Mastercard New B2b Digital Platform, Simplifying Global Trade

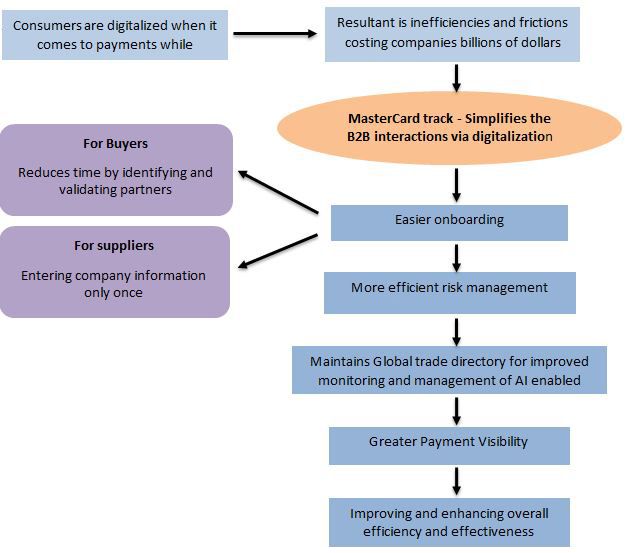

The world has witnessed a great shift with the commencement of the digital age. The digitalization has truly supported the world in becoming a global village. Almost all the domains have moved on to the digital platform and so has the business world, be it business to business, business to customer or customer to customer. According to MasterCard, digitalization has played a major role in other areas of the business-to-business industry but gaps still remain. Many areas like administration, transactions and expenses are still incompetent and unproductive due to missing or very little involvement of digitalization in the field. Even with the revolution and advancements seen in consumer payments over the last 5 years, the global business-to-business market is still mostly visible on paper. Owing to this scenario, administrative costs have reached $500 billion as per the Goldman Sachs 2015 report on “The Future of Finance, Redefining the Way We Pay in Next Decade”. According to Microsoft, US$ 58 trillion in transactions, or nearly half the value of business-to-business transactions, are done on paper. The situation is further worsened by the fact that in absence of digitalization in the B2B industry, it takes around sixteen days to bring suppliers onboard. This is due to the involvement of extensive manual processes. Also, the transactions are still done using cash or cheque which further adds on to the inefficiencies. The complexity of new rules and regulations for the businessesthat expand their market by operating across borders around the globe, struggling to traverse the details and essentials of new markets.

Microsoft, in collaboration with MasterCard, has announced the launch of MasterCard Track, a new B2B digital platform to overcome all these issues and streamline the process to get maximum from minimum inputs in the most effective and efficient manner.,. This platform is powered by Microsoft Azure. MasterCard Track will bring together and integrate the existing procure-to-pay process to strengthen third-party risk management for the businesses by improving cash flow discernibility and shrink the costs of manual tasks. Using this platform, businesses would be able to instantaneously explore for suppliers, collect a report on the credit rating of a supplier and get other important and much-required information at once, thereby making the entire process efficient.

While using MasterCard Track, suppliers will be required to enter company information only for the first time and then will have the ability to monitor cash flow across several networks. Once registered in the MasterCard Track, it makes the progression for registering with new customers simpler and easier by securely sharing key business identity documentation and payment credentials. MasterCard Track will keep a track of and would combine payment timing and payment details across all the customers of the supplier at the same place. It would further enhance their cash flow visibility and reduce the need for payment status inquiries to customers. This approach would improve the cash flow reflectiveness and lessen the requirement of time to time inquiries pertaining to payment status to the customers. As per the “Global Chief Procurement Officer Survey” of Deloitte in 2018, 65% of companies don’t screen beyond tier 1 suppliers. This results in the restricted domain and flawed risk management & mitigation aspects. MasterCard Track would facilitate in minimizing the legal and regulatory risk keeping a track of new evolving compliance issues. It steadily takes care of payment details, business entity information and searches for vital contacts from over 150 million records. Further, it monitors business credit reporting to generate alerts about potential credit risk with third-party partners. The risk alerts further provide tip-off pertaining to AML, sanctions and confrontational media for all the suppliers. This facilitates the businesses to stay ahead of new compliance issues thereby minimizing the legal, regulatory and brand risk.

The unique trade directory of the MasterCard Track presents a database of more than 150 million businesses across the globe. This provides a better understanding of the supplier operations, corporate hierarchies, financial risk and many other important business aspects. It further takes into consideration the account of important data from POs, invoices and batch payment files. The tracker further assembles the collected information into a single source which is open to both buyers and suppliers thereby improving the transparency and thus avoiding the unnecessary confusions and queries. Due to the involvement of artificial intelligence, new and significant information across a supply chain is updated that enlightens alternative and emerging choices, as an effect it proves to be a better option for the businesses. This saves a lot of resources of the involved parties thereby improving the efficiency and effectiveness of the entire system.

MasterCard Track Process Flow

In the initial phase, MasterCard Track has partnered with nine business-to-business network and procure-to-pay providers namely Invalua, Jaggaer, Basware, BirchStreet, Coupa, Liaison Technologies, Tungsten Network, Tradeshift, and the Infor GT Nexus Commerce Network.

As of now, the platform is operational in Singapore via its National Trade Platform. Here, it is being used in logistics functions. Further, it will be made live in the U.S. and the U.K in the first quarter.

Moving on to the next developmental phase of MasterCard Track, it will involve banks, technology providers and insurance companies. All these stakeholders will be allowed to extend value-added services on the platform. To move ahead with this phase, MasterCard has partnered with Barclays and Citi to further explore the financing competences. Before this financing phase is made available to the companies, they are expected to build up a history on the platform. This is meant to facilitate the banks to assess their risk and credit behaviour. Once the phase is made fully functional, the banks would be able to examine the transaction record of a company. Banks are anticipated to commence financing via Track by early 2020. On the other hand, insurance companies are expected to offer services earlier.

Thus, it can be stated that MasterCard Track will facilitate the companies around the world in speeding up the pace of the revolution by generating a more efficient buying and selling process.