- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Middle East Real Estate Market: Current Analysis and Forecast (2023-2030)

Emphasis on Property Type (Offices, Residential, Hotels, Retail, Industrial And Logistics, And Others); and Country

Geography:

Industry:

Last Updated:

Mar 2024

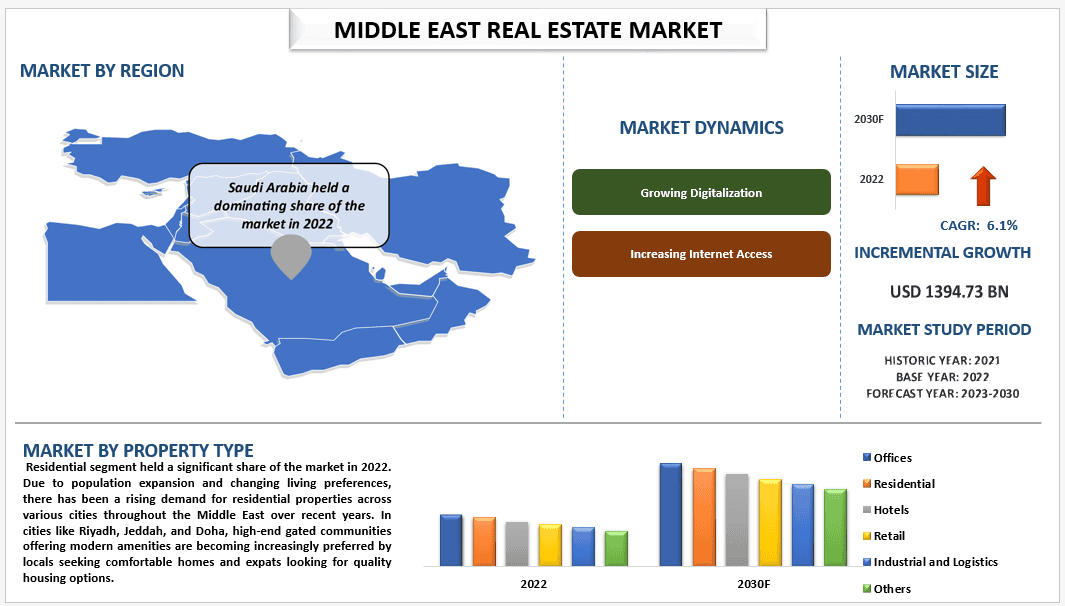

The Middle East Real Estate Market is expected to grow at a strong CAGR of 6.1% during the forecast period (2023-2030). The real estate market in the Middle East has experienced rapid growth in recent years, with many countries in the region witnessing significant increases in property values and investment opportunities. The UAE, particularly Dubai, has been at the forefront of this growth, attracting both local and foreign investors with its world-class infrastructure, luxurious lifestyle options, and favorable government policies. Other countries such as Saudi Arabia, Qatar, and Kuwait have also seen substantial development in their respective markets due to factors like economic diversification initiatives and large-scale projects like megacities and theme parks. However, it is important to note that the regional market faces challenges like fluctuating oil prices and geopolitical tensions which can impact investor confidence. Overall, the outlook for the Middle Eastern real estate market remains positive long term as governments continue prioritizing economic diversification plans and investing heavily in infrastructure projects.

Some of the major players operating are Emaar Properties, Aldar Properties, Nakheel, Damac Properties, Arada, Sobha, Bahria Town, Eagle Hills, IMKAN, Wasl Asset Management Group. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products/technologies.

Insights Presented in the Report

“Amongst property type, the market is segmented into offices, residential, hotels, retail, industrial and logistics, and others. Residential segment held a significant share of the market in 2022.”

Based on the property type, the market is segmented into offices, residential, hotels, retail, industrial and logistics, and others. Residential segment held a significant share of the market in 2022. Due to population expansion and changing living preferences, there has been a rising demand for residential properties across various cities throughout the Middle East over recent years. In cities like Riyadh, Jeddah, and Doha, high-end gated communities offering modern amenities are becoming increasingly preferred by locals seeking comfortable homes and expats looking for quality housing options. This surging interest in residential properties has prompted developers to focus more on delivering family-friendly environments with recreational facilities rather than solely targeting commercial ventures.

Middle East Real Estate Market Report Coverage

Report Attribute | Details |

Base year | 2022 |

Forecast period | 2023-2030 |

Growth momentum | Accelerate at a CAGR of 6.1% |

Market size 2022 | USD 1364.73 Billion |

Country analysis | Saudi Arabia, UAE, Kuwait, Bahrain, Rest of Middle East |

Major contributing Country | Saudi Arabia is expected to grow at the highest CAGR during the forecasted period |

Companies profiled | Emaar Properties, Aldar Properties, Nakheel, Damac Properties, Arada, Sobha, Bahria Town, Eagle Hills, IMKAN, Wasl Asset Management Group. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Property Type; By Region/Country |

“Saudi Arabia dominated the market.”

Saudi Arabia, the largest economy in the Gulf Cooperation Council (GCC), has also witnessed a remarkable growth in the real estate market. Saudi Arabia’s Vision 2030 has brought about a paradigm shift in the kingdom’s economic landscape, significantly impacting the real estate sector. Large-scale projects, including NEOM, a futuristic city, and the Red Sea Development, a luxury tourism destination, have become focal points for domestic and international investment. The government’s decision to open up the real estate market to foreign investors has sparked increased competition and innovation. This strategic approach aligns with the broader goals of Vision 2030, aiming to reduce the nation’s reliance on oil and position Saudi Arabia as a key player in the global real estate arena. For Instance. The real estate sector contributes 7% of GDP to Saudi Arabia’s economy, and the government aims to increase this contribution to 8.8% by 2030.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

The Middle East Real Estate market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Middle East Real Estate Market Analysis (2023-2030)

Analyzing the historical market, estimating the current market, and forecasting the future market of the Middle East real estate market were the three major steps undertaken to create and analyze the adoption of Middle East real estate in major countries. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the Middle East real estate market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the Middle East real estate market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Middle East real estate market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as property type. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Middle East real estate market. Further, we conducted factor analysis using dependent and independent variables such as property type of the Middle East real estate market. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the Middle East real estate market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the Middle East real estate market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2030 for different segments and sub-segments across the major markets. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the Middle East real estate market across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the Middle East real estate market in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

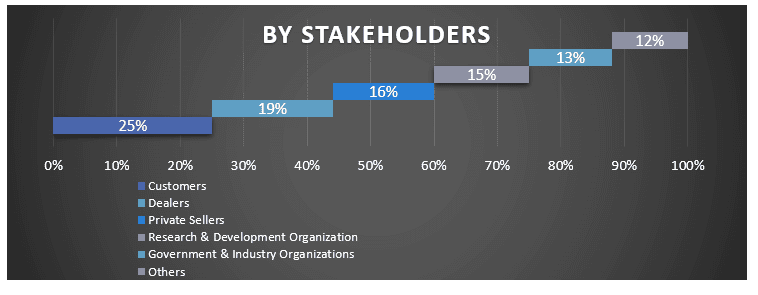

Key Stakeholders of Middle East Real Estate Market in the Middle East Region

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the Middle East real estate market. The data was split into several segments & and sub-segments post studying various parameters and trends in the areas of the property type of the Middle East real estate market.

The main objective of the Middle East real estate Market Study

The current & future market trends of the Middle East real estate market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional and country level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the Middle East real estate market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of the property type.

- Define and analysis of the regulatory framework for the Middle East real estate

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the Middle East real estate market for the major region.

- Major countries of regions studied in the report include Saudi Arabia, UAE, Iran, Egypt, and Rest of Middle East

- Company profiles of the Middle East real estate market and the growth strategies adopted by the market players to sustain in the fast-growing market.

- Deep dive regional level analysis of the industry

Frequently Asked Questions FAQs

Q1: What is the current market size and growth potential of the Middle East real estate market?

Q2: What are the driving factors for the growth of the Middle East real estate Market?

Q3: Which segment has the largest share of the Middle East real estate market by Property Type?

Q5: Which country will dominate the Middle East Real Estate market?

Q6: Who are the key players operating in the Middle East real estate market?

Related Reports

Customers who bought this item also bought