The Rising Awareness of Preventive Care Would Propel the Growth of the Market in North America

Author: Himanshu Patni

11 May 2023

A rise in awareness for preventive care such as dental checkups, maternal healthcare, vaccination, and screening for disease has led to an increase in demand for mobile healthcare clinics in this region. According to the international journal of equity health 2020 study, stated that there were approximately 1500-2000 mobile clinics that catered to around 3500 patients visiting mobile healthcare clinics nationwide. Furthermore, the presence of a reimbursement policy coupled with government funding is driving the market growth in this region. For instance, according to a study published by International Journal for Equity in Health, around 45% of the respondents reported funding for the development of mobile clinics from federal bodies whereas 52% of the respondents reported philanthropic funding. Thus the rising need for preventive care and the presence of reimbursement policy and favourable government initiatives drives the market growth in the forecasting period.

Request For Sample PDF-https://univdatos.com/report/mobile-healthcare-clinic-market/get-a-free-sample-form.php?product_id=37488

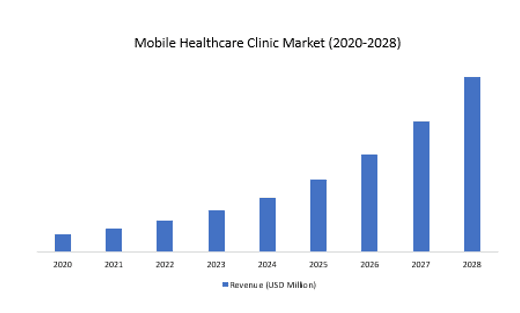

FIG. 1 Mobile Healthcare Clinic Revenue (2020-2028)- USD Mn

For a detailed analysis of the global mobile healthcare clinic market browse through

Based on service type, the market is segmented into maternal health, neonatal and infant health, geriatric care, dental care, OPD and others. The dental care segment dominates the market in 2021. This is attributed to the rising prevalence of dental diseases coupled with a lack of dental access in rural communities. For instance, according to a study conducted by Rural Information Hub, in March 2022, around 67% of rural America comes under Dental Health Professional Shortage Areas. Thus, the above-mentioned factor is anticipated to boost the market growth of this segment.

Based on vehicle type, the market is segmented into mobile medical vans, mobile medical bus, mobile medical shipping containers and others. Amongst these medical vans, dominates the market in 2021. This is attributed to the prevalence of the poor population in the rural area coupled with the lack of adequate primary healthcare facilities in this area. For instance, in March 2023 report, the Ministry Of Health & Family Welfare Government of India extended its support to Mobile Medical Units under the National Health Scheme, it encompassing both the National Rural Mission (NRM) & National Health Mission (NHM) a key strategy to facilitate access to public health care, particularly to people living in remote, difficult, under-served and unreached areas. Furthermore, the objective of this strategy is to take healthcare to the doorstep of populations, particularly rural, vulnerable, and under-served areas. These factors are expected to propel the growth of the market.

Global Mobile Healthcare Clinic Market Segmentation

Market Insights by Service Type

o Maternal Health

o Emergency Care

o Geriatric Care

o Dental

o OPD

o Others

Market Insights, by Vehicle Type

o Mobile Medical Van

o Mobile Medical Bus

o Mobile Medical Shipping Containers

o Others

Market Insight, by Layout design

o Single Exam Room

o Double Exam Room

o Triple Exam Room

Market Insight, by Region

· North America

o U.S.

o Canada

o Rest of North America

· Europe

o UK

o Germany

o France

o Italy

o Spain

o Rest of Europe

· APAC

o China

o Japan

o India

o Rest of APAC

· Rest of the World

Top Company Profiles

o ADI Mobile Health

o Armor Mobile Systems

o Odulair, LLC

o Matthew Speciality Vehicles

o Farber Specialty Vehicles

o MinFound Medical Systems Co., Ltd

o La Boit Specialty Vehicles Inc

o CVR Industries USA, Inc.

o Kentucky Trailer

o LifeLine Mobile, Inc

Get a call back