- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Blood Culture Tests Market: Current Analysis and Forecast (2021-2027)

Emphasis on Product (Consumables, Instruments, Software & Services); Method (Conventional/Manual, Automated); Technology (Culture-Based, Molecular, Proteomic); Application (Bacteremia, Fungemia, Mycobacterial Detection); End User (Hospital Laboratories, Reference Laboratories, Academic Research Laboratories, Others); Region and Country

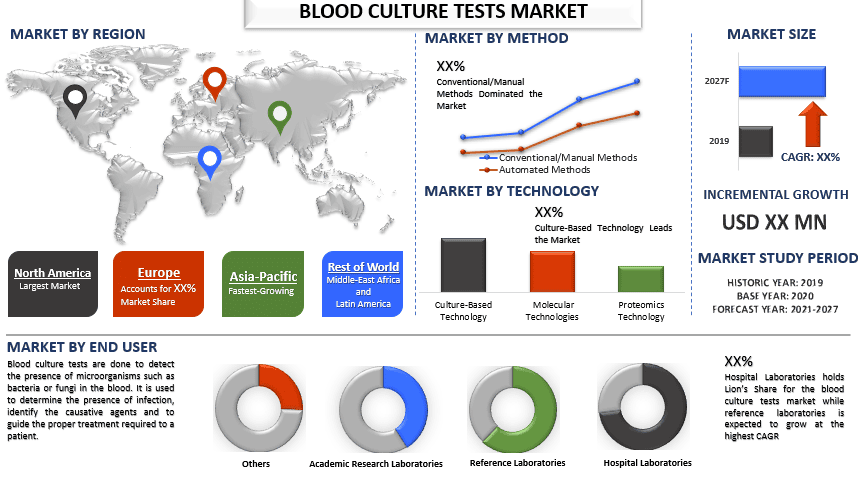

Blood Culture Tests Market was valued at US$ 4 billion in 2020 and is expected to grow at a CAGR of 9% over the forecast period (2021-2027). Blood culture tests are done to detect the presence of microorganisms such as bacteria or fungi in the blood. It is used to determine the presence of infection, identify the causative agents and to guide the proper treatment required to a patient. Blood culture testing is used to identify a blood infection (also called septicemia) which if otherwise left undetected can lead to a serious and fatal condition called sepsis. The symptoms of an initial bacterial infection or bacteremia are moderate or high fever, chills, breathlessness, tachycardia, muscular pain, palpitations, nausea, and headache.

Although blood samples can be used for the detection of virus in the blood, blood culture is generally used to detect bacteria and fungi. Blood culture test is often done in conjunction with other diagnostic tests such as complete blood count (CBC) or other chemical analysis. A variety of technique such as conventional/manual, semi-automated and automated methods can be used to perform blood culture test.

The growth of this market is driven owing to increasing number of sepsis cases, rising geriatric population, high prevalence of infectious diseases, and high incidence of bloodstream infections. For instance, Globally, bloodstream infections affect about 30 million people leading to 6 million deaths, with 3 million newborns and 1.2 million children suffering from sepsis annually. In Eastern African countries, the proportion of patients with bloodstream infections is reported to range from 11% to 28%. In Ghana, bloodstream infection rates are estimated to be in the range of 9.3% to 11.2%. The occurrence of these infections increases the overall duration of hospitalization as well as the cost of treatment.

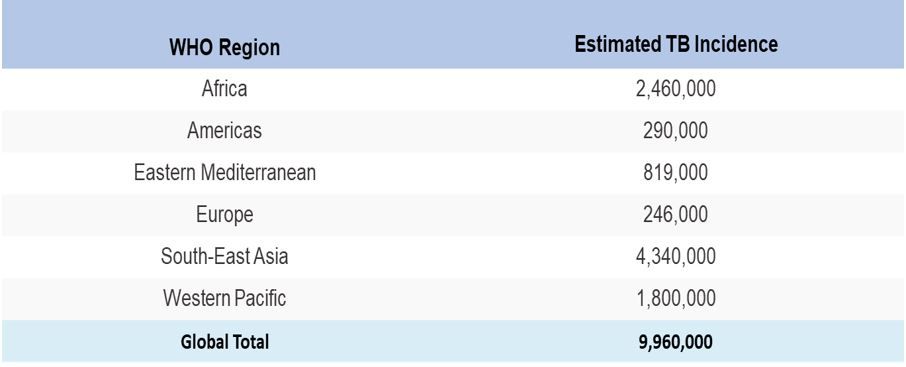

Regional TB statistics, 2019

The global TB statistics are that there were an estimated 10.0 million new cases of TB disease (also known as active TB) in 2019. This is equivalent to 130 cases per 100,000 population. TB affects all countries and age groups. Overall, the best estimates are that in 2019 fifty-six per cent were adult males. Thirty-two per cent were adult women. Twelve per cent were children.

TB is one of the top ten leading causes of death worldwide and the leading cause from a single infectious agent, ranking above HIV/AIDS. In 2019 the TB statistics show that there was a total of 1,418,000 TB related deaths, 1.21 million among HIV negative people and an additional 208,000 among HIV positive people. People who have both TB and HIV when they die, are internationally classified as having died from HIV.

Becton Dickinson and Company, Thermo Fisher Scientific, Inc., bioMérieux SA, Luminex Corporation, Danaher Corporation, Bruker Corporation, IRIDICA, Roche Diagnostics, T2 Biosystems, Inc, Anaerobe Systems, Inc. are some of the prominent players operating in the global blood culture tests market. Several M&A’s along with partnerships have been undertaken by these players to develop new and advanced products.

Insights Presented in the Report

“Amongst product, consumables segment holds the major share”

Based on product, the global blood culture tests market is segmented into consumables, instruments, and software and services. Currently, consumables segment is expected to dominate the market by holding largest market share during the forecast period which cab be ascribed to the recurring requirement of consumables as compared to instruments.

“Amongst method, conventional/manual blood culture segment holds the major share”

In terms of method, the market is categorized into conventional/manual blood culture and automated blood culture methods. In 2020, the conventional/manual blood culture segment held the largest market share in 2020 due to its extensive use in independent clinical laboratories and increase in application of this conventional blood culture method in hospitals & pathology laboratories. However, the automated blood culture methods segment is expected to register the highest CAGR during the forecast period. The quick turnaround time and reduced risk of contamination due to low manual intervention are the key factors contributing to market growth.

“Amongst technology, the culture-based segment holds the major share”

By technology, the global blood culture tests market is segmented into culture-based, molecular, and proteomic. In 2020, culture-based technology segment held the largest market share in terms of revenue. This is due to high usage of this technology by various laboratories such as hospital, reference, pathology, and physician office laboratories.

“Amongst application, the bacteremia segment holds the major share”

In terms of application, the blood culture tests market is segmented into bacteremia, fungemia, and mycobacterial detection. Among them, bacteremia accounted for the largest market share in 2020 and is further projected to maintain its leading position during the forecast period as well. The large share of this segment is primarily attributed to the increasing number of bloodstream infections and the growing number of sepsis cases worldwide.

“Amongst end-user, the hospital laboratories segment holds the major share”

Based on end-user the market is categorized into hospital laboratories, reference laboratories, academic research laboratories, others. Hospital laboratories accounted for the largest market share in terms of revenue. This is owing to the increasing incidence of Hospital-acquired Infections (HAIs). According to the WHO, the rate of ICU-acquired infections, including Urinary Tract Infections (UTIs) and surgical-site wound infections, is around two to three times higher in developing countries as compared to developed countries. In Canada, about 8,000 patients die annually because of hospital-acquired infections.

“North America signifies one of the largest markets of blood culture tests market”

For a better understanding of the market dynamics of the Blood Culture Tests market, a detailed analysis was conducted for different regions across the globe including North America (United States, Canada, and the Rest of North America), Europe (Germany, France, Italy, Spain, United Kingdom and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of APAC), Rest of World has been conducted. North America has dominated the Blood Culture Tests Market which is attributable to rise in prevalence of bloodstream infection and presence of advanced healthcare infrastructure. Furthermore, rise in awareness & acceptance of novel diagnostic method, strong economic growth, and increase in demand for advanced healthcare facilities are contributing toward growth of the market.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts

- The report presents a quick review of overall industry performance at one glance

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry

- The study comprehensively covers the market across different segments

- Deep dive regional level analysis of the industry

Customization Options:

The Blood Culture Tests market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

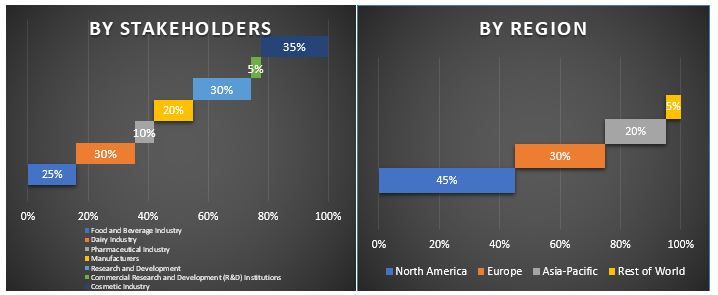

Analyzing the historical market, estimation of the current market, and forecasting the future market of the Global Protein Ingredients market were the three major steps undertaken to create and analyze the adoption of Protein Ingredients for the different applications such as Food & beverages, Feed, Cosmetic & personal care products, and Pharmaceuticals. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the Protein Ingredients sector. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecast the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments the industry pertains to.

Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detailed secondary study was conducted to obtain the historical market size of the Protein Ingredients through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Protein Ingredients market, we conducted a detailed secondary analysis to gather historical market insights and share for different segments for major regions. Major segments included in the report are Source, Form, Application, and Region. Further country-level analyses were conducted to evaluate the overall adoption of Protein Ingredients in every region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of Protein Ingredients. Further, we conducted factor analysis using dependent and independent variables such as the rising demand for protein functionalities, awareness regarding healthy diets, and new technological development in the protein ingredients industry

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the Protein Ingredients Market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach was applied to arrive at the market forecast about 2027 for different segments and subsegments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (USD) and the adoption rate of Protein Ingredients across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the Protein Ingredients market in terms of services offered. Also, the growth strategies adopted by these players to compete in the fast-growing market.

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment of the Protein Ingredients market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of Source, Form, Application, and Region of the Protein Ingredients market.

Main Objective of the Protein Ingredients market Study

The current & future market trends of Protein Ingredients were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends were determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of Protein Ingredients in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of Source, Form, Application, and Region

- Define and analysis of the regulatory framework for the Protein Ingredients industry

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

- Analyze the current and forecast market size of the Protein Ingredients market for the major region

- Major regions studied in the report include North America (the United States, Canada, and Rest of North America), Europe (Germany, France, Italy, Spain, United Kingdom and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of APAC), and Rest of the World

- Company profiles of the Protein Ingredients market and the growth strategies adopted by the market players to sustain in the fast-growing market

- Deep dive regional level analysis of the industry

Related Reports

Customers who bought this item also bought