- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Autonomous Construction Equipment Market: Current Analysis and Forecast (2024-2032)

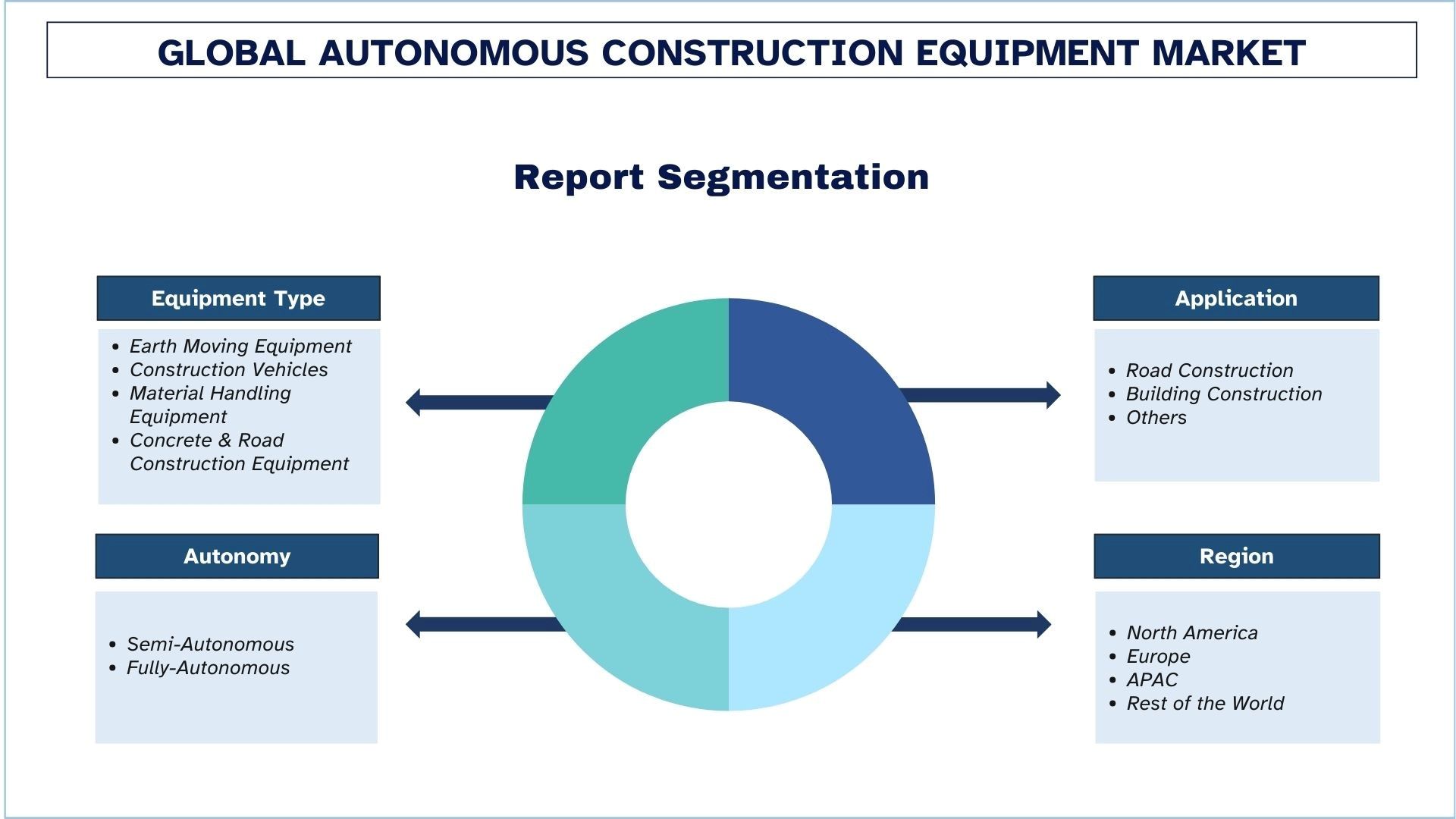

Emphasis on Equipment Type (Earth Moving Equipment, Construction Vehicles, Material Handling Equipment, and Concrete & Road Construction Equipment); Application (Road Construction, Building Construction, and Others); Autonomy (Semi-Autonomous, and Fully-Autonomous); Region/Country

Autonomous Construction Equipment Size & Forecast

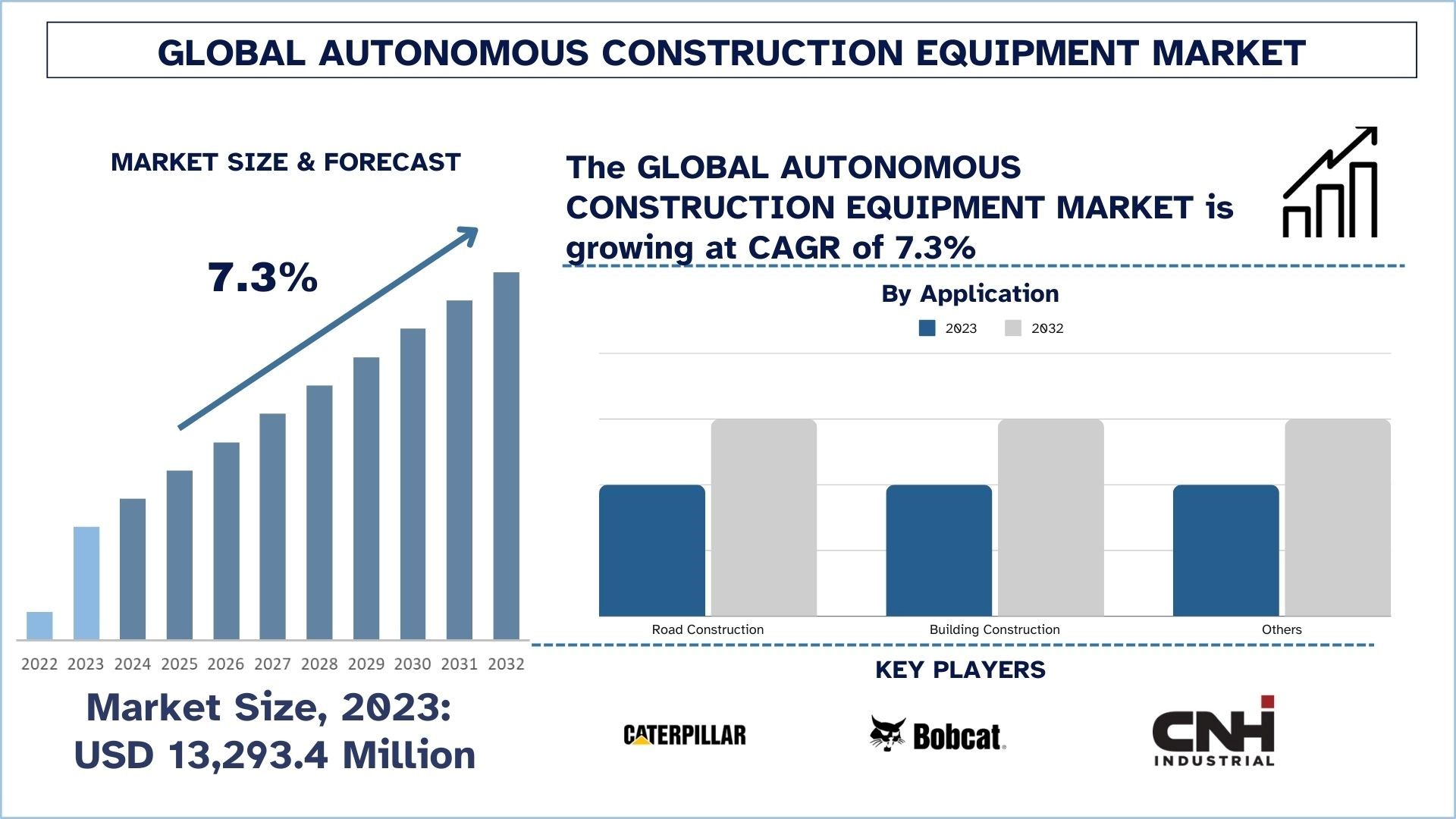

The Autonomous Construction Equipment market was valued at USD 13,293.4 Million in 2023 and is expected to grow at a robust CAGR of around 7.3% during the forecast period (2024-2032) owing to the growing demand for automation to enhance efficiency, safety, and productivity in large-scale infrastructure projects.

Autonomous Construction Equipment Analysis

The Autonomous Construction Equipment market is aimed at creating and expanding the use of self-operating machinery and vehicles in construction activities. The technologies, which include AI, IoT, and robotics, are used in earth-moving machinery, material handling equipment, construction vehicles, and concrete, and road construction equipment. The key drivers of this market are the growing demand for large-scale infrastructure projects, increasing labor costs, labor shortage, and the need for improved safety and operational efficiency on construction sites. In construction automation not only decreases the cost of human intervention but also reduces errors, improves productivity, and reduces downtime respectively, making it a key expanding point in the world over building sector.

The market has been greatly influenced by technologies, with AI, machine learning, GPS, and sensor-based technologies transforming construction equipment into smarter and more efficient machines. The improvements in overall site productivity are enabled by the fact that autonomous systems are now able to do complex tasks such as excavation, grading, and material loading with little if any human input. The industry is shifting towards digitalization and automation is moving up while recent mergers and acquisitions, such as Trimble acquiring B2W Software and Caterpillar working with tech companies reflect this trend. They are helping improve software integration within construction equipment, increasing equipment performance and operational insight through real-time data analysis.

The fastest growing markets for autonomous construction equipment are expected from such countries as China, India, and the USA which are currently undergoing rapid urbanization, huge investments in infrastructure, and government-driven smart city projects. Accelerating the future of this market is a Chinese government that supports infrastructure development and the adoption of AI. Just like India’s Atmanirbhar Bharat and the US government’s Infrastructure Investment and Jobs Act, these are making the surroundings conducive for the use of the most advanced construction technologies. These policies, to encourage faster completion, safer places to work, and cost efficiency—will push for even more autonomous equipment.

Autonomous Construction Equipment Trends

This section discusses the key market trends that are influencing the various segments of the Autonomous Construction Equipment as identified by our team of research experts.

Government Policies Supporting the Autonomous Construction Equipment Industry

Here are some government policies supporting the growth and adoption of the Autonomous Construction Equipment Industry:

Infrastructure Development Initiatives:

Governments are undertaking many large-scale infrastructure projects (such as smart cities, highways, bridges, and public utilities) that support the growing use of automated construction technologies. China's Belt and Road Initiative (BRI)—which has led to investing over $1 trillion in infrastructure all over Africa and Asia—as well as India's Smart Cities Mission, offer ways to do just that through advanced construction technologies, including autonomous equipment.

Subsidies and Incentives:

Some governments offer financial incentives, tax breaks, and subsidies for construction companies investing in automation, robotics, and AI-driven machinery. In Japan’s Robot Revolution Initiative, Construction automation is encouraged through the implementation of semi-autonomous and autonomous technology in companies

Safety and Efficiency Regulations:

Enhanced safety regulations mandate the use of technology to minimize construction hazards, motivating companies to adopt autonomous equipment that improves precision and reduces human error. However, U.S. agencies such as OSHA (Occupational Safety and Health Administration) help push out safety innovations, which revive demand for autonomous machinery. Green construction and sustainability policies urge clean and efficient machinery to be used utilities, which encourage the adoption of automated construction solutions. Programs like India’s Smart Cities Mission and China’s Belt and Road Initiative (BRI) prioritize advanced construction technologies, including autonomous equipment.

Environmental Sustainability Policies:

Policies promoting green construction and sustainability push for the adoption of cleaner and more efficient machinery. However, in the wake of Europe’s Green Deal, where stringent emissions targets and greater energy efficiency are expected in construction, electric or hybrid autonomous equipment are encouraged by the EU.

Technology Advancement Support:

Governments are funding R&D for AI, IoT, and robotics, which directly support the development of autonomous construction equipment. For example, South Korea’s National Strategy for AI and Germany’s Industry 4.0 Initiative both attempt to increase the sector’s automation capabilities in the construction industry.

Labor and Workforce Regulations:

Labor shortages and regulations limiting the use of migrant labour have pushed governments to advocate for autonomous equipment adoption to sustain productivity. Construction automation receives support from respectively Australia and Canada as a solution to labour market challenges.

These policies collectively create a favourable environment for the development and expansion of autonomous construction technologies, facilitating faster adoption and growth in the industry.

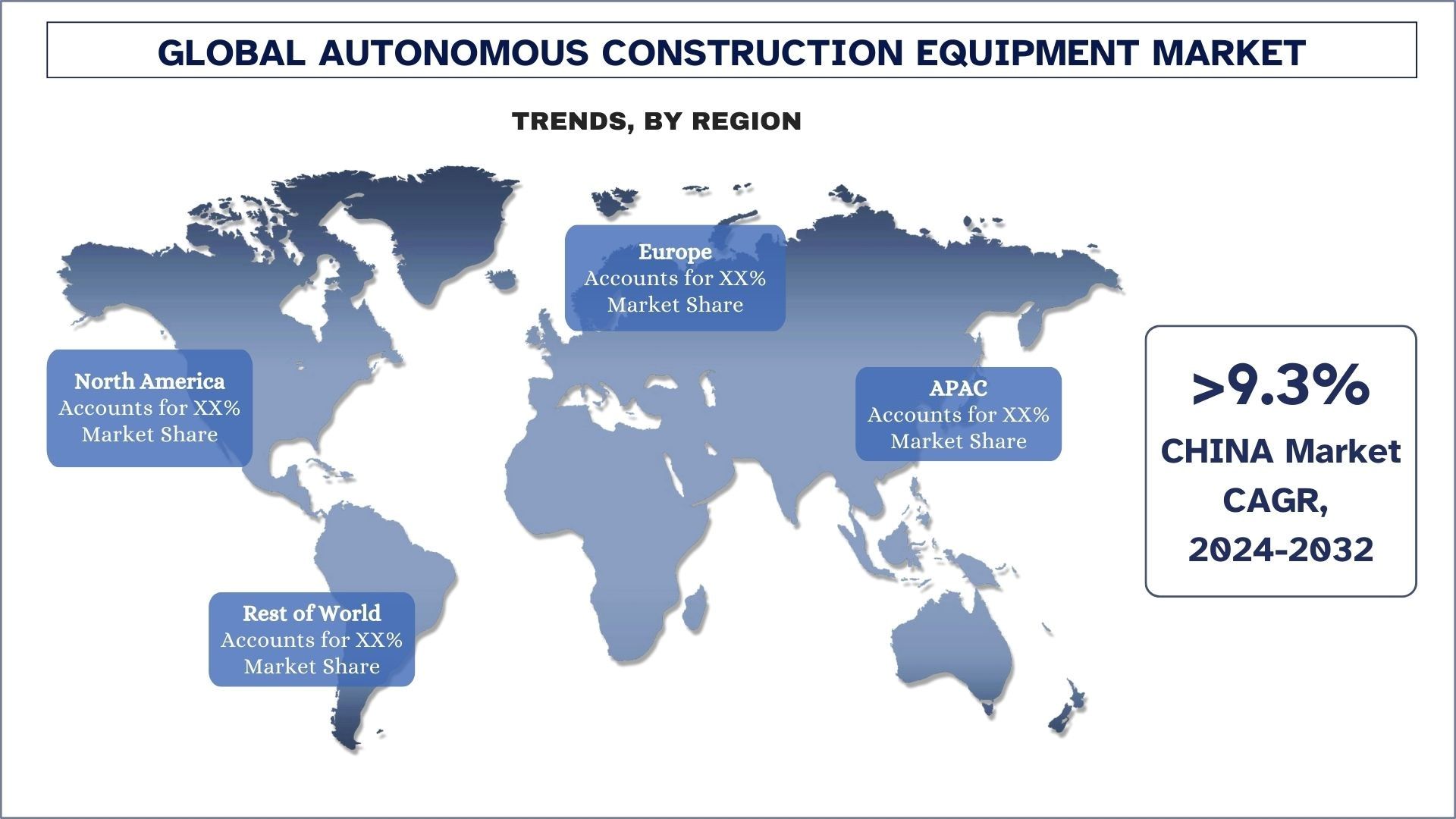

APAC is Expected to Grow with Significant CAGR During Forecast Period

Large-scale infrastructure projects, rapid urbanization, government investments in modern infrastructure, and increasing purchasing power in cities globally, are the key factors fueling the APAC market for Autonomous Construction Equipment. Major countries like China, India, Japan, and South Korea are the major focus of the market in this region. Among its reasons for using automated machinery to improve job site efficiency, safety, and productivity is that demand for such machinery has been driven by the work of countries such as China on its Belt and Road Initiative, India on its Smart Cities Mission, and Japan on its focus on rebuilding urban infrastructure. With a mix of semi-autonomous and fully autonomous equipment necessary to complete these projects in a timeframe, within precision, and relying less on labor, APAC is one of the fastest-growing regions within the market.

The adoption of autonomous construction equipment in the region is further fueled by technological progress in AI, IoT, and robotics, as well as government support for the digitalization and automation of the industry. For instance, China is collaborating with tech companies for AI integration into construction, and Japan’s Robot Revolution Initiative and South Korea’s smart manufacturing push have all contributed to a good backdrop for this market. Other factors that have accelerated the move toward autonomous solutions are rising labor costs and labor shortages in developed countries such as Japan and South Korea. The smart cities and sustainable infrastructure trend are seeing more and more countries in APAC invest and the market is poised for more growth, driven by a demand for both the upgrades in the infrastructure and for the next generation of construction technologies.

Autonomous Construction Equipment Industry Overview

The Autonomous Construction Equipment market is competitive and fragmented, with the presence of several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market are Caterpillar, Bobcat Company, CNH Industrial America LLC, Built Robotics, AB Volvo, Komatsu Ltd., Hitachi Construction Machinery Co. Ltd., Royal Truck & Equipment, Sany Group, and TOPCON CORPORATION.

Autonomous Construction Equipment News

July 2024 - Doosan Bobcat’s board of directors have announced that it plans for Doosan Robotics to complete a merger with Doosan Bobcat. The merger is expected to be initialized by early next year.

Autonomous Construction Equipment Report Coverage

Report Attribute | Details |

Base year | 2023 |

Forecast period | 2024-2032 |

Growth momentum | Accelerate at a CAGR of 7.3% |

Market size 2023 | USD 13,293.4 Million |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | Asia-Pacific is expected to grow at the highest CAGR during the forecasted period |

Key countries covered | U.S., Canada, Germany, Spain, Italy, France, United Kingdom, China, Japan, Australia, and India |

Companies profiled | Caterpillar, Bobcat Company, CNH Industrial America LLC, Built Robotics, AB Volvo, Komatsu Ltd., Hitachi Construction Machinery Co. Ltd., Royal Truck & Equipment, Sany Group, and TOPCON CORPORATION. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Equipment Type; By Application; By Autonomy; By Region/Country |

Reasons to buy this report:

The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

The report presents a quick review of overall industry performance at one glance.

The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional level analysis of the industry.

Customization Options:

The global Autonomous Construction Equipment can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Autonomous Construction Equipment Analysis (2024-2032)

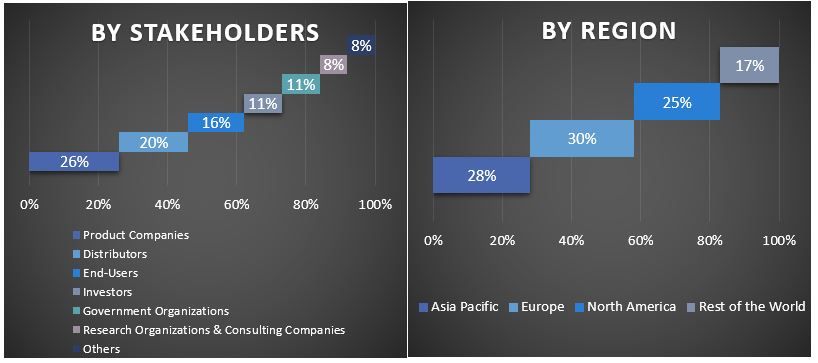

Analyzing the historical market, estimating the current market, and forecasting the future market of global Autonomous Construction Equipment were the three major steps undertaken to create and explore the adoption of Autonomous Construction Equipment in major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, numerous findings and assumptions were taken into consideration to validate these insights. Moreover, exhaustive primary interviews were also conducted with industry experts across the value chain of the global Autonomous Construction Equipment. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the Autonomous Construction Equipment through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of Autonomous Construction Equipment, we conducted a detailed secondary analysis to gather historical market insights and share for different segments and sub-segments for major regions. Major segments are included in the report such as Equipment Type, Application, and Autonomy. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the Autonomous Construction Equipment. Further, we conducted factor analysis using dependent and independent variables such as Equipment Type, Application, and Autonomy of the Autonomous Construction Equipment. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the Autonomous Construction Equipment sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the global Autonomous Construction Equipment, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2032 for different segments and sub-segments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

The industry’s market size, in terms of revenue (USD) and the adoption rate of the Autonomous Construction Equipment across the major markets domestically

All percentage shares, splits, and breakdowns of market segments and sub-segments

Key players in the global Autonomous Construction Equipment in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the global Autonomous Construction Equipment. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of Equipment Type, Application, and Autonomy in the global Autonomous Construction Equipment.

The main objective of the Global Autonomous Construction Equipment Study

The current & future market trends of the global Autonomous Construction Equipment were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

Analyze the current and forecast market size of the Autonomous Construction Equipment in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments

Segments in the study include areas of Equipment Type, Application, and Autonomy

Define and analysis of the regulatory framework for the Autonomous Construction Equipment industry

Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

Analyze the current and forecast market size of the Autonomous Construction Equipment for the major region

Major countries of regions studied in the report include Asia Pacific, Europe, North America, and the Rest of the World

Company profiles of the Autonomous Construction Equipment and the growth strategies adopted by the market players to sustain in the fast-growing market

Deep dive regional level analysis of the industry

Frequently Asked Questions FAQs

Q1: What is the current market size and growth potential of the Autonomous Construction Equipment market?

The Autonomous Construction Equipment market was valued at USD 13,293.4 Million in 2023 and is expected to grow at a CAGR of 7.3% during the forecast period (2024-2032).

Q2: What are the driving factors for the growth of the Autonomous Construction Equipment market?

The primary driver of the Autonomous Construction Equipment market is the growing demand for automation to enhance efficiency, safety, and productivity in large-scale infrastructure projects.

Q3: Which segment has the largest share in the Autonomous Construction Equipment Market by Application?

The Building Construction segment has the largest share of the Autonomous Construction Equipment market by Application.

Q4: What are the emerging technologies and trends in the Autonomous Construction Equipment market?

Emerging technologies and trends in the Autonomous Construction Equipment market include AI integration, IoT connectivity, robotics, electric-powered machinery, and real-time data analytics for enhanced efficiency and sustainability.

Q5: Which region will dominate in the Autonomous Construction Equipment market?

APAC is expected to dominate the market during the forecast period.

Related Reports

Customers who bought this item also bought