RISING STARS: STARTUPS TRANSFORMING THE ADVANCED DERIVATIVES MARKET

The derivatives market, a cornerstone of modern financial systems, is an intricate web of contracts that derive their value from underlying assets such as stocks, bonds, commodities, currencies, interest rates, or market indexes. These financial instruments, which include futures, options, swaps, and forwards, provide investors with a range of strategies for hedging risks, speculating on market movements, and enhancing portfolio performance. The advancement in derivatives markets over the past few decades has been driven by the increasing complexity of financial needs, technological innovations, regulatory changes, and the globalization of financial markets.

Initially, derivatives were primarily used for hedging risks in commodity trading. However, their application has since expanded significantly, becoming integral to various financial sectors. The evolution of the derivatives market is characterized by the development of sophisticated products and trading platforms, enabling greater accessibility and efficiency. For instance, the advent of electronic trading platforms has revolutionized the speed and transparency of transactions, while quantitative finance and algorithmic trading have introduced new dimensions of strategy and execution.

Unlock Insights into the Advanced Derivatives Market – https://univdatos.com/report/advance-directives-market/

The growth of advanced derivatives markets is also closely linked to the rise of financial engineering. This discipline combines mathematical modeling, statistics, and economic theory to design and manage complex financial products. Through financial engineering, market participants can create tailored solutions to manage risk exposure, leverage positions, and capitalize on market inefficiencies. Derivatives, with their inherent leverage and flexibility, are particularly suited to such innovative financial strategies.

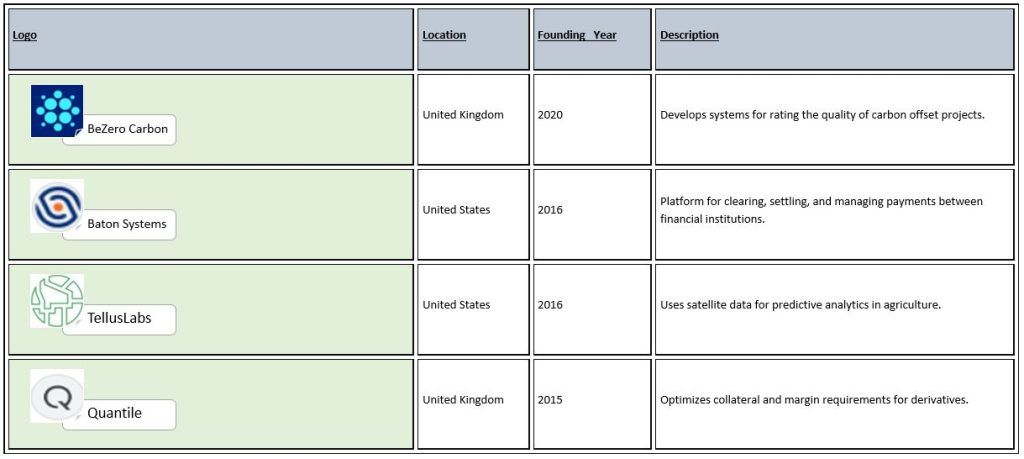

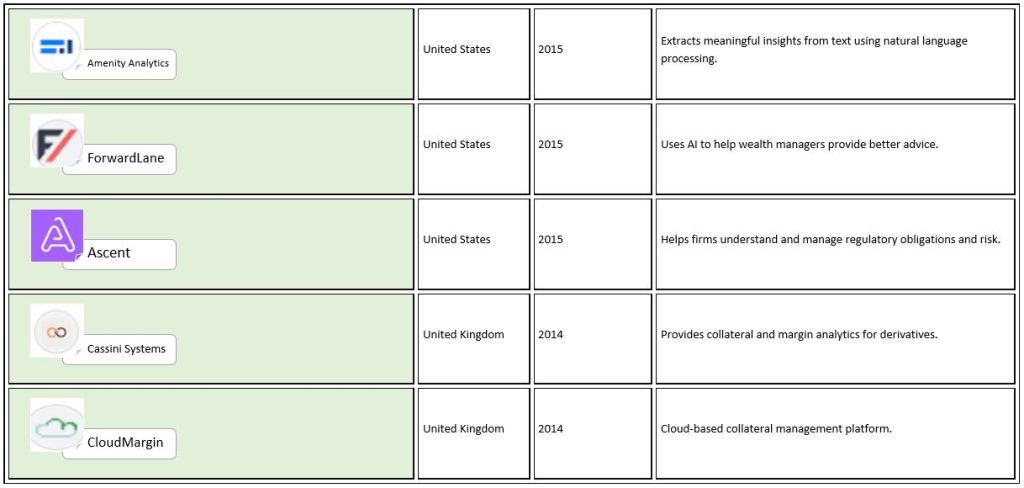

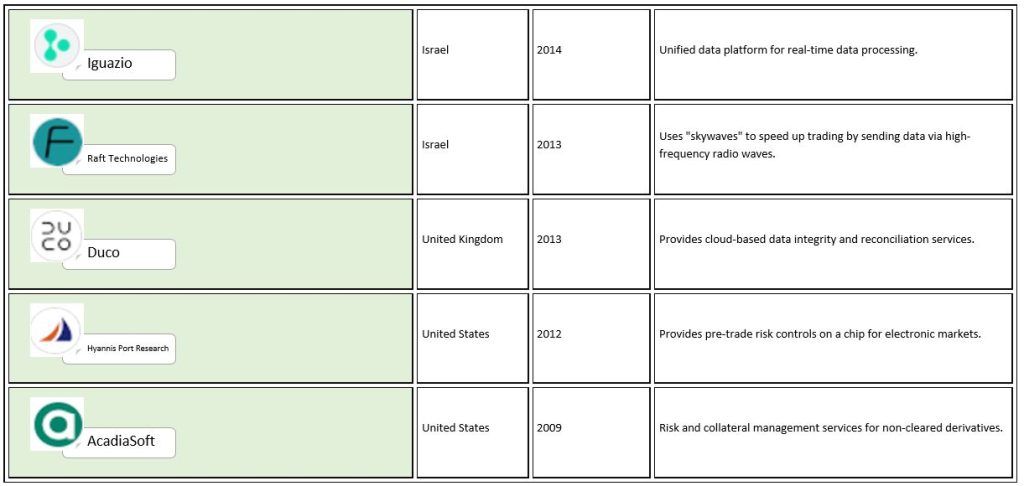

Here are some of the startups that are contributing towards the upliftment of Advance Derivatives market:

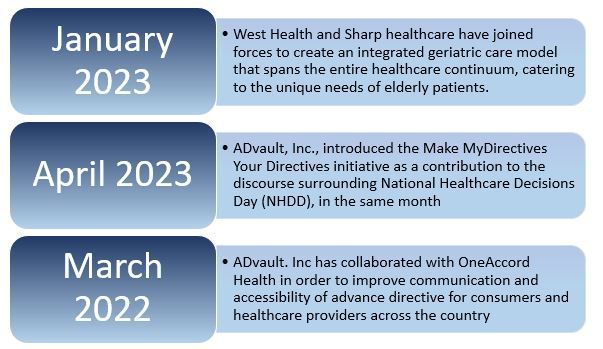

Recent Developments

Conclusion

The advanced derivatives market stands at the forefront of financial innovation, offering a plethora of instruments and strategies that cater to the diverse and complex needs of market participants. Its development reflects the broader trends in the financial sector, characterized by technological advancements, increasing globalization, and evolving regulatory landscapes. Derivatives have proven to be invaluable tools for managing risk, enhancing returns, and ensuring market efficiency.

In conclusion, the advanced derivatives market represents a dynamic and integral component of the global financial system. Its ability to innovate and adapt in response to changing market conditions and regulatory environments underscores its importance in modern finance. As market participants and regulators navigate the complexities of this evolving landscape, the ongoing development and responsible management of derivatives will be essential in fostering a stable, efficient, and inclusive financial system. According to the UnivDatos analysis, the advance directives market was valued at USD 113,946.86 Million in 2022 and is expected to grow at a strong CAGR of around 18.1% during the forecast period (2023-2030) owing to the rising awareness of advance directives among people.

Contact Us:

UnivDatos Market Insights

Email – [email protected]

Contact Number – +1 9782263411

Contact Us – [email protected]

Website – www.univdatos.com