- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

MENA Market Insights on Automotive Composite Materials: Insights and Forecast (2018-2024)

Emphasis on Material Type (Polymer Matrix Composites, Metal Matrix Composites, Ceramic Matrix Composites and Hybrid Composites), Manufacturing Process (Hand Lay up, Compression Molding, Injection Molding, Resin Transfer Molding) – Insights and Forecast, 2018-2024

The automotive industry of Middle East and North Africa (MENA) is a key industry sector. The rise in population in the region has increased the demand for automobiles for transportation. Moreover, MEA is an important strategic centre for trade and commerce across the globe, attracting a large pool of foreign investors. The growing automotive industry of some of the countries in the region made them worst performing countries (Qatar, United Arab Emirates and Bahrain, among others) in terms of GHG emissions. Moreover, in the past few years, the percentage of GHG emissions in the region increased due to lack of government attention. In addition to this, Gulf Cooperation Council (GCC) holds approximately 30% of the world’s oil reservoir, hence exports large portion of its treasure to other countries. During the past few years, it led to the shortage of the oil and gas natural resources in the region. Owing to this, countries such as the UAE, Algeria, Kuwait and Egypt among others have set certain target values for GHG emissions to be achieved in the coming years. Hence the increasing emission standards in several countries across the region are propelling the growth of automotive composite materials market in MENA. However, high installation cost, high cost of the raw materials and recyclability issues are hampering the market.

Insights Presented in the Report:

- The Middle East and North Africa automotive composites material market is segmented based on different materials such as Polymer Matrix Composite (PMC), Metal Matrix Composite (MMC), Ceramic Matrix Composite (CMC) and Hybrid Composite. Currently, PMCs are the most popular composite type among the automakers, as they have high flexibility, high insulation, lower density and lighter weight than other composite material types. In addition, to get a deep dive analysis of PMC, the segment is further segmented across thermosets and thermoplastics. However, low cost and exceptionally good structural and mechanical properties of hybrid composites are making them an alternative to the single fiber composites. Hence hybrid composites are anticipated to be the fastest growing segment during the forecast period.

- The market is further fragmented across different manufacturing processes, which include hand lay-up, compression molding, injection molding, and resin transfer molding (RTM). Injection molding process dominated the market in 2017 and is expected to continue its dominance over the forecast period. On the other hand, RTM will be the fastest growing manufacturing process because of its growing adoption in the auto industry. RTM process is expected to grow at a CAGR of 13.1% during the forecast period (2018-2024).

- Based on several application areas in automobiles, Middle East and North Africa, automotive composite materials market is segmented into interior, exterior, chassis, powertrain & under the hood and structural. Among different application areas, exterior segment dominated the market however a gradual increase in the adoption rate of composite materials for vehicle interiors is expected in the coming years.

- Middle East and North Africa automotive composite materials market is further segmented on the basis of different vehicle types. This includes performance cars, passenger cars and other (commercial vehicles and others). Passenger cars held the maximum market share in 2017 and they are expected to prevail during the forecast period.

- To get a better understanding of MENA automotive composite material market, the region has been further segmented by countries, which include the UAE, Saudi Arabia, Algeria, Kuwait, Egypt, Qatar and rest of MENA. Saudi Arabia held the largest market share in 2017 and the country is expected to remain dominant during the forecast period.

Top Companies in the Composites Market

The major companies that are profiled in the study are BASF SE, DowDupont Inc., Gurit Holding AG, Magna International Inc., Mitsubishi Chemical Holdings Corporation, Owens Corning, SGL Group, Solvay SA, Teijin Limited and Toray Industries Inc.

Reasons to buy the Report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts

- The report presents a quick review of overall industry performance at one glance

- The report covers in depth analysis of prominent industry peers with primary focus on key business financials, product portfolio, expansion strategies and recent developments

- Detailed examination on drivers, restraints, key trends and opportunities prevailing in the industry.

- Examination of industry attractiveness with the help of Porter’s Five Forces analysis

- The study comprehensively covers the market across different segments

- Deep dive regional level analysis of the industry

Customization Options:

The MENA Automotive Composites Market can be customized to the country level or any other market segment. Besides this, UMI understands that you may have your own business need, hence we also provide fully customized solutions to clients.

Table of Content

Analysing historical market, estimation of the current market and forecasting the future market for MENA automotive composite materials were the three major steps considered while creating and analysing the overall adoption rate of automotive composite materials in major countries in the MENA region. Exhaustive secondary research was done to collect the historical market of the technology and overall estimation of the current market. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were conducted with industry experts across value chain of the MENA automotive composite materials market. After all the assumption, market sizing and validation of market numbers through primary interviews, top-down approach was employed to forecast the complete market size of the MENA automotive composite materials market. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyse the market size of segments and sub-segments of the technology. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the MENA automotive composite materials market through company internal sources such as annual report & financial statements, performance presentations, press releases, inventory records, sales figures etc. and external sources including trade journals, news articles, government publications, International Organization of Motor Vehicle Manufacturers, competitor publications, sector reports, regulatory bodies publications, safety standard organizations, third-party database and other creditable publications.

Step 2: Market Segmentation:

After obtaining historical market size of the overall market, detailed secondary analysis was done to gather historical market insights and share for different segments & sub-segments of the MENA Automotive Composite Materials market. Major segments included in the report are material type, manufacturing process, application, and vehicle types.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, detailed factor analysis was conducted to estimate the current market size of the MENA automotive composite materials market. Factor analysis was conducted using dependent and independent variable such as purchasing power, government initiatives, government regulations in major countries in the MENA region. Historical trends of the automotive composite materials and their year-on-year impact on the market size and share in the recent past were analyzed. Demand and supply side scenario was also thoroughly studied.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at current market size, key players in market, market share of these players, industry’s supply chain, and value chain of the industry. All the required percentage shares, splits, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weightage was assigned to different factors including drivers, restraints, trends and opportunities available in the market. After analyzing these factors, relevant forecasting techniques i.e. Bottom-up/Top-down was applied to arrive at the market forecast pertaining to 2024 for different segment and sub-segments in major countries in the MENA region. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (US$) and rate of adoption of automotive composite materials in major countries in the MENA region

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players across different technologies and markets as well as market share of each player. Also, the growth strategies adopted by these players to compete in the rapidly growing MENA Automotive Composite Materials market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head etc.). Primary research findings were summarized, and statistical analysis was performed to prove the stated hypothesis. Input from primary research were consolidated with secondary findings, hence turning information into actionable insights.

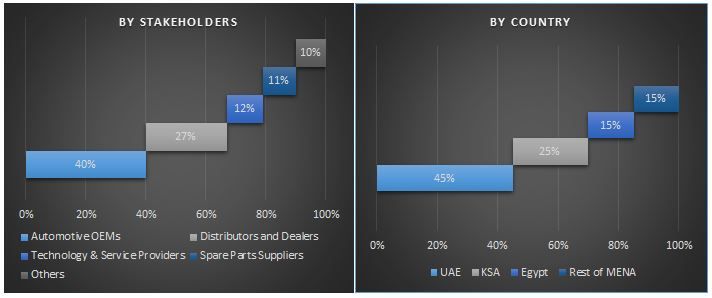

Split of Primary Participants

Market Engineering

Data triangulation technique was employed to complete the overall market engineering process and to arrive precise statistical numbers of each segment and sub-segment pertaining to the MENA automotive composite materials market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of material type, manufacturing process, application, and vehicle type.

Main objective of the MENA Automotive Composite Materials Market Study

The current & future market trends of the MENA automotive composite materials market are pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends would determine the overall attractiveness of the market, providing a platform for the industrial participant to exploit the untapped market to benefit as first mover advantage. Other quantitative goal of the studies includes:

- Analyse the current and forecast market size of MENA automotive composite materials in terms of value (US$)

- Analyse the current and forecast market size of different segments and sub-segments of the MENA automotive composite materials market. Segments in the study include material type, manufacturing process, application, and vehicle type

- Define and describe the technologies and protocols used in automotive composite materials

- Anticipate potential risk associated with the technology along with customer and competitor analysis, among others

- Define and analysis of the government regulations for automotive composite materials in major countries in the MENA region

- Analyse the current and forecast market size of automotive composite materials in the MENA regions, in terms of value for countries including UAE, KSA, Algeria, Kuwait, Egypt, Qatar and Rest of MENA

Define and analyse the competitive landscape of the MENA automotive composite materials and the growth strategies adopted by the market players to sustain in the ever-growing market

Related Reports

Customers who bought this item also bought