- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

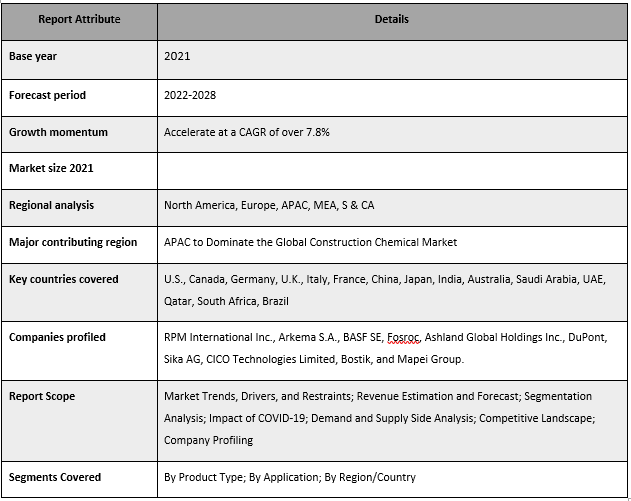

Construction Chemical Market: Current Analysis and Forecast (2022-2028)

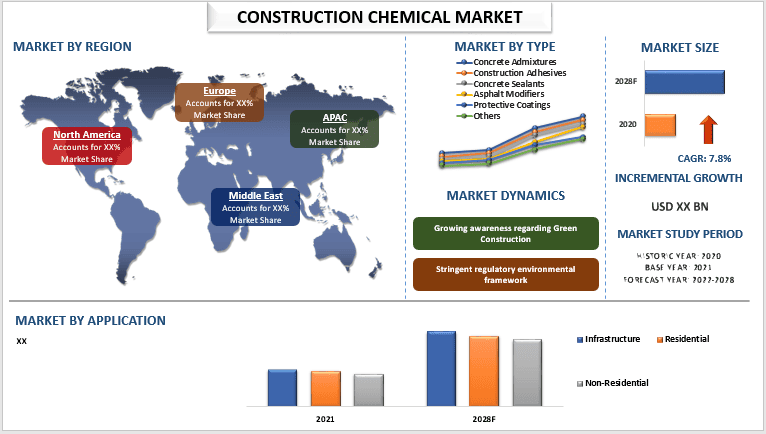

Emphasis on Product Type (Concrete Admixtures, Construction Adhesives, Concrete Sealants, Asphalt Modifiers, Protective Coatings, and Others); Application (Infrastructure, Residential, and Non-Residential); and Region/Country

Global Construction Chemical Market is expected to grow at a significant rate of around 7.8% during the forecast period 2022-2028. Construction Chemicals are chemical formulations used to hold the construction material together. Construction chemicals such as concrete admixtures, asphalt modifiers, adhesives, sealants, grout and mortar, insulation, protective coatings, and other products are used in improving workability, enhancing performance, adding functionality, and protecting structures from weather and pollution. Additionally, construction chemicals help in enhancing concrete strength and quality, provide water-tightness, and protect concrete structures from atmospheric degradation.

The Construction Chemical Market is expected to grow at a steady rate of around 7.8% owing to the increasing awareness regarding green construction. For instance, in Jun 2021, JSW Cement entered the construction chemicals biz and launched green products. The range comprises ‘Enduro Plast’ ready mix plaster, ‘Krysta Leakproof’ integral crystalline waterproofing compound, and ‘Duraflor’floorhardner. Additionally, the growing adoption of construction chemicals in the construction industry. For instance, BASF launched a new brand for the construction industry. The chemical solutions for new construction, maintenance, repair, and renovation of buildings and infrastructure: concrete admixtures, cement additives, chemical solutions for mining and tunneling, waterproofing, concrete protection and repair products, grouts, and high-performance flooring products.

RPM International Inc., Arkema S.A., BASF SE, Fosroc, Ashland Global Holdings Inc., DuPont, Sika AG, CICO Technologies Limited, Bostik, and Mapei Group are some of the key players in the market. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products/technologies.

Construction Chemical Market Report Coverage

Insights Presented in the Report

“Amongst product type, concrete admixtures category is to show dominance in the market”

Based on product type, the market is segmented into concrete admixtures, construction adhesives, concrete sealants, asphalt modifiers, protective coatings, and others. The concrete admixtures category is to show dominance in the market. Concrete admixtures are a type of construction chemical that is added to the concrete mix before or during mixing. These admixtures modify the properties of fresh and hardening concrete, such as setting time, workability, and strength development. Also, many major players are launching new products in the market to provide better binding of the concrete. For instance, in Feb 2022, Euclid launched three new admixtures at World of Concrete. The three admixtures are EUCOSHIELD is a ready-to-use liquid admixture designed to be used as an integral finishing aid that prevents rapid moisture loss from the concrete surface by binding the internal water in the pore structure; EUCON Eco-Strength improves both early- and late-age strength development in concrete; Eucon AM-10L is formulated to interact with concrete capillary pore structures to provide a system that greatly reduces the permeability of concrete through the formation of tiny crystals that block the pores.

“Amongst application, residential category is to show dominance in the market”

Based on application, the market is categorized into infrastructure, residential, and non-residential. Among these, the residential category is to show dominance in the market. This is mainly due to the rising populations, urbanization, and increasing demand for affordable housing. Also, homeowners are becoming increasingly concerned with the quality and durability of their homes and are looking for products that will ensure the longevity and performance of their structures. Thus, that can be provided with the use of construction chemicals which is escalating the growth of the market.

“APAC is anticipated to grow at a substantial CAGR during the forecast period”

In 2021, APAC is anticipated to grow at a substantial CAGR during the forecast period. This is mainly due to rapid urbanization, a growing economy, government initiatives, rising awareness of building codes and standards, and increasing demand for high-quality and durable building structures. Furthermore, the government of China has been investing heavily in the construction of new infrastructure, including roads, bridges, airports, and high-speed rail lines, as part of its ongoing economic development plan. This has created a significant demand for construction chemicals, which are essential for ensuring the quality and durability of these structures. Thus, increasing the demand for construction chemicals in the region.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The global construction chemical market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Construction Chemical Market Analysis (2022-2028)

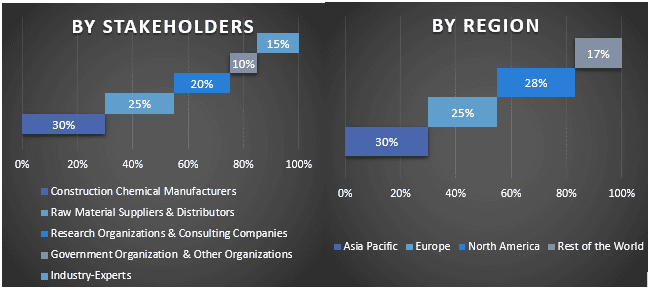

Analyzing the historical market, estimating the current market, and forecasting the future market of the global construction chemical market were the three major steps undertaken to create and analyze the adoption of construction chemical in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global construction chemical market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the construction chemical market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the construction chemical market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as product type and application. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the construction chemical market. Further, we conducted factor analysis using dependent and independent variables such as various product type and application of construction chemical . A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the construction chemical market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global construction chemical market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2028 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the construction chemical market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the global construction chemical market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global construction chemical market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of product type and application in the global construction chemical market.

The main objective of the Global Construction Chemical Market Study

The current & future market trends of the global construction chemical market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the construction chemical market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include areas of product type and application.

- Define and analysis of the regulatory framework for the construction chemical

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the construction chemical market for the major region.

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World.

- Company profiles of the construction chemical market and the growth strategies adopted by the market players to sustain in the fast-growing market

- Deep dive regional level analysis of the industry

Related Reports

Customers who bought this item also bought