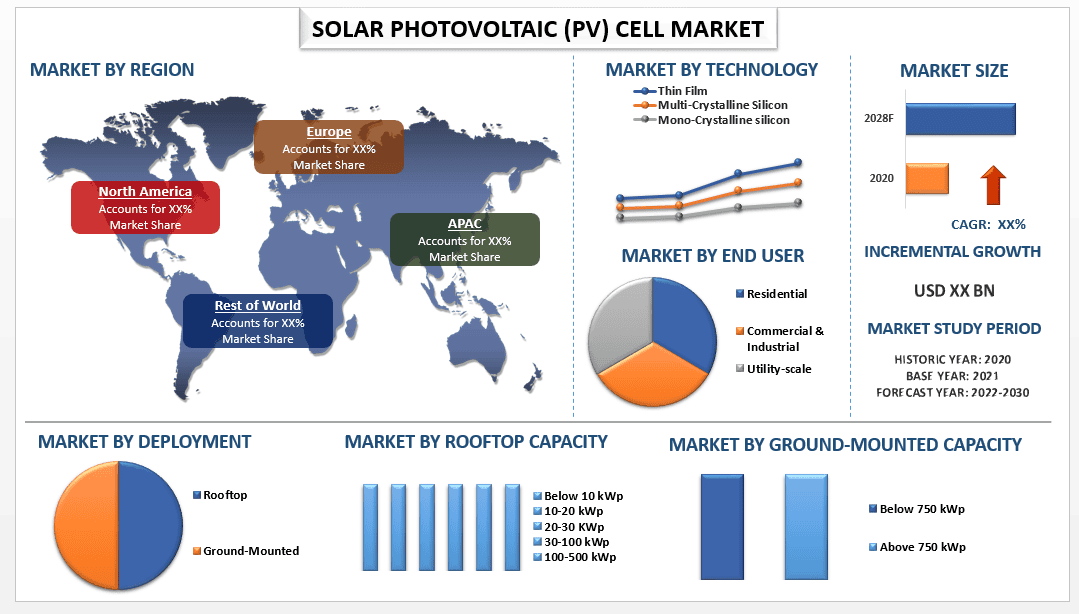

Emphasis on Deployment (Rooftop, and Ground Mounted); Capacity (Rooftop Capacity (Below 10 kWp, 10-20 kWp, 20-30 KWp, 30-100 kWp, 100-500 kWp and Above 500 kWp) and Ground Mounted Capacity (Below 750 kWp and Above 750 kWp)); Technology (Thin Film, Multi-Crystalline Silicon, and Mono-Crystalline silicon); End User (Residential, Commercial & Industrial, and Utility-scale); and Region/Country

Solar Photovoltaic (PV) industry” report, the global market was valued at USD 184.3 Million in 2022, growing at a CAGR of 21.8% during the forecast period from 2023 – 2030 to reach USD X billion by 2030. It is mainly owing to the government programs and incentives to promote cleaner renewable energy in order to meet climate change policies globally. Moreover, the need to meet net zero emission goals across the globe in various countries and rising consumer awareness towards environmentally friendly energy is acting as a catalyst in the growth of Solar Photovoltaic (PV) Cell globally during the projected period. Solar power generation needs to grow by a CAGR of 25% for the period of 2022-30 in order to meet the targets set by the Net Zero Emissions 2050 policy.

Furthermore, key players in the market are also launching new products and technology to increase the yield of Solar Photovoltaic (PV) Cell and produce more environmentally friendly products not based on silicon in the projected period. Most governments have formulated new policies to support the growth of solar energy worldwide. China is one of the biggest players in the Solar PV market and showcased 38% of solar PV generation growth in 2021 due to large capacity additions in the years 2020 and 2021. The second-largest growth in solar generation was followed by the European Union due to their newly introduced policies such as “RePowerEU Plan: Joint European action on renewable energy and energy efficiency” which was introduced in the year 2022.

Some of the major players operating in the market include First Solar Inc., Astronergy (Chint Solar Co. Ltd.), JinkoSolar Holding Co. Ltd., LONGi Green Energy Technology Co. Ltd., Canadian Solar Inc., JA Solar Technology Co., Trina Solar Co. Ltd., Risen Energy Co. Ltd., Suntech Power Holdings Co. Ltd., and Hanwha Q CELLS Co. Ltd.

Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products/technologies.

Insights Presented in the Report

“Amongst Deployment, the Rooftop segment held a dominating share of the market in 2021”

Based on deployment, the Solar Photovoltaic (PV) Cell market is bifurcated into Rooftop and Ground-Mounted segments. The rooftop segment acquired a majority share in the Solar PV market and is expected to register a substantial growth rate during the forecast period. A Rooftop PV system means a PV system that has electricity-generating solar panels mounted on the rooftop of a building or structure. Most rooftop PV systems are usually residential and much smaller when compared to utility-scale solar ground-mounted systems. Most residential rooftop PV systems are in the range of 5-20 kW while commercial rooftop-mounted systems can range from 100 kW to 1 MW. many large rooftops have built industrial-scale PV systems in the range of 10 MW.

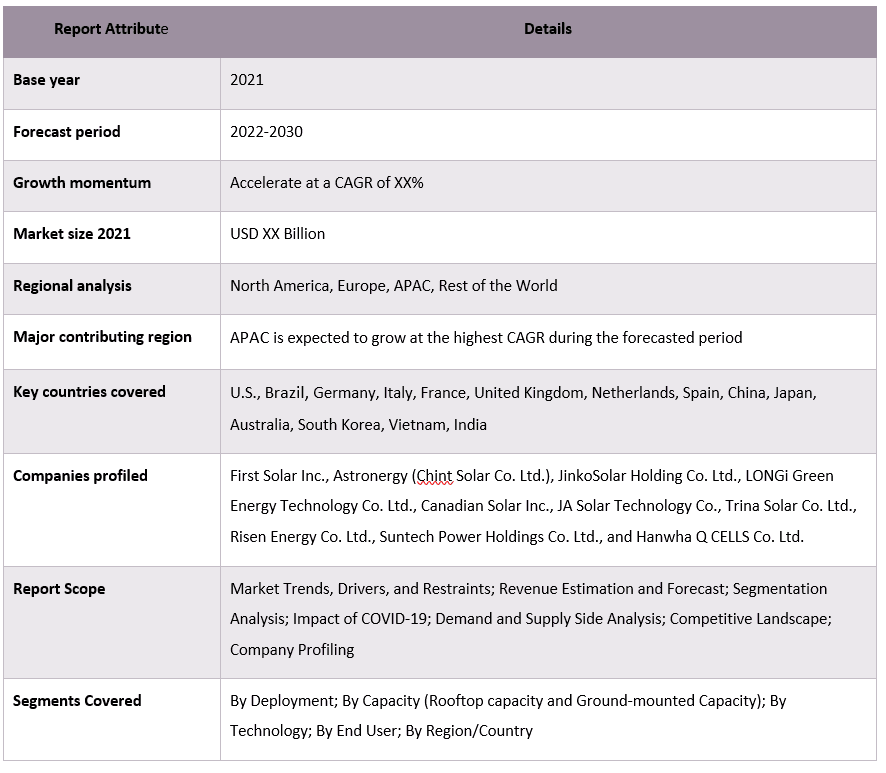

Solar Photovoltaic (PV) Cell Market Report Coverage

“Amongst Capacity, the Below 10 kWp in Rooftop Capacity and Below 750 kWp in Ground-mounted Capacity segment held the majority share of the market in 2021”

Based on capacity, the Solar Photovoltaic (PV) Cell market is bifurcated into rooftop capacity and ground-mounted capacity segments. The rooftop capacity segment is further bifurcated into Below 10 kWp, 10-20 kWp, 20-30 KWp, 30-100 kWp, 100-500 kWp, and Above 500 kWp. The ground-mounted capacity segment is further bifurcated into Below 750 kWp and Above 750 kWp. The rooftop capacity segment is growing due to government subsidies and high demand from consumers for Solar PV, whereas the ground-mounted segment is driven by government policies and upcoming large-scale solar power generation projects. Policies such as “Rural Clean Energy Initiative & Support to rural energy transition” of the USA and government funding of AUD 37 million government investment in new high-tech solar farms in Australia are the reasons which are driving the solar PV market during the projected period.

“Amongst Technology, the Mono-Crystalline silicon segment held a dominating share of the market in 2021”

Based on technology, the Solar Photovoltaic (PV) Cell market is divided into Thin Film, Multi-Crystalline Silicon, and Mono-Crystalline silicon segments. The Mono-Crystalline silicon segment acquired a majority share in the Solar PV market and is expected to register a substantial growth rate during the forecast period. The shift to more efficient monocrystalline solar PV accelerated in 2021, with the technology capturing almost all crystalline PV production.

“Amongst End User, the Utility-scale segment held a dominating share of the market in 2021”

Based on End User, the Solar Photovoltaic (PV) Cell market is divided into Residential, Commercial & Industrial, and Utility-scale segments. The Utility-scale segment acquired a majority share in the Solar PV market and is expected to showcase a substantial growth rate during the forecast period. Utility-scale PV remains the most competitive source of PV generation globally; however, building large-scale installations is becoming increasingly challenging in many regions of the world due to the lack of suitable sites. Moreover, Solar PV is the main choice for the private sector if they want to invest in renewable energy. Companies investing in distributed (including rooftop) solar PV installations on their commercial buildings and premises are responsible for around 30% of the total installed PV capacity, moreover, Companies are entering into corporate power purchase agreements with solar PV plant operators which would drive the market for solar PV during the forecast period.

“APAC dominated the Solar Photovoltaic (PV) Cell market in 2021”

APAC registered the highest market share in the Solar Photovoltaic (PV) Cell market and is expected to witness an influential CAGR in the forecasted period. It is mainly owing to many Solar Photovoltaic (PV) Cell projects taking place in China, India, Australia, and Japan. Moreover, favorable government policies, regulations, and investments in achieving renewable energy targets set by various countries are driving the market. For instance: In Australia, the Australian government will provide AUD 14 million to support 5B’s AUD 33.4 million strategic technology innovation project through the Australian Renewable Energy Agency; In Japan, the Japanese government allocated 8 billion yen in the 2021 national budget to support the introduction of independent solar power generation equipment and storage batteries including electric vehicles through on-site PPA; and in India, the Government of India announced an additional capital infusion of Rs. 10 billion to the Solar Energy Corporation of India and Rs.15 billion to the Indian Renewable Energy Development Agency.

Reasons to buy this report:

Customization Options:

The global Solar Photovoltaic (PV) Cell market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

1. Market Introduction

2. Research Methodology Or Assumption

3. Market Synopsis

4. Executive Summary

5. Impact Of Covid-19 On The Solar Photovoltaic (pv) Cell Market

6. Solar Photovoltaic (pv) Cell Market Revenue (usd Bn), 2020-2030f

7. Premium Insights

8. Market Insights By Deployment

9. Market Insights By Capacity

10. Market Insights By Technology

11. Market Insights By End User

12. Market Insights By Region

13. Solar Photovoltaic (pv) Cell Market Dynamics

14. Solar Photovoltaic (pv) Cell Market Opportunities

15. Solar Photovoltaic (pv) Cell Market Trends

16. Demand And Supply-side Analysis

17. Value Chain Analysis

18. Policy Framework

19. Competitive Scenario

20. Companies Profiled

21. Disclaimer

Research Methodology for the Solar Photovoltaic (PV) Cell Market Analysis (2022-2028)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global Solar Photovoltaic (PV) Cell market were the three major steps undertaken to create and analyze the adoption of Solar Photovoltaic (PV) Cell in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global Solar Photovoltaic (PV) Cell market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the Solar Photovoltaic (PV) Cell market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Solar Photovoltaic (PV) Cell market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as Deployment, Capacity, Technology, and End User. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Solar Photovoltaic (PV) Cell market. Further, we conducted factor analysis using dependent and independent variables such as Deployment, Capacity, Technology, and End User of the Solar Photovoltaic (PV) Cell market. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the Solar Photovoltaic (PV) Cell market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global Solar Photovoltaic (PV) Cell market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2028 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

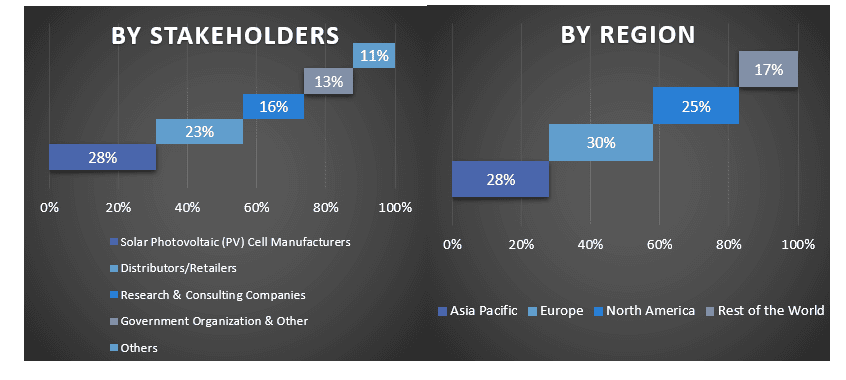

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global Solar Photovoltaic (PV) Cell market. data was split into several segments & sub-segments post studying various parameters and trends in the areas of Deployment, Capacity, Technology, and End User in the global Solar Photovoltaic (PV) Cell market.

The main objective of the Global Solar Photovoltaic (PV) Cell Market Study

The current & future market trends of the global Solar Photovoltaic (PV) Cell market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

Customers who bought this item also bought