- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

MENA ONLINE FOOD DELIVERY MARKET: RIDING THE WAVE OF DIGITAL DINING TRENDS

Author: Vikas Kumar

June 24, 2024

In the bustling culinary scene of the Middle East and North Africa (MENA), the online food delivery market continues to capture headlines and reshape consumer dining habits. With technological advancements and shifting preferences driving innovation, the MENA region is witnessing a surge in digital dining trends.

Market Expansion and Investment Influx:

The MENA online food delivery market is experiencing unprecedented growth, attracting significant investments from both domestic and international players. Delivery Hero’s acquisition of Kuwait-based Talabat for 170 million USD in 2015 marked a pivotal moment, signaling the region’s potential as a lucrative market for online food delivery services. Since then, the market has witnessed a flurry of activity, with startups securing funding rounds to fuel expansion and innovation. Recent investments in regional players like Kitopi, a cloud kitchen platform, and Elmenus, an Egypt-based food delivery app, underscore investor confidence in the MENA online food delivery ecosystem.

For More Detailed Analysis in PDF Format, Visit- https://univdatos.com/reports/mena-online-food-delivery-market?popup=report-enquiry

Emergence of Cloud Kitchens and Virtual Brands:

Cloud kitchens, also known as ghost kitchens, have emerged as a key trend reshaping the MENA food delivery landscape. These off-premises cooking facilities, devoid of traditional dining spaces, cater exclusively to delivery orders from multiple virtual restaurant brands. With lower overhead costs and increased operational efficiency, cloud kitchens offer a scalable model for restaurants and entrepreneurs looking to capitalize on the growing demand for online food delivery. In response, major players like Deliveroo and Uber Eats have invested in establishing their network of cloud kitchens across the MENA region, providing a platform for virtual brands to thrive.

Hyperlocalization and Personalization:

As competition intensifies, online food delivery platforms are doubling down on hyperlocalization and personalized experiences to differentiate themselves. MENA consumers have diverse tastes and preferences, varying across cities, neighborhoods, and even individual households. To cater to this demand, delivery apps are leveraging data analytics and machine learning algorithms to offer personalized recommendations, promotions, and menu selections. Moreover, partnerships with local restaurants and chefs allow platforms to curate exclusive dining experiences tailored to specific demographics, further enhancing customer loyalty and engagement.

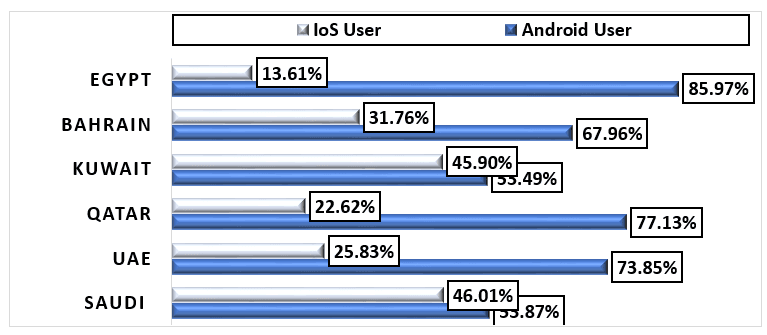

Fig1: Healthcare Expenditure in the Saudi Arabia, from 2017 to 2021.

Sustainable Practices and Social Responsibility:

Amid growing concerns about environmental sustainability and food waste, online food delivery platforms in the MENA region are embracing eco-friendly practices and social responsibility initiatives. From biodegradable packaging to food surplus redistribution programs, companies are prioritizing sustainability across their operations. For example, Talabat’s “Good Deeds” initiative partners with local charities to redistribute surplus food from partner restaurants to those in need, reducing food waste and supporting communities. Similarly, Deliveroo’s “Food for Good” program collaborates with restaurants to donate excess food to charitable organizations, addressing food insecurity and promoting social welfare.

Conclusion

The MENA online food delivery market continues to evolve at a rapid pace, driven by technological innovation, changing consumer preferences, and strategic partnerships. From cloud kitchens and virtual brands to hyperlocalization and sustainability initiatives, the landscape is ripe with opportunities for growth and disruption. As the market matures, regulatory challenges and market consolidation will shape its trajectory, prompting industry players to adapt and innovate in response. Nevertheless, the MENA online food delivery market remains a vibrant and dynamic ecosystem, poised to redefine the future of dining experiences in the region. According to the UnivDatos analysis, the MENA Online Food Delivery Marketwas valued at USD 9,825.14 million in 2022, growing at a CAGR of 20.5% during the forecast period from 2023 – 2030 to reach USD million by 2030.

Get a Callback