Industrial Automation Oil & Gas Market: Current Analysis and Forecast (2021-2027)

$4999 – $8699

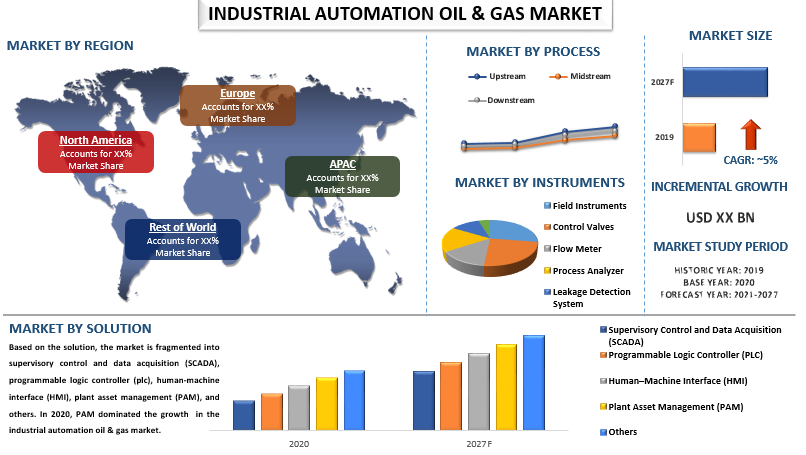

Emphasis on Process (Upstream, Midstream, Downstream); Solution (Supervisory Control and Data Acquisition (SCADA), Programmable Logic Controller (PLC), Human-Machine Interface (HMI), Plant Asset Management (PAM), Others); Instruments (Field Instruments, Control Valves, Flow Meter, Process Analyzer, Leakage Detection System, Others); and Region/Country

Detailed Analysis of COVID-19 Impact on the Industrial Automation Oil & Gas Market

| Pages: | 172 |

|---|---|

| Table: | 44 |

| Figure: | 86 |

| Report ID: | UMEP211138 |

| Geography: |

Report Description

The global industrial automation oil & gas market is expected to witness a CAGR of around 5% during the forecast period (2021–2027). As the market is anticipated to witness an uptick owing to the demand for industrial automation oil & gas has been increasing rapidly all over the globe owing to the growing integration of cyber-physical systems, IoT, and cloud computing in the oil and gas industry. For instance, Zyfra builds an Industrial Internet of Things (IoT) Platform and the startup’s IIoT products for upstream feature the field development platform Geonaft, a software-based precision drill, production scheduling, artificial lift, and predictive maintenance tools among others. Zyfra’s IIoT solutions allow oil companies to optimize their processes in real-time while helping field operators and workers to improve efficiency and safety.

In addition, major players such as Cisco Systems Inc., Honeywell International Inc., Siemens AG, ABB Ltd., Emerson Electric Co., Mitsubishi Electric Corp., Schneider Electric SE, Endress+Hauser AG, Rockwell Automation, Yokogawa Electric Corp. Several M&As along with partnerships have been undertaken by these players to develop the industrial automation oil & gas market.

Industrial automation oil & gas market helps in collecting the data through various sensors and analyzing them using software suites to form a pattern and predict any forthcoming issues beforehand. In other words, oil and gas automation is also known as oilfield automation. In the oil and gas industry, it is referred to a growing number of processes, many involving digital technologies, that can help energy producers better compete in global markets. In addition, industrial automation is the control of machinery and processes used in various industries by autonomous systems using technologies like robotics and computer software. Furthermore, the production is optimized using comprehensive surveillance and analysis systems. The geographical data of the reservoir and surrounding area are analyzed for understanding the feasibility of operating aging reservoirs. Moreover, the enterprise-wide monitoring of wells and production optimization through the analysis of the collected data of wells decreases the risk of downtime and operation failure. Hence, operation failures are predicted, power costs are reduced, and optimization opportunities are identified daily with the use of industrial automation, thus predicting the actual life span of an oil well. The global industrial automation oil & gas market is expected to witness a CAGR of around 5.34% during the forecast period (2021–2027).

However, Covid – 19 has devasted the global economy due to which many sectors experienced a downfall as the demand for industrial automation oil and gas got reduced within the industries due to their shutdown. The production and supply chain in many industries got declined due to a lack of operations which directly or indirectly affected the market industrial automation oil & gas. In addition, the production is optimized using comprehensive surveillance and analysis systems requires the use of industrial automation oil & gas, by which the growth of the industrial automation oil & gas market will be seen during the forecasted period.

Insights Presented in the Report

“Amongst process, upstream category to hold a significant share in the market”

Based on process, the market is fragmented into upstream, midstream, and downstream. The upstream process will grow significantly in the industrial automation oil and gas market during the forecasted period. This is due to its applications such as tank management, well optimization, well test management, injection control, surface control management, scada system for oil and gas. In addition, drilling is one of the upstream segments that benefited from the industrial automation of oil & gas. Furthermore, IoT solutions backed by analytics will permit upstream solutions to keep track of the extraction process from a distanced location in real-time. Through software integration companies can link the latest technologies to change the entire maintenance process by transforming it into a proactive one. Hence, these factors will drive the market growth of industrial automation oil and gas in the coming years.

“Amongst solution, plant asset management (pam) category to hold a significant share in the market”

Based on the solution, the market is fragmented into supervisory control and data acquisition (scada), programmable logic controller (plc), human-machine interface (hmi), plant asset management (pam), and others. In 2020, plant asset management (pam) is seen dominating the growth of the industrial automation oil & gas market. This is mainly due to its use in managing long-term and short-term scheduling of operations. In addition, plant asset management (pam) software reduces the cycle time of the operational process, which comprises the production, treatment, transportation, maintenance, and realization of hydrocarbon products. Furthermore, industrial automation oil & gas has several operations such as scheduling, executing, and monitoring. These operations have to be planned well to increase profitability. Moreover, these solutions also help oil and gas plants to reduce operational costs, without increasing any risk pertaining to unplanned downtime or employee and environment safety. Hence, the industry needs plant asset management (pam) solutions to ensure the safety and operational efficiency of oil and gas plants and these factors signify its growth during the forecasted period.

“Amongst instruments, field instruments segment to hold a significant share in the market”

Based on the instruments, the market is fragmented into field instruments, control valves, flow meters, process analyzers, leakage detection systems, and others. During the forecasted period, the field instruments segment is seen dominating the growth of the industrial automation oil & gas market. This is mainly due to four types of transmitters involved in instrumentation such as pressure, temperature, level, and vibration level switch. In addition, field instruments are the instruments that can adapt to IoT, and field parameter analysis propels the market in industrial automation for the oil & gas market. Hence, pressure transmitters are extensively used in the oil and gas sector for the measurement of flow, level, pressure, density, and viscosity, among which flow measurement is the most common application area.

Asia-Pacific to witness significant growth during the forecast period”

Asia-Pacific is anticipated to grow at a substantial CAGR during the forecast period. This is mainly due to the large-scale advancements and technological innovations in the oil & gas industry. In addition, many manufacturing industries with continuously changing trends and ongoing advancements in automation technologies. Furthermore, many major players are looking toward improved industrial automation oil & gas and solutions for predictive alerts, as well as for analyzing their systems to reduce overall operational and maintenance costs. Moreover, the deployment of industrial automation oil & gas components and solutions is expected to increase rapidly during the forecast period in Asai-Pacific region countries such as China, India, and Malaysia. For instance, in March 2020, ABB launched a new range of color-coded sensors that make it easy to choose and manage the optimal pH measurement solution. The sensors will help analyze the pH level of water more effectively.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The Global Industrial Automation Oil & Gas Market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

You can also purchase parts of this report. Do you want to check out a section wise

price list?

Research Methodology

Research Methodology for the Global Industrial Automation Oil & Gas Market Analysis (2021-2027)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global industrial automation oil & gas market were the three major steps undertaken to create and analyze the adoption of the industrial automation oil & gas in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global industrial automation oil & gas market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the industrial automation oil & gas market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the industrial automation oil & gas market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as a process, solution, and instrument. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the industrial automation oil & gas market. Further, we conducted factor analysis using dependent and independent variables such as various processes, solutions, and instruments of industrial automation oil & gas equipment. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the industrial automation oil & gas market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global industrial automation oil & gas market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., top-down/bottom-up approach were applied to arrive at the market forecast about 2027 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the industrial automation oil & gas market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the global industrial automation oil & gas market in terms of solutions offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at a precise statistical number for each segment and sub-segment of the global industrial automation oil & gas market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of various processes, solutions, and instruments in the global industrial automation oil & gas market.

The main objective of the global industrial automation oil & gas Market Study

The current & future market trends other than the global industrial automation oil & gas market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investment on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the industrial automation oil & gas market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include areas of process, solution, and instruments

- Define and analysis of the regulatory framework for the industrial automation oil & gas market industry.

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

- Analyze the current and forecast market size of the industrial automation oil & gas market for the major region

- Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the world

- Company profiles of the industrial automation oil & gas market and the growth strategies adopted by the market players to sustain in the fast-growing market

- Deep dive regional level analysis of the industry