- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Saudi Arabia's Meat Market Expected to Grow 4.84% to Reach USD Million by 2033, According to UnivDatos

Author: Shalini Bharti, Research Analyst

September 4, 2025

Key Highlights of the Report:

The key factors that have boosted the growth of demand in meat products include urbanization, the increase in disposable incomes, and the high per capita meat consumption in fresh, frozen, and processed meat.

The main product segment is the poultry meat that has high demand with consumers preferring it because it is affordable, it is relatively fast in terms of turnaround, and the government has also supported poultry farming in the country.

The Central Region is the most consumed and retail-oriented region, and the Western Region is the fastest-growing region because of the increasing hospitality, tourism, and food services industries.

The most competitive players, such as Al Watania Poultry, Almarai, and Tanmiah Food Company, are keen on vertical integration, automation, and distribution size, where they may have a competitive advantage.

Subsidies of smart farming, feed technology, and cold chain infrastructure are taking place due to the Vision 2030 policy, which aims to enhance the local production capabilities and dependence on imports.

According to a new report by UnivDatos, the Saudi Arabia Meat Market is expected to reach USD million in 2033 by growing at a CAGR of 4.84% during the forecast period (2025- 2033F). The demand for premium, fresh, convenient, and processed meat products is being driven by urbanization and rising disposable income levels. Moreover, the government programs associated with Vision 2030 focus on increasing local production and reducing the level of importation, which stimulates investment in domestic farm and factory facilities. Furthermore, with the growth of both tourism and hospitality, the HORECA industry has started to generate stable, high-volume demand in regions.

For example, on June 3, 2025, Tanmiah Food Company introduced Saudi Arabia’s first fully refrigerated, 100% electric zero-emission trucks for fresh chicken products distribution—marking a major advancement in their sustainability journey. These trucks, powered by Quantron technology and supported by new infrastructure, reflect their commitment to reducing environmental impact while enhancing operational efficiency.

Driver: High Per Capita Meat Consumption

Saudi Arabia has the highest level of meat consumption per capita in the GCC, and this is a major growth factor in the fresh and processed segments. This continued desire for high-protein lifestyles, rooted in a cultural reverence for and traditional foods, would facilitate a long-term expansion in both poultry and red meat, as well as value-added meat products. It also forces retailers and foodservice operators to have a wide and quality assortment throughout the year.

The demand also motivates importers and local producers to invest in certified cold chains, breed efficient livestock, and enact halal-certified processing. The consumption pattern towards premium and convenience-led products is also changing as urbanization picks up pace and higher disposable incomes increase, which once again strengthens the upward momentum in the market.

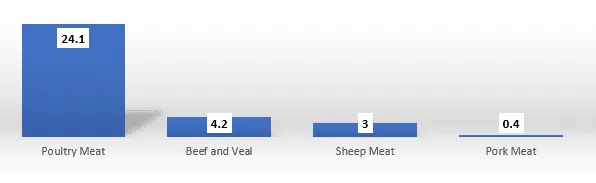

Fig #: Meat consumption, Beef and veal, Poultry meat, Pork meat, Sheep meat, Kilograms/capita - retail weight, 2023, Saudi Arabia

Segments that transform the industry

Based on form, the Saudi Arabian Meat market is segmented into fresh, frozen, and canned. Among them, the frozen are expected to grow with the highest CAGR during the forecast period (2025-2033F). The increasing urbanization, longer storage requirements, and convenience of storage and delivery drive the popularity of frozen meat. This opens up new inventory efficiencies for companies, allowing them to expand into underserved or remote areas. It also enables the local producers to compete with the imports since they can provide a uniform quality at higher prices.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/saudi-arabia-meat-market?popup=report-enquiry

Region that transforms the industry

The Central Region held a dominant market share in 2024. This region has a large population and numerous commercial centers, including the Central Region, centered on Riyadh, which is the largest market for meat products. Additionally, its large cityscape features a thriving retail landscape, comprising supermarkets, hypermarkets, and a variety of foodservice chains that drive the market. The premium, organic, and ready-to-cook meat is in high demand among people from high-income brackets and those with contemporary consumer orientations. The area is also appealing to giant players in food production and distribution owing to its logistics and infrastructure. Consequently, it dictates the rate of product adoption, branding, and innovation in the country's meat market.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Product Type, by Form, by Distribution Channel, by End User, by Region

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Get a Callback

Related News

Subscribe to our newsletters

By submitting this form, I understand that my data will be processed by Univdatos as indicated above and described in the Privacy Policy. *