- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Battery Pack costs rising for EV: A future perspective.

Author: Vikas Kumar

December 19, 2023

In recent years, EV battery cell prices have fallen as global production has increased. As per sources, the average cost of battery cells is currently $128 per kWh. By next year, the average cost could reach $110 per kWh.

However, it is predicted that the declines will be short-lived. From 2023 to 2026, the average price of battery cells will increase by 22%, reaching a peak of $138 per kWh, before declining steadily through 2031, possibly reaching a low of $90 per kWh.

Unlock Insights: Receive a Sample Research Report on the Electric Vehicle Battery Market – https://univdatos.com/get-a-free-sample-form-php/?product_id=11188

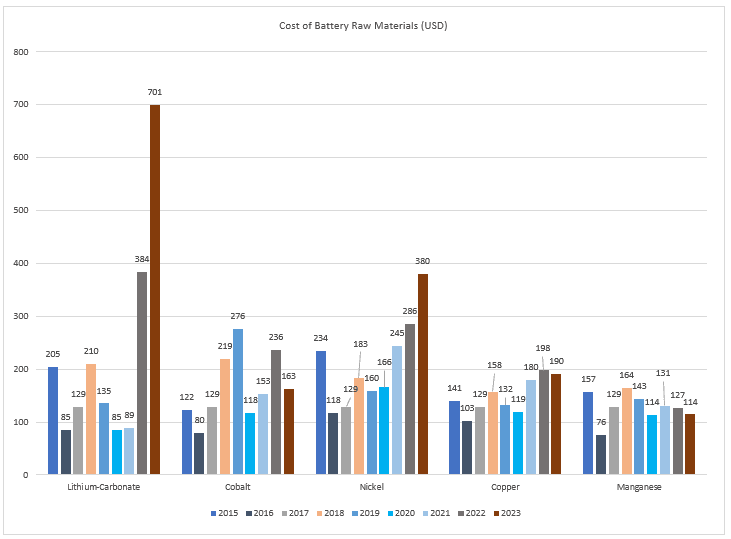

The projected increase in battery cell prices is due to an increase in demand for critical raw materials, such as lithium, which is needed to produce tens of millions.

The increasing cost of electric vehicle (EV) batteries is holding up the availability of affordable electric vehicles — and it will only worsen before it gets better.

After declining for the past decade, the cost of electric car batteries increased by 7 percent in 2021, according to a BloombergNEF report.

This about-face jeopardizes the future of lower-cost EVs and further complicates the industry’s effort to find a more cost-effective path to electrification. It also begs the question of whether, by making this change, automakers are ushering in a new age of uncertainty and bringing car buyers with them.

Battery materials, particularly lithium, nickel, and cobalt, sent shockwaves throughout the auto industry earlier this year as automakers raced to expand their EV offerings. According to McKinsey, lithiumalone has risen 500% in the last year alone.

These costs are at the root of why electric cars have yet to become affordable for the mass market. In November, the average new EV price was $65,042, according to data from Kelley Blue Book. That’s significantly more than the average new gas-powered car ($48,681) and is largely driven by today’s pricier electric pickups and sedans. These costs make it harder for automakers to lower the price of their EVs, a key factor in driving widespread EV adoption.

Understanding The Global Supply Chains of Electric Vehicle Batteries

The term supply chain refers to the process of manufacturing and delivering a product to a consumer. There are four main steps in the manufacturing and use of an EV battery:

Ø Upstream: Mining and processing of raw materials. Raw materials for batteries typically include lithium, cobalt, and manganese, as well as nickel and graphite.

Ø Midstream: Purification of raw materials by processors and refiners, which are then used to create cathode/anode active battery materials

Commodities traders purchase raw materials and sell them to firms that manufacture battery cells.

Ø Downstream: Manufacturers assemble battery cells into modules, which are then packaged and sold to automakers, who package and sell the finished batteries into EVs

Some automakers, such as Ford and Stellantis, partner with battery manufacturers to manufacture their own batteries for their vehicles.

Ø End of life: When a battery is no longer suitable for its intended purpose, it can be recycled or reused.

The global supply chain for electric vehicle (EV) batteries is highly dispersed. On average, battery minerals travel 50,000 miles (80,000 km) from extraction to the manufacturing of battery cells. Most of the supply is concentrated in a few countries.

What types of disruptions can there be?

This dispersion and concentration make the global supply chain susceptible to disruptions. These disruptions can be caused by:

• Extreme weather events (e.g., hurricanes, tornadoes, and earthquakes) that disrupt energy inputs and infrastructure such as pipelines and shipping routes.

• Geopolitical disruptions, such as the war in Russia and Ukraine, has disrupted supply chains.

• Changing trade alliances, such as between countries or regions, can also affect supply chain networks.

• Corporate consolidation, which means that as EV demand increases, there will be more big players overseeing more parts of the EV supply chain. If one or more of these companies experience a disruption, the impact will be larger.

• Rapid changes in battery chemistries and designs, such as the introduction of alternative or more abundant materials, will also have an impact on supply chain networks.

These disruptions lead to supply chain disruptions and have a negative impact on the entire battery supply chain. They can also have a negative effect on economies, cause supply chain delays, drive up transportation costs, cause employers to reduce employment, deter investment, and impede transportation decarbonization.

The current state of global EV battery supply

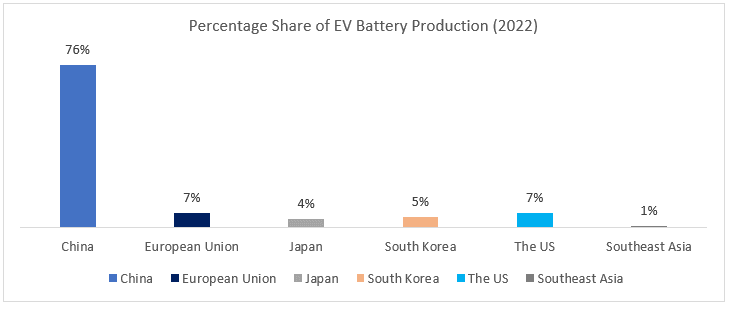

Currently, the supply chain is largely controlled by China. As wider geopolitical issues impact economic and trade relations, the security of global supply chains is at risk when a large portion of the world’s EV battery components are extracted, refined, processed, and assembled anywhere in the world.

Some critics have labeled US efforts to expand domestic EV supply chain capacity a “China-bait” strategy, which is a bit of a misnomer. US Trade Representative (USTR) Katherine Tai calls the current administration’s approach a de-risking strategy.

As the market for EVs and other cutting-edge energy technologies continues to grow, all producing nations will have plenty of opportunities to grow, even as production capacity continues to diversify.

Strengthening the supply chain for EVs isn’t a zero-win situation. Developing a strong supply chain for EVs will benefit people all over the world by creating economic opportunity, job creation, and easier access to EVs. We can significantly strengthen EV supply chains by partnering with other countries; improving regulations; investing more in domestic battery production; and improving battery circularity.

Moreover, In the wake of Russia’s invasion of Ukraine, prices for nickel, lithium, and other materials have skyrocketed, exacerbating the global chip shortages and supply chain disruptions caused by the global coronavirus pandemic.

Are there enough minerals available to produce the EV batteries we need?

The answer is YES.

Demand for these minerals is high and expected to increase significantly over the next few years. Today, we have enough minerals to meet current and future EV demand.

The challenge is that the supply chain is not prepared to meet the demand. Today, even though we have enough minerals, we don’t have enough mines operating.

Since establishing a mine can take years, we need to act fast to ensure that supply meets growing demand while also meeting local communities’ expressed needs. This work will require substantial investment. In the US alone, we will need to spend $175 billion over the next two to three years to meet China’s demand for battery production.

In the short term, however, automakers are testing different battery types to see whether they can reduce reliance on some of the most heavily invented materials. Alternatives, however, take longer to develop and may not be sufficient if they involve sacrificing performance.

Moving Forward

Transportation electrification is a movement that is gaining momentum every day. As we work together to decarbonize the way we transport people and goods, it is essential for governments, policymakers, private and public stakeholders, and communities to understand the value chain of EV batteries in order to effectively tackle its challenges while realizing the economic, health and environmental benefits of electrification.

Get a Callback