Author: Vikas Kumar

08 July 2023

The companies have localized the manufacturing and assembly of EV components to a large extent, but battery cells are still mainly sourced from China. However, the companies have announced plans to partner with Indian cell manufacturers to localize cell sourcing also. The buses can be fully recharged in three to four hours and can travel up to 300 km per charge. Further, the buses are equipped with an electronically controlled air suspension system, advanced disc braking system, power-assisted steering system, closed circuit television (CCTV) cameras, dashboard for engine monitoring, universal serial bus (USB) sockets for each seat, lightning protection system, and zero CO2 emission. The operators have redesigned public transport depots with interoperable charging systems for e-buses. For instance, Tata Motors won the FAME II tender from Convergence Energy Services Limited (CESL) in June 2022 for the 12-year deployment of 5,450 electric buses in Kolkata, Delhi, Bangalore, Hyderabad, and Surat for INR50 billion. The offering was held across five classifications of e-Buses 12-meter low-floor AC and non-AC, 12-meter standard floor non-AC, and 9-meter standard floor AC and non-AC. In July 2022, Olectra Greentech secured a contract from Telangana State Road Transport Corporation (TSRTC) to supply, operate, and maintain 300 electric buses for 12 years. The cost of the project is estimated at INR5 billion. The buses will be delivered over a period of 20 months. In July 2022, PMI Electro Mobility Solutions Private Limited (PEMSPL) secured a contract to supply, operate, and maintain 100 electric buses for the Rajkot Municipal Corporation in Gujarat. PMI will operate these buses for 10 years. The order is in addition to a previous order for 50 electric buses. In August 2022, Hinduja Group’s EV arm, Switch Mobility, collaborated with Chalo (a transport technology company) to deploy 5,000 electric buses worth INR79.5 billion in three years in cities where Chalo is currently operating. Switch Mobility will own, operate, and maintain the EiV12 model variants. Chalo will deploy charging infrastructure and technology solutions like live tracking, route planning, and purchase of digital tickets through app and card, respectively.

Access sample report (including graphs, charts, and figures): https://univdatos.com/report/electric-buses-market/get-a-free-sample-form.php?product_id=40435

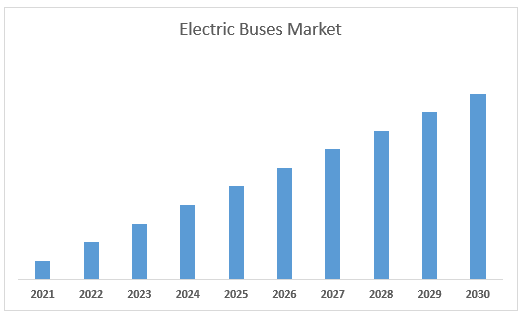

Further, the APAC Electric Buses Market is expected to grow at a strong CAGR of 19.6% during the forecast period (2022-2030). APAC is anticipated to emerge as the fastest growth in the Automotive and Electric Buses industry. Moreover, manufacturers in APAC are investing in research and development to produce innovative and technologically advanced products. These new products are designed to meet the specific requirements of different industries and are aimed at improving efficiency, reliability, and safety. APAC Electric Buses Market

Revenue (2022-2030)- USD Mn.

For a detailed analysis of the Global Electric Buses Market browse through :-https://univdatos.com/report/electric-buses-market/

Based on propulsion, the market is segmented into BEV, HEV, PHEV, and FCEV. Among these, HEV has a high market share in 2021 and will dominate during the forecast period. This is due to HEVs being seen as a more practical and convenient option for many drivers, especially those who may have concerns about range anxiety or access to charging infrastructure. HEVs combine a gasoline engine with an electric motor, allowing them to switch between the two power sources as needed, which means drivers do not need to worry about running out of battery power.

Based on length, the market is segmented into <9m, 9-14m, and >14m. Among these, 9m-14m has a high market share in 2021 and will dominate during the forecast period. adoption of 9–14-meter electric buses has been gaining momentum as cities and transit agencies worldwide seek to transition to sustainable and zero-emission public transportation. Several key players in the automotive industry have launched electric bus models in this size range, driving the market forward. For instance, BYD, a leading electric vehicle manufacturer, introduced the BYD K9 electric bus, which has a length of 12 meters and offers a long driving range on a single charge.

Global Electric Buses Market Segmentation

Market Insight, by Propulsion Type

Market Insight, by Length

Market Insight, by Range

Market Insight, by Battery Capacity

Market Insight, by Region

Top Company Profiles

Get a call back