Integrated Smart Traffic Control System Market: Current Scenario and Forecast (2019-2026)

$3500 – $6860

Emphasis on Offerings (Traffic Monitoring, Traffic Control, Information Provision), Service Type (Deployment and Integration, Training & Consulting, Support and Maintenance), Hardware (Display Boards, Sensors, Surveillance Cameras, Smart Traffic Lights, Interface Boards, Others), Application Type (Freeway Management, Electronic Toll Collection, Tunnel Management, Road Safety & Security, Parking Management, Others) and Region

| Published: | Jan-2020 |

|---|---|

| Pages: | 187 |

| Table: | 101 |

| Figure: | 83 |

| Report ID: | UMAU19201 |

Report Description

Global Integrated Smart Traffic Control System Market was valued at US$ 11 billion in 2018 and is anticipated to reach US$ 29.6 billion by 2026 displaying a reasonable CAGR of 13.3% over the forecast period (2020-2026). Integrated traffic systems are multi-modal transport systems, where modes of transport are linked with each other. The implementation of integrated traffic systems would result in the easy movement of automobiles. The integrated traffic system is a combination of information and communication technology with transportation infrastructure, to improve passenger safety and enhances the competence of the overall transport process. The system is designed to enable the optimal utilization of traffic flow on existing roadways. It contains a database management system for traffic data (including accidents, roadway volumes, and signal timing details) and links this database to the traffic analysis programs. With the growing number of vehicles on roads, the need for an integrated traffic system across various public and private infrastructures has increased. The demand for sophisticated traffic management software such as automatic number plate recognition, smart surveillance, and smart signalling has been increasing across the globe. The continuous transformation in the roadway infrastructure has led to an increased need for managing traffic through automatic operations. Further, rising income levels have increased the demand for personal mobility and led to a rise in road traffic in major cities across the globe, which has increased the demand for advanced traffic systems such as integrated traffic systems. The increasing demand for a reduction in average traffic speed is expected to fuel the overall growth of the integrated traffic systems market. However, initial investments in existing road infrastructure and its capital-intensive nature are inhibiting the growth of the technology.

A Typical Smart Parking System

“Amongst major offering type, Traffic Monitoring holds the largest market and is expected to dominate the Global Integrated Smart Traffic Control System Market by 2026”

The market on the basis of offering is bifurcated Traffic Monitoring, Traffic Control and Information Provision. In 2018, the Traffic Monitoring segment accounted for the largest share of 43.8%, Traffic Control segment is expected to witness the highest CAGR growth during the forecast period. Traffic monitoring helps divert traffic away from busy or dangerous areas, preventing traffic jams and also reducing the risk of collisions.

“Deployment & Integration dominated the service segment of the global Integrated Smart Traffic Control System Market and is expected to dominate the market during the analyzed period”

Based on Service Type, the global Integrated Smart Traffic Control System Market is segmented into Deployment & Integration, Training & Consulting and Support & Maintenance. In 2018, Deployment & Integration occupied the largest share and is expected to maintain its dominance throughout the forecast period 2020-2026 owing to the increased installation of the smart traffic control system in traffic management infrastructure.

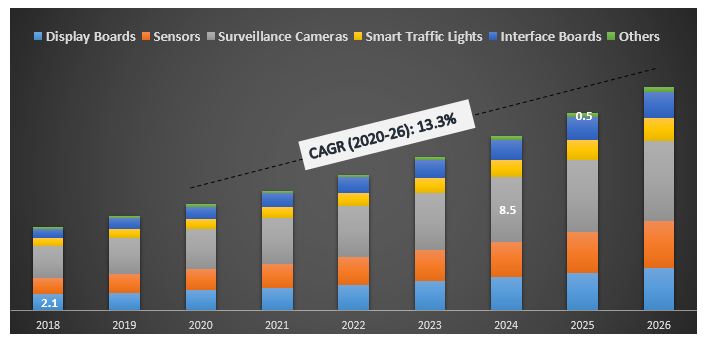

“Amongst hardware type, Surveillance Camera segment dominated the market”

Based on hardware, the global Integrated Smart Traffic Control System Market is fragmented into Display Boards, Sensors, Surveillance Cameras, Smart Traffic Lights, Interface Boards, and Others. Surveillance Camera dominated the market in 2018, generating revenue of US$ 4.33 billion. However, the smart traffic light segment is expected to grow with the highest CAGR of 15.48% during the forecast period.

Integrated Smart Traffic Control System Market Size by Hardware Type, Global 2018-2026 (US$ Billion)

“Electronic Toll Collection was the major application of Integrated Smart Traffic Control System”

On the basis of application, the report segments the global Integrated Smart Traffic Control System market into Freeway Management, Electronic Toll Collection, Tunnel Management, Road Safety & Security, Parking Management and Others. In 2018, the Electronic Toll Collection System accounted for the largest share of 42.7%, followed by Parking Management and Road Safety & Security. The freeway management segment is expected to witness the highest CAGR growth of 14.88% during the forecast period.

“North America represents one of the largest markets of the Integrated Smart Traffic Control System Market globally.”

For a deep-dive analysis of the industry, the study also includes regional-level analysis for major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa. In 2018; North America dominated the market, generating revenue of US$ 4.33 billion, owing to the presence of well-established traffic infrastructure, technological advancements, and the presence of advanced products in the field of traffic control & management. However, Asia-Pacific is expected to witness the highest CAGR growth of 14.37% during the analyzed period.

Competitive Landscape-Top 10 Market Players

Kapsch Traffic Com AG, Iteris, Inc., Cisco Systems, Inc., Thales Group, Cubic Corporation, TomTom, Siemens AG, EFKON GmbH, SWARCO, Inc. and IBM Corporation are some of the prominent players operating in the Global Integrated Smart Traffic Control System Market. Several M&A’s along with partnerships have been undertaken by these players to facilitate commuters with hi-tech and innovative traffic solutions.

Reasons to buy:

- Current and future market size from 2018 to 2026 in terms of value (US$)

- Combined analysis of deep-dive secondary research and input from primary research through Key Opinion Leaders of the industry

- Regional level details of the overall adoption & Utilization of integrated smart traffic control system market

- A quick review of overall industry performance at a glance

- In-depth analysis of key industry players

- A detailed analysis of drivers, restraints, key trends and opportunities prevailing in the industry

- Examination of industry attractiveness with the help of Porter’s Five Forces analysis and start-ups

- The study comprehensively covers the market across different segments and sub-segments of the market

- Region Covered: North America, Europe, Asia-Pacific, Latin America and MEA (the Middle East & Africa)

Customization Options:

UMI understands that you may have your own business need, hence we also provide fully customized solutions to clients. Integrated Smart Traffic Control System Market can be customized to the country level or any other market segment.

You can also purchase parts of this report. Do you want to check out a section wise

price list?

Research Methodology

Analyzing the historical market, estimation of the current market and forecasting the future market for the Integrated Smart Traffic Control System was based on the three major steps undertaken to create and analyze the adoption trend of integrated smart traffic control systems across different regions globally. Exhaustive secondary research has also been conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews have also been conducted with industry experts across the value chain of the integrated smart traffic control system technology. Post assumption and validation of market numbers through primary interviews, the bottom-up approach has been employed to forecast the complete market size of the integrated smart traffic control system market. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the integrated smart traffic control system market through company internal sources such as annual report & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the integrated smart traffic control system, a detailed secondary analysis was conducted to gather historical market insights and share for different segments & sub-segments for major regions across the world. Major segments included in the report are offering, services, hardware, and applications. Further analysis was also done for different regions to analyze the overall adoption of the integrated smart traffic control system in that particular region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, detailed factor analysis was conducted to estimate the current market size of the integrated smart traffic control system market. Factor analysis was conducted using dependent and independent variables such as increasing urbanization and car ownership, increasing concerns related to public safety, the advent of digital and advanced technologies in transportation infrastructure, increasing Public-Private Partnerships (PPPs) and increasing number of megacities in developing countries. The demand and supply-side scenario were also thoroughly studied by considering top partnerships, merger and acquisition, business expansion, product launches and analyzing the list of start-ups in the integrated smart traffic control system across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the integrated smart traffic control system market and market shares of these players. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weight was assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e. Bottom-up approach was applied to arrive at the market forecast pertaining to 2026 for different segments and sub-segments across different regions. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (US$) and penetration rate of integrated smart traffic control system across the major regions

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the integrated smart traffic control system market in terms of the services offered as well as market share. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment pertaining to the integrated smart traffic control system market globally. Data will split into several segments & sub-segments post studying various parameters and trends in the areas of as offering, services, hardware, and applications of integrated smart traffic control system market.

Main objective of the Integrated Smart Traffic Control System Market Study

The current & future market trends of the integrated smart traffic control system are pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends would determine the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the integrated smart traffic control system in terms of value (US$). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include as an offering, services, hardware, and applications

- Define and analysis of the regulatory framework for integrated smart traffic control system

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors pertaining to the industry

- Analyze the current and forecast market size of the integrated smart traffic control system market for the major regions. Major regions studied in the report include North America, Europe, Asia-Pacific, Latin America and MEA (the Middle East & Africa)

- Define and analyze the competitive landscape of the integrated smart traffic control system market and the growth strategies adopted by the market players to sustain in the fast-growing market