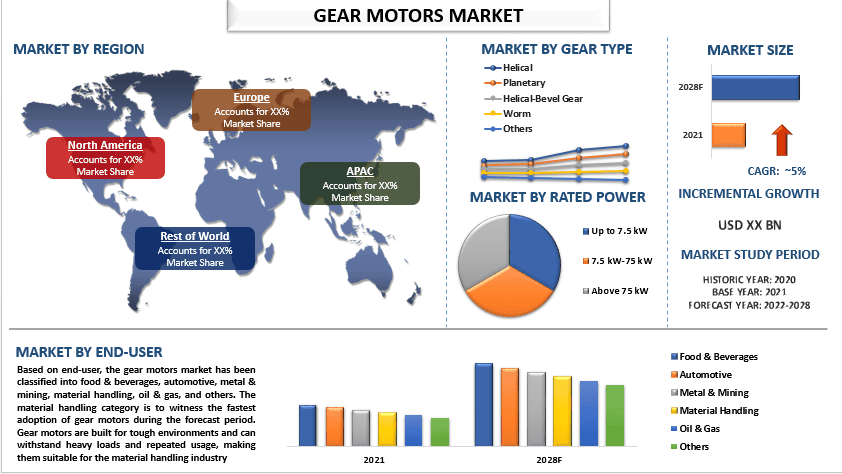

Emphasis on Gear Type (Helical, Planetary, Helical-Bevel Gear, Worm, and Others); Rated Power (Up to 7.5 kW, 7.5 kW-75 kW, and Above 75 kW); End-User (Food & Beverages, Automotive, Metal & Mining, Material Handling, Oil & Gas, and Others); and Region/Country

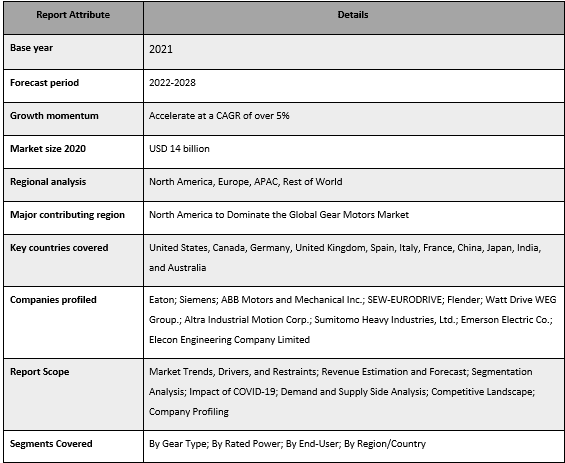

the gear motors market was valued at more than USD 14 billion in 2020 and is expected to grow at a CAGR of around 5% from 2022-2028.

Gear motors are electric motors with integrated gear reducers, and it works like the speed and torque converter of an electric motor to closely match the speed and torque requirements of a specific application. Gear motors are a particularly simple and cost-effective solution to achieve optimal energy efficiency. These motors are available in a variety of AC and DC motor types, gear technologies, gear ratios, and mechanical features, giving equipment producers a large amount of flexibility to design the ideal product for their application requirements. A challenge for the global gear motors market is the constant inspection and maintenance required by gear motors to prevent problems like oil leakage and temperature check. As a result, gear motor manufacturers are investing more in R&D to address current operational issues.

The major factors for the growth of the gear motor market are rising demand in energy sectors, growing wind power installations, and increasing concerns regarding the efficiency of mechanical power transmission. For instance, according to the Global Wind Energy Council (GWEC), wind power installation is increasing immensely as around 71 GW of new wind projects were established globally in 2020.

Eaton; Siemens; ABB Motors and Mechanical Inc.; SEW-EURODRIVE; Flender; Watt Drive WEG Group.; Altra Industrial Motion Corp.; Sumitomo Heavy Industries, Ltd.; Emerson Electric Co.; Elecon Engineering Company Limited are some of the key players in the market. Several M&As along with partnerships have been undertaken by these players to facilitate customers with hi-tech and innovative products/technologies.

Insights Presented in the Report

“Amongst gear type, helical category to witness robust CAGR during the forecast period.”

Based on gear type, the market is segmented into helical, planetary, helical-bevel gear, worm, and others. The helical category is to witness the highest CAGR during the forecast period owing to the last longer and is ideal for high-load applications since they have a higher number of teeth in contact. Also, some other factors such as easy handling along with high torque, low maintenance, and power consumption are likely to contribute to the growth of the segment.

“Amongst end-user, the food & beverages held a significant share in the market in 2021.”

On the basis of end-user, the market is categorized into food & beverages, automotive, metal & mining, material handling, oil & gas, and others. Among these, the food & beverages category held a significant share of the market in 2021. This is mainly due to the gear motors being one of the key components of the food & beverage processing machinery, it helps in powering these machines and play an important role in affecting the reliability and longevity of equipment. Also, rising demand for dairy, canned goods, bakery & snacks, and ready-to-eat food products are the major growth factors for the food & beverages industries which will propel the gear motor market during the forecast period.

Gear Motors Market Report Coverage

“APAC to hold a significant share in the market”

For a better understanding of the market adoption of the gear motors industry, the market is analyzed based on its worldwide presence in the countries such as North America (U.S., Canada, Rest of North America), Europe (Germany, U.K., France, Spain, Italy, Rest of Europe), Asia-Pacific (China, Japan, India, Rest of Asia-Pacific), Rest of World. APAC is anticipated to grow at a substantial CAGR during the forecast period. This is mainly due to the high demand for large-scale industrialization and infrastructural development in the region. Governments in Asia-Pacific are currently focusing on improving existing infrastructure, the increasing investment in wind power projects in the region. For instance, in 2021, China’s total renewable energy capacity increased by 10.2 percentage points as compared to 2015. The capacity exceeded 1,000 GW in 2021, according to the National Energy Administration, accounting for 43.5% of the country’s total power generation capacity.

Reasons to buy this report:

Customization Options:

The global gear motors market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

1. Market Introduction

2. Research Methodology Or Assumption

3. Market Synopsis

4. Executive Summary

5. Impact Of Covid-19 On The Gear Motors Market

6. Gear Motors Market Revenue, 2020-2028f

7. Market Insights By Gear Type

8. Market Insights By Rated Power

9. Market Insights By End-user

10. Market Insights By Region

11. Gear Motors Market Dynamics

12. Gear Motors Market Opportunities

13. Gear Motors Market Trends

14. Demand And Supply-side Analysis

15. Value Chain Analysis

16. Pricing Analysis

17. Strategic Insights

18. Competitive Scenario

19. Company Profiled

20. Disclaimer

Research Methodology for the Gear Motors Market Analysis (2022-2028)

Analyzing the historical market, estimating the current market, and forecasting the future market of the global gear motors market were the three major steps undertaken to create and analyze the adoption of gear motors market in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the global gear motors market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the gear motors market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the gear motors market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report as gear type, rated power, and end-user. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Gear Motors Market. Further, we conducted factor analysis using dependent and independent variables such as various gear type, rated power, and end-users of gear motors market. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the gear motors market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global gear motors market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2028 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

Market Size and Share Validation

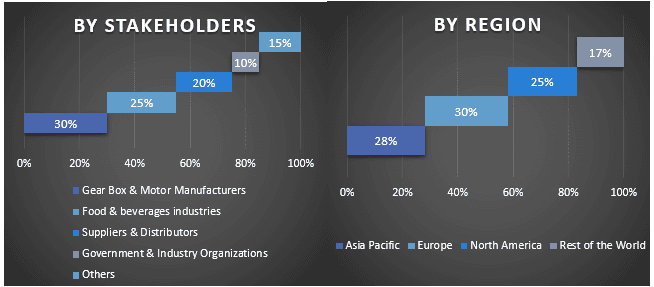

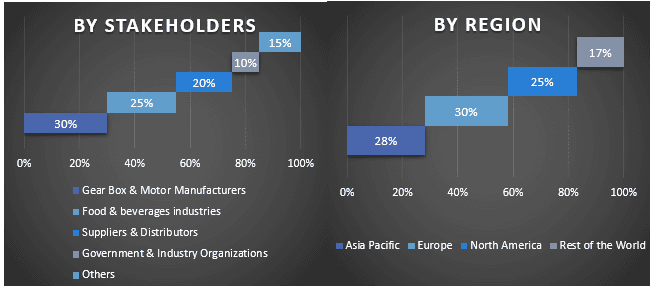

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global gear motors market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of gear type, rated power, and end-user in the global Gear Motors Market.

The main objective of the Global Gear Motors Market Study

The current & future market trends of the global gear motors market were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

Customers who bought this item also bought