Carbon Offset and Carbon Credit Trading Service Market: Current Analysis and Forecast (2022-2028)

$3999 – $6999

Emphasis on Type (Industrial, Household, Energy Industry, and Other); Application (REDD Carbon Offset, Renewable Energy, Landfill Methane Projects, and Others); and Region/Country

Detailed Analysis of COVID-19 Impact on the Carbon Offset and Carbon Credit Trading Service Market

| Pages: | 154 |

|---|---|

| Table: | 49 |

| Figure: | 83 |

| Report ID: | UMCH211686 |

| Geography: |

Report Description

Global Carbon Offset and Carbon Credit Trading Service Market are expected to grow at a significant rate of around 19% during the forecast period 2022-2028. A carbon offset is a reduction or removal of emissions of carbon dioxide or other greenhouse gases made in order to compensate for emissions made elsewhere. Also, carbon credit training service is defined as the use of a marketplace to buy and sell credits that allow companies or other parties to emit a certain amount of carbon dioxide. In addition, the companies that received carbon credits are frequently reviewed and decreased. Private enterprises stand to gain significantly from lowering carbon emissions since they first avoid having to purchase extra credit tokens. Additionally, unused carbon credits can be sold to other businesses, which will profit financially. The carbon credit is referred to as “retired” after it has been utilized because it cannot be exchanged or used once again. Companies have the choice to join the industry-wide program or take part in the voluntary carbon market as individual organizations.

Carbon Credit Capital, Terrapass, Forest Carbon, 3Degrees, NativeEnergy Inc., GreenTree Global, South Pole, AERA GROUP SAS, Allcot Group, and Carbon Clear are some of the key players in the market. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative services.

Insights Presented in the Report

“Amongst type, Industrial category is expected to witness the highest CAGR during the forecast period”

Based on type, the market is segmented into industrial, household, energy industry, and other. The industrial category is expected to witness the highest CAGR during the forecast period owing to the high levels of industrial emissions that contribute to global warming. An efficient technique to reduce greenhouse emissions is to reduce these gases (GHG). The industries are hesitant to join the low-carbon economy, even though industrial gas offset projects are inexpensive to carry out and generate a significant number of offsets. Thus, the industrial-type carbon offset and carbon credit trading service offer better control capability and performance in the field.

“Amongst application, landfill methane projects category is expected to witness the highest adoption during the forecast period.”

Based on application, the carbon offset and carbon credit trading service market has been classified into REDD carbon offset, renewable energy, landfill methane projects, and others. The landfill methane projects category is expected to witness the highest adoption of carbon offset and carbon credit trading services during the forecast period. This is mainly because it is a natural byproduct of the decomposition of organic material in landfills. It is composed of roughly 50 percent methane (the primary component of natural gas), 50 percent carbon dioxide (CO2), and a small amount of non-methane organic compounds.

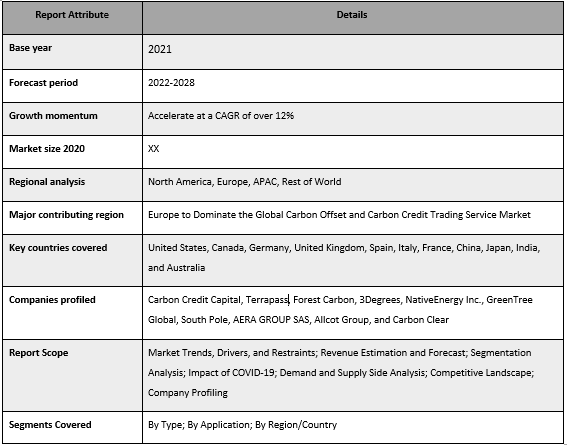

Carbon Offset and Carbon Credit Trading Service Market Report Coverage

“Europe to hold a significant share in the market”

Europe is anticipated to grow at a substantial CAGR during the forecast period. This is mainly due to the increasing government initiatives and programs pertaining to the reduction of greenhouse gas emissions and climate change, well-established industrial sector, technological advancements and developments, and growth in the renewable energy sector. For instance, EU Commission plans a carbon offset scheme for big polluters to stall their own climate action. Furthermore, the volatile carbon prices in Europe are increasing the demand for carbon credit trading services within the region.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The global carbon offset and carbon credit trading service market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

You can also purchase parts of this report. Do you want to check out a section wise

price list?

Research Methodology

Research Methodology for the Carbon Offset and Carbon Credit Trading Service Market Analysis (2022-2028)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global carbon offset and carbon credit trading service market were the three major steps undertaken to create and analyze the adoption of carbon offset and carbon credit trading services in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global carbon offset and carbon credit trading service market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the carbon offset and carbon credit trading service market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the carbon offset and carbon credit trading service market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as type and application. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the carbon offset and carbon credit trading service market. Further, we conducted factor analysis using dependent and independent variables such as various types and applications of carbon offset and carbon credit trading services. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the carbon offset and carbon credit trading service market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global carbon offset and carbon credit trading service market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2028 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the carbon offset and carbon credit trading service market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the global carbon offset and carbon credit trading service market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global carbon offset and carbon credit trading service market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of type and application in the global carbon offset and carbon credit trading service market.

The main objective of the Global Carbon Offset and Carbon Credit Trading Service Market Study

The current & future market trends of the global carbon offset and carbon credit trading service market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the carbon offset and carbon credit trading service market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include areas of type and application.

- Define and analysis of the regulatory framework for the carbon offset and carbon credit trading service

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the carbon offset and carbon credit trading service market for the major region.

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World.

- Company profiles of the carbon offset and carbon credit trading service market and the growth strategies adopted by the market players to sustain in the fast-growing market

Deep dive regional level analysis of the industry