Rise Of Upi Payment System In India, 2020

A systematic shift to UPI payments:

As per the recent report titled “Global Digital Payment Market: Current Analysis and Forecast (2020-2026)” Owing to the sudden COVID-19 outbreak demand for contactless payment, the market is expected to witness high growth and is expected to reach a market size of US$ 65.3 billion in 2020. In recent times, Indian consumers have a variety of options to make payments from. These consist of credit/debit cards, Unified Payments Interface (UPI), Net banking mobile wallets, and as buy-now-pay-later (BNPL). However, there has been a sharp rise in the volume and number of UPI transactions. As per statistics, during October 2020, UPI transactions in India crossed the 2-billion mark for the first time. This growth has been determined by factors such as no difficulty in use and negligible hassles. So, does this increase mean that there is a complete shift in the Indian payments landscape? Or is this a momentary consequence of the pandemic? Let us look deeper to find solutions to these questions.

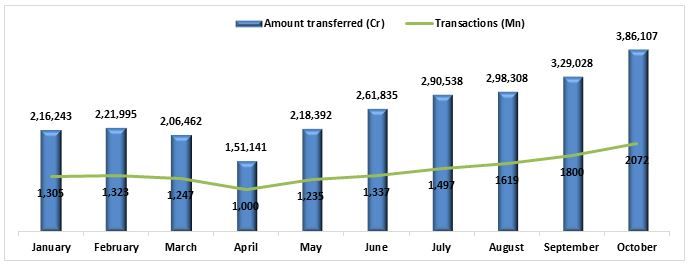

Growing UPI Transactions and Volumes

Ever since its launch in 2016, UPI has reached a variety of milestones. In October 2019, it recorded one billion dealings in a month. UPI has continued with its achievement story in 2020 as well. Two billion UPI transactions were estimated in October 2020. UPI has turn into the ideal digital mode of payment among consumers. As per the Reserve Bank of India between January 2020 and September 2020, the value of UPI transactions during the same period increased from INR 2,162 billion to INR 3,290 billion. The figure below shows the volume of UPI payments for the year 2020.

What does this signify for the Indian Financial Sector?

The impact of UPI payments on the Indian market is huge and has made a difference in the payment methods and as well as shopping sites used by the consumers. This has in turn allowed easier access to international shopping platforms. The following points illustrate the same.

- Openness to Online Payments: This consistent growth in UPI transactions is also indicative of the fact that Indian consumers are becoming more open to online payments. This growth, united with the rising penetration of smart phones and rising income levels, show that the market is prepared for the next phase of expansion.

- Embracing International Platforms: Another aspect is that Indians are embracing international shopping platforms as well. The domestic e-commerce market is fetching extremely attractive for worldwide merchants, as it presents a profitable expansion chance to them.

- Helping Government: Further, UPI transaction volumes have also helped the government in meeting its objective associated to the Digital India movement. For example, during FY19, UPI transactions contributed as much as 18% of the total target of 30 billion transactions across the country.

UPI App Ranking (%)

Google Pay, PhonePe, Patym, Bhim, and others like Amazon make up most of the market share for the UPI payment apps. Among these, Google Pay has the highest share for three consecutive years with about 39%, 50%, and 39.5%. It is followed by PhonePe whose demand is also increasing over the years. The following table shows the share of each of them for the last four years.

| UPI Payment Apps | 2017 | 2018 | 2019 | 2020 |

| Google Pay | 12.0% | 39.0% | 50.0% | 39.5% |

| PhonePe | 16.0% | 14.0% | 25.0% | 40.3% |

| Paytm | 4.0% | 6.0% | 9.0% | 11.8% |

| Bhim UPI | 52.0% | 34.0% | 12.0% | – |

| Others | 16.0% | 7.0% | 4.0% | 8.4% |

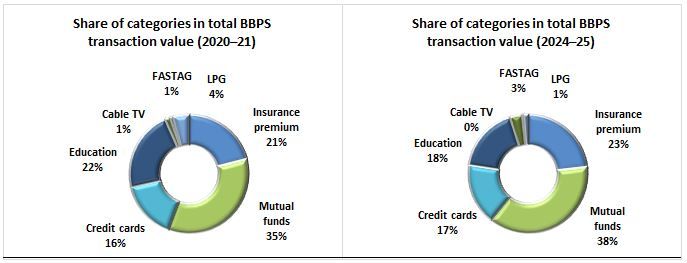

Outlook for 2021-2022

Overall, it is extremely encouraging to witness the increase in UPI transactions during the year 2020. If the existing trend continues throughout the next few years as well, then the contribution of UPI transactions in the overall digital payment industry of the nation could rise even more. These developments clearly point that we are witnessing a complete change in the Indian payments landscape, and it is probable that this shift will help consumers and digital payment players alike. Growth in digital payments system in India is driven by multiple of factors including the launch of new and innovative payment apps, increasing smartphone penetration, growing need for faster payment modes, and a strong push from the Government and regulators towards adoption of digital channels. Prior to 2010, digital transactions saw single-digit growth. During FY2010-2016, the figure rose to 28% owing to the launch of faster payment modes and jumped to 56% in FY2016-2017 following demonetization. Covid-19 has further accelerated the shift to digital payment modes. All together, these factors are likely to generate revenue of INR 2,937 billion by FY2024-2025 period for the digital payment players operating in India, compared to INR 1,982 billion of revenue generated during the FY2019-2020.