- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Marine Scrubber Market Seen Soaring ~12.23% Growth to Reach USD XX Billion by 2033, Projects UnivDatos

Author: Ritika Pandey, Research Analyst

May 8, 2025

Key Highlights of the Report:

Technology trends: New innovative technologies and integration of artificial intelligence, Machine learning are aggravating the efficiency of scrubber systems due to their flexibility and ability to meet the stringent emission standards.

Applications: They are widely used in bulk containers, oil tankers, chemical tankers, cruises, and more.

Cost efficiency: The scrubbers offer a cost-efficient solution by allowing ships to use high-sulphur fuels while adhering to emission regulations. According to the Community Emissions Data System 2022, Asia is the highest sulphur oxide emitter in the world.

Environmental impact: The marine scrubbers contribute to sustainability by removing sulphur oxides and nitrogen oxides from exhaust gases, hence, assist the ships to adhere to the international regulations, such as the IMO sulphur cap.

According to a new report by UnivDatos, the Marine Scrubber Market is expected to reach USD XX Billion in 2033 by growing at a CAGR of 12.23% during the forecast period (2025-2033). The increasing maritime trade, implementation of stringent environmental regulations, and the rising adoption of emission control technologies across the maritime sectors are catalysing the marine scrubber market. Furthermore, the constant evolution of scrubber technologies enhances the cost efficiency by allowing the ships to use cheaper high-sulfur content fuels while meeting the emission standards. The demand for marine scrubbers has further been elevated as a result of a larger fleet of ships brought about by growing international trade. The building and development of some important maritime trade routes, such as the Panama Canal, the Suez Canal, and the Arctic shipping lanes, have also expanded the marine trade. With the grant of incentives and subsidies to manufacturers in some countries, like the United States, the market is seeing exponential growth. In addition to abiding by the law, many shipping companies have made the transition to eco-friendly operations as a result of mounting pressure from stakeholders, the general public, and environmental organizations.

Some of the rules and regulations increasing the growth of marine scrubbers are:

Authorities have created standards for how marine scrubbers should operate.

Since 2020, the International Maritime Organization has regulated maritime sulphur emissions in SECAS under MARPOL Annex VI by setting fuel sulphur content limits to 0.50%.

Authorities worldwide, including the IMO, have specified water discharge standards for scrubbers that prohibit washing waters below a pH of 6.5 and set limits on oil content, plus clarity and water temperature.

Open-loop scrubber usage becomes limited due to legal restrictions that several ports and international regions enforce around their waters. In February 2023, there were 93 global policies mainly targeting open-loop scrubber systems because of environmental reasons.

Ports throughout Europe, the Americas, and Asia maintain rules that prevent wash water discharges from the equipment. The California Air Resources Board prevents ship operators from using scrubbers to replace low-sulphur fuel in nearby water zones.

Ships need to keep an Exhaust Gas Cleaning System (EGCS) Record Book that shows all maintenance activities during device operations. Permits ship inspectors from both surveys and port states to check the recorded data.

More environmentally-concerned people and stricter pollution rules stimulate the market for better scrubber technology including hybrid systems that adapt well to different operation methods.

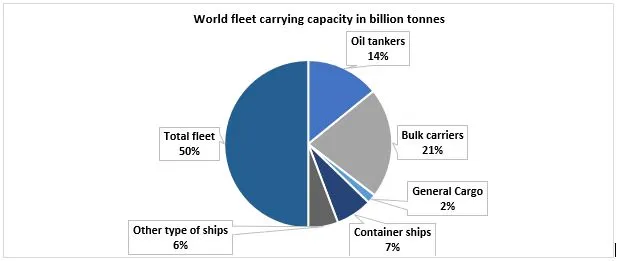

This regulatory framework stimulates the marine scrubber use, which aims to balance environmental protection with operational flexibility and cost efficiency in the shipping industry. In 2023, according to the United Nations Trade and Development 2022, 11.76 billion metric tons of goods were loaded for international maritime trade. As of January 2024, the world’s fleet carrying capacity reached 2.35 billion dead weight tons, an increase of 77 million dead weight tons from the previous year.

Figure 1: World fleets by principal vessel type, millions of dead weight tons, in 2024

Source: UNCTADstat (UNCTAD, 2023a). Note: Commercial ships of 100 gt and above. Beginning-of-year figures.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Technology Type, By Application, By Installation, By Region/Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Get a Callback