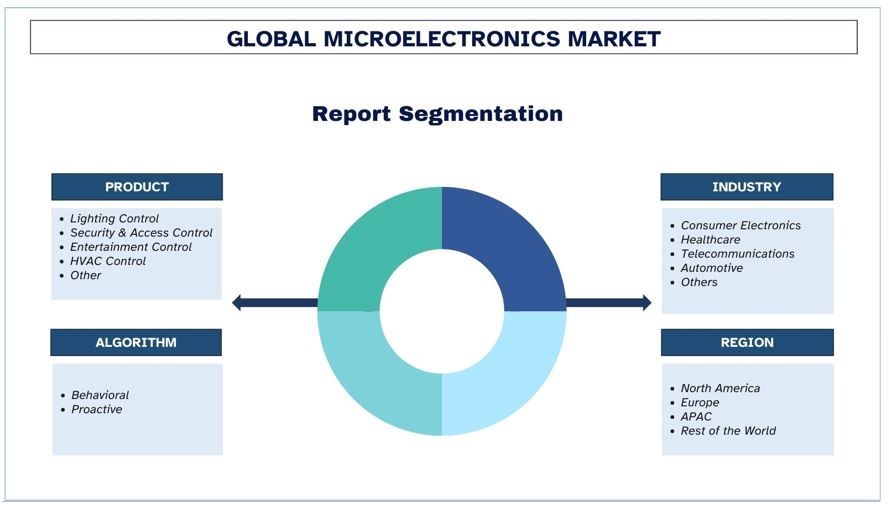

Emphasis on Product (Lighting Control, Security & Access Control, Entertainment Control, HVAC Control, and Other); Industry (Consumer Electronics, Healthcare, Telecommunications, Automotive, and Others); Algorithm (Behavioral, and Proactive); Region/Country.

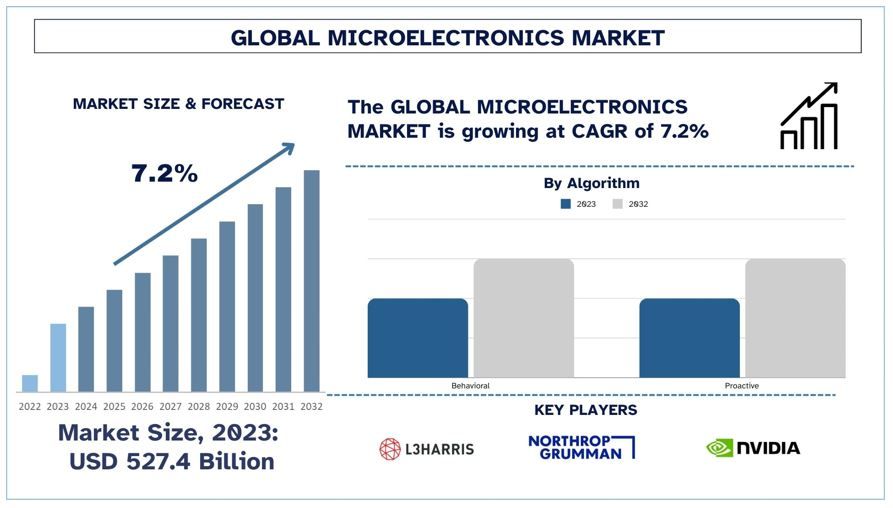

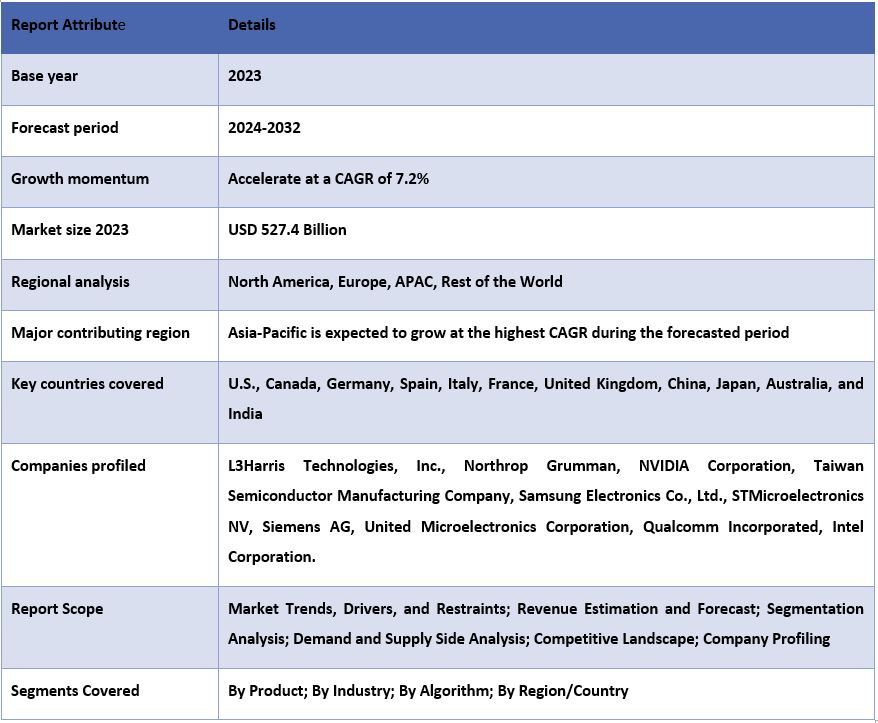

The Microelectronics market was valued at USD 527.4 Billion in 2023 and is expected to grow at a robust CAGR of around 7.2% during the forecast period (2024-2032) owing to the rising demand for faster, smaller, and more energy-efficient electronic devices across sectors like consumer electronics, automotive, telecommunications, and healthcare.

The word ‘Microelectronics’ encompasses the circuity semiconductors and sensor technology used in consumer electronics, automobiles, healthcare, telecommunication, etc. The demand for microelectronics is supported by rising demand for high-performance, faster, inexpensive, and energy-efficient electronic end-products. This has been supported by the fast development and use of other technologies including artificial intelligence, IoT, and 5G which also need enhanced microchips for maximum efficiency. Also, industry automation and the continued rise in computing requirements provide the basis for the market’s steady growth.

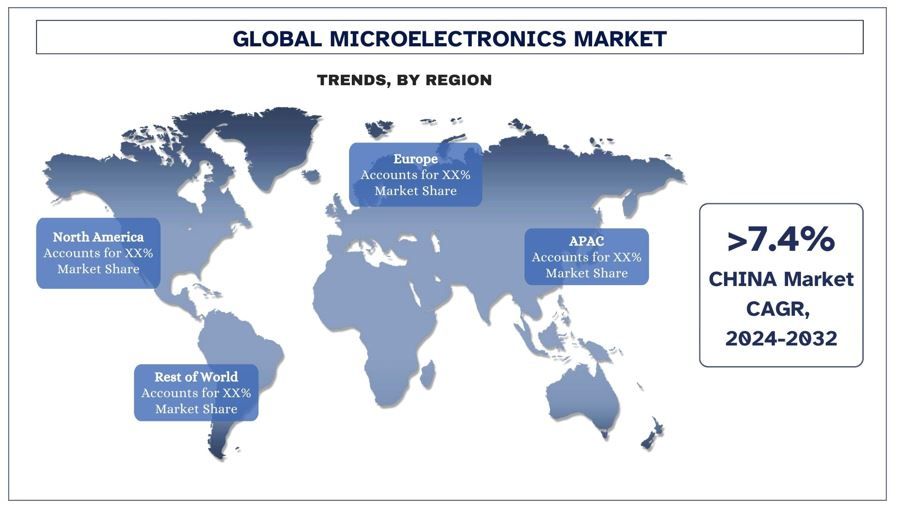

APAC Economies such as China, India, and South Korea are emerging as new Manufacturing powerhouses for microelectronics (specifically semiconductors) with increasing R&D investors. For instance, India has inaugurated the Semicon India Program, a $10 billion plan focused on boosting its home semiconductor industry. The Chinese government through its Made in China 2025 strategy is investing significantly in microelectronics with an aim of ending its dependency on imports of semiconductor chips. Vietnam has also been diversifying a little in the electronics supply chain by gradually liberalizing the incentives offered to entice FDI into its burgeoning technology industry.

This section discusses the key market trends that are influencing the various segments of the Microelectronics as identified by our team of research experts.

Government policies are shaping and supporting the microelectronics industry. They provide incentives, investments, and strategic directions feeding the growth of the microelectronics market. Here are some key areas where government policies support the microelectronics sector:

Various world governments have been offering subsidies, tax breaks, and grants to advance semiconductor manufacturing plants or factories in their respective nations. For instance, the U.S. Department of Commerce released its strategy outlining how the Department will implement $50 billion from the bipartisan CHIPS Act of 2022, signed by President Biden. The CHIPS for America program, housed within the Department’s National Institute of Standards and Technology (NIST), will revitalize the domestic semiconductor industry and spur innovation while creating good-paying jobs in communities across the country. China’s “Made in China 2025” initiative is also taking steps to develop Chinese semiconductors, thus reducing its dependencies on foreign technology.

Governments also fund R&D in microelectronics as an approach to forward innovation and advance technology in the industry. This encompasses funding of universities, other research institutions, and private companies engaged in next-generation technologies such as quantum computing, AI-driven microelectronics, and advanced semiconductor materials. For instance, South Korea announced a 26 trillion won ($19 billion) support package for its chip businesses, citing a need to keep up in areas like chip design and contract manufacturing amid ‘all-out warfare’ in the global semiconductor market.

Governments are now targeting sustainable manufacturing in the industry of microelectronics. Rising regulations on energy efficiency, waste, and the use of dangerous substances in semiconductor manufacturing are also on the rise. Besides providing help to the companies that embrace ecological governance as per global environmental policies such as RoHS or Restriction of Hazardous Substances and REACH for Registration, Evaluation, Authorization, and Restriction of Chemicals.

The Asia-Pacific (APAC) region is probably one of the most important engines of global growth, largely as a result of the large economies of China, India, Japan, South Korea, and the rest of the ASEAN nations. It’s characterized by rapid industrialization, urbanization, and increasing middle-class populations that powerfully drive domestic demand for goods and services. Major manufacturing in the world is in APAC, especially in electronics, automotive, and textiles, often referred to as the world’s factory in China. Other countries, like India, are turning into tech hubs and service centers, whereas Japan and South Korea keep developing innovation with the latest technologies. Trade agreements, foreign direct investment, and infrastructural developments have further catalyzed this progress, thereby making APAC a critically important economic driver for the world. However, a combination of geopolitical tensions, environmental sustainability demands, and a rising digital transformation will mold the future course of the region.

The Microelectronics market is competitive and fragmented, with the presence of several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market are L3Harris Technologies, Inc., Northrop Grumman, NVIDIA Corporation, Taiwan Semiconductor Manufacturing Company, Samsung Electronics Co., Ltd., STMicroelectronics NV, Siemens AG, United Microelectronics Corporation, Qualcomm Incorporated, Intel Corporation.

The global Microelectronics can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to contact us to get a report that completely suits your requirements.

1. Market Introduction

2. Research Methodology or Assumption

3. Executive Summary

4. Market Dynamics

5. Pricing Analysis

6. Global Microelectronics Market Revenue (USD BN), 2022-2032F

7. Market Insights by Product

8. Market Insights by Industry

9. Market Insights by Algorithm

10. Market Insights by Region

11. Value Chain Analysis

12. Competitive Landscape

13. Company Profiled

14. Acronyms & Assumption

15. Annexure

Analyzing the historical market, estimating the current market, and forecasting the future market of global Microelectronics were the three major steps undertaken to create and explore the adoption of Microelectronics in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, numerous findings and assumptions were taken into consideration to validate these insights. Moreover, exhaustive primary interviews were also conducted with industry experts across the value chain of the global Microelectronics. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the Microelectronics through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of Microelectronics, we conducted a detailed secondary analysis to gather historical market insights and share for different segments and sub-segments for major regions. Major segments are included in the report such as Product, Industry, and Algorithm. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Microelectronics. Further, we conducted factor analysis using dependent and independent variables such as Product, Industry, and Algorithm of the Microelectronics Market. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the Microelectronics sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global Microelectronics, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2032 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

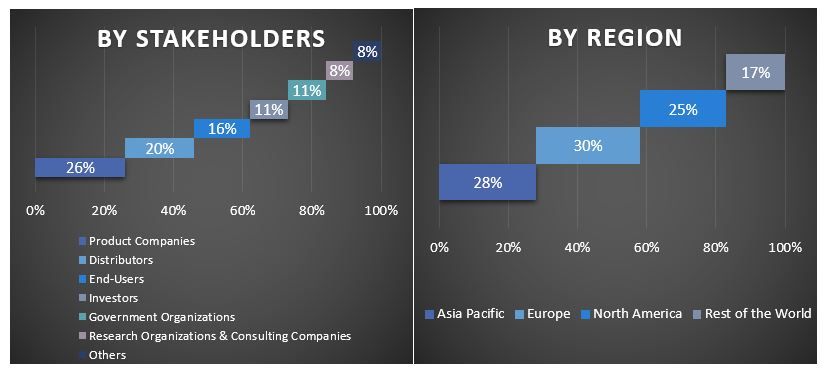

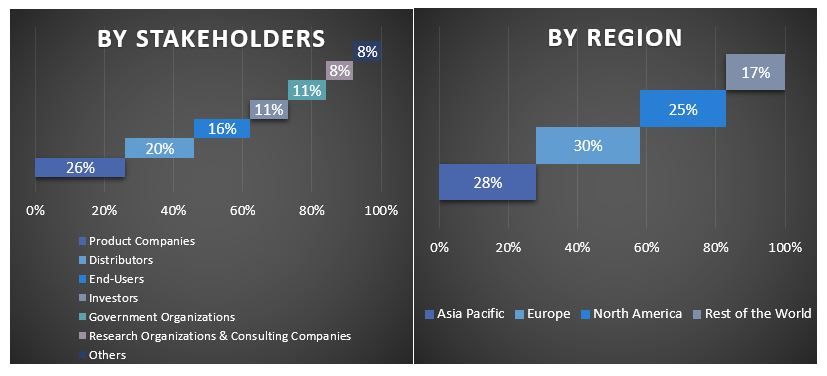

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global Microelectronics. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of Product, Industry, and Algorithm in the global Microelectronics Market.

The current & future market trends of the global Microelectronics were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

Q1: What is the current market size and growth potential of the Microelectronics market?

Q2: What are the driving factors for the growth of the Microelectronics market?

Q3: Which segment has the largest share in the Microelectronics market by Industry?

Q4: What are the emerging technologies and trends in the Microelectronics market?

Q5: Which region will dominate in the Microelectronics market?

Customers who bought this item also bought