink regularly.

In Europe, the government norms for the shutdown had disproportionately impacted bars and restaurants, eliminating 42% of beer hospitality sales volumes in 2020. The drop in consumption, provoked 860,000 job losses, a 25% decline in beer’s overall value-added to the European economy, and a 23% decline in government tax revenues from beer, principally due to USD 8.31 billion in lost VAT receipts usually collected through beer hospitality. A further USD 4.75 billion in government revenues were lost because of the income and social security contributions usually paid by the hundreds of thousands who lost their jobs.

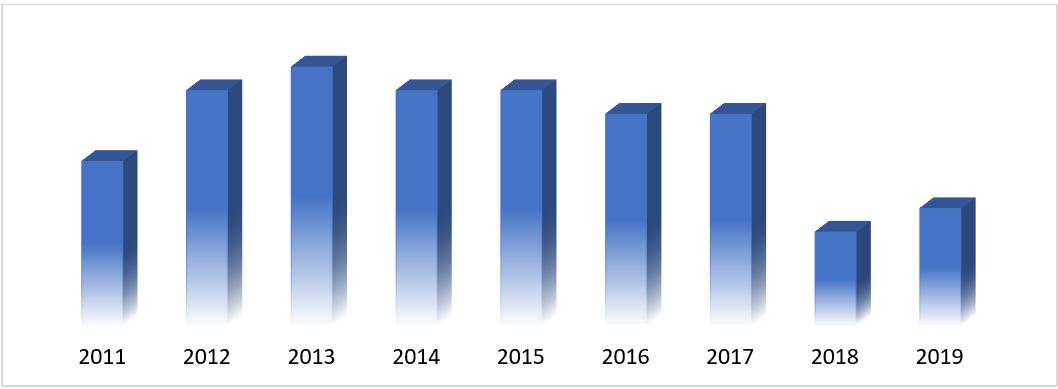

Global Beer Production (In Billion Hectoliters), 2014-2019

Cargill Incorporated, Angel Yeast Co. Ltd., Boortmalt, Malteurop Groupe, Rahr Corporation, Lallemand Inc., Viking Malt, Lesaffre, Maltexco S.A., etc., are some of the prominent players operating in the Brewing Ingredients market. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products.

Insights Presented in the Report

“Amongst Source, Malt Extract segment holds the major share”

Based on the Source Type, the market is fragmented into Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives. The Malt Extract segment dominated the market with a share of XX% in 2020 and is expected to maintain its dominance during the forecast period owing to the rising awareness and emerging demand for high protein content in the beers. However, the Adjuncts/Grains are expected to witness a considerable CAGR during the forecast period.

“Amongst Brewery Size, Craft Brewery segment dominated the market during the forecast period”

Based on Brewery Size, the market is mainly fragmented into Craft Brewery and Macro Brewery. In 2020, the macro brewery grabbed XX% market share. Moreover, the market of this segment is expected to proliferate with a CAGR of XX% in the forthcoming coming period of 2021-27. Howvwem the carft breweries are xepcetd to witness exhibit growth in coming years. Craft breweries offer different flavors, which allow consumers with different tastes to cater to their preferences.

“Amongst Form, Dry Form segment grabbed Major Market share in 2020”

Based on Form Type, the market is mainly fragmented into Dry and Liquid. In 2020, the dry form segment grabbed the major market share and dominated the market. The segment gathered an XX% revenue share in 2020.

“Asia-Pacific represents one of the largest markets of Brewing Ingredients market”

For a better understanding of the market dynamics of the Brewing Ingredients market, a detailed analysis was conducted for different regions across the globe including North America, Europe, Asia Pacific, and the Rest of the world. Asia-Pacific dominated the market and generated revenue of US$ XX Million in 2020 owing to the surging adoption of western culture in developing countries. Also, a rise in disposable income is a key factor contributing to the growing market of the region.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts

- The report presents a quick review of overall industry performance at one glance

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry

- The study comprehensively covers the market across different segments

- Deep dive regional level analysis of the industry

Customization Options:

The brewing Ingredients Market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

You can also purchase parts of this report. Do you want to check out a section wise

price list?

Research Methodology

Analyzing the historical market, estimation of the current market, and forecasting the future market of the Brewing Ingredients Market were the three major steps undertaken to create and analyze the demand for brewing ingredients across major regions. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the Brewing Ingredients market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/ bottom-up approach to forecast the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detailed secondary study was conducted to obtain the historical market size of the brewing ingredients through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Brewing Ingredients market, we conducted a detailed secondary analysis to gather historical market insights and share for different brewery sizes and Forms for major regions. Major segments included in the report are Source, Form, and brewery Size. Further region and country-level analyses were conducted to evaluate the overall adoption of Brewing Ingredients across the globe.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of Brewing Ingredients. Further, we conducted factor analysis using dependent and independent variables such as surging disposable income, growing demand for low sugar- non-alcoholic beers, change in lifestyle, etc. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, merger and acquisition, business expansion, and product launches in the Brewing Ingredients industry across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the Brewing Ingredients market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weightage was assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e. bottom-up/ top-down approach was applied to arrive at the market forecast about 2027 for different segments and subsegments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (US$) and the adoption rate of Brewing Ingredients across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the Brewing Ingredients market in terms of services offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment of the Brewing Ingredients market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of Components, Deployment, Type of Threat, Security Type, Solutions, and End-Users of the Brewing Ingredients market.

Main Objective of the Brewing Ingredients Market Study

The current & future market trends of Brewing Ingredients were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends were determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of Brewing Ingredients in terms of value (US$). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include areas of source, brewery size, and form

- Define and analysis of the regulatory framework for the Brewing Ingredients industry

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

- Analyze the current and forecast market size of the Brewing Ingredients market for the major countries

- The major region studied in the report includes North America, Europe, Asia- Pacific and Rest of the World.

- Company profiles of the Brewing Ingredients market and the growth strategies adopted by the market players to sustain in the fast-growing market

- Deep dive regional level analysis of the industry