- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

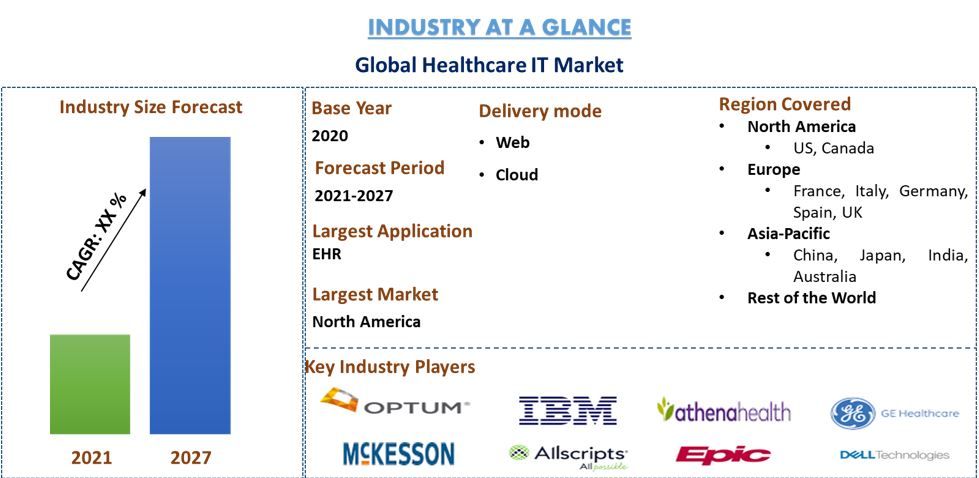

Healthcare IT Market: Current Analysis and Forecast (2021-2027)

Emphasis on Product Type (EHR, mHealth, PHM, RIS, PACS, RCM, Healthcare Analytics, Telehealth, SCM); Delivery Mode (Web, Cloud); End-User [Healthcare Providers (Hospitals, Pharmacies, Diagnostic & Imaging Centers, Ambulatory Care Centers, Others); Healthcare Payers (Private Payer, Public Payer)]; Region and Country

Healthcare IT Market was valued at US$ 230 billion in 2020 and is expected to grow at a CAGR of 18% over the forecast period (2021-2027). The market is primarily driven by shift from volume-based to value-based care, growing volume of patient data, technological advancements, government mandates and financial incentives for adoption of HCIT solutions, increasing awareness of the value of digital health, and high return on IT investment in the healthcare industry. In addition, increasing incidence & prevalence of chronic diseases associated with aging population, growing concern to curtail healthcare cost, and rising use of big data further supports the growth of this market. However, high installation and maintenance cost hinders the growth of the overall healthcare IT market to some extent.

In March 2020, Siemens Healthineers announced launch of teamplay digital health platform. The platform facilitates easy access to solutions for clinical and operational support. The platform comprises more than 5,000 institutes and 23,000 connected systems in over 60 countries. This helped the company to expand its business to untapped economies as well as customer base.

Expanding usage of AI technologies in surgical systems is owing to its advantages that range from the consolidation of databases to intraoperative video analysis this, in turn, is supporting the adoption of Healthcare IT. An article published in Annals of Surgery in 2018 stated that AI has proved to be beneficial in assisting radiologists and surgeons in reducing the lumpectomy rate by around 30% among patients having breast needle biopsies. These biopsies considered being high-risk lesions, but after the surgical excision, it has found to be benign. Hence, such instances signify the advantageous nature of artificial intelligence and allied technologies in surgical procedures.

Because of the progress and improvement in internet sourced technology, increasing occurrences of chronic sicknesses, and rising acceptance as well as encouraging consumer actions regarding the latest technology in healthcare, the Covid-19 pandemic has globally increased the demand as well as acceptance of virtual otherwise online medical consultancy. The pandemic boosted the acceptance of virtual health. Such as, the proportion of the customers or respondents, making use of virtual visits, improved as of 15.0% in 2019 toward 19.0% in the early months of 2020. An unexpected spike of about 28.0% was observed in April 2020. As a result, such occasions are expected to maintain the expansion of the market, in the near future. In February 2019, Oracle announced availability of its data center in UAE and Middle East. This data center offered cloud applications services to its customers across the region, thereby strengthening its market position in the Middle East. These strategic initiatives by key participants are anticipated to drive the market for Healthcare IT in the coming years.

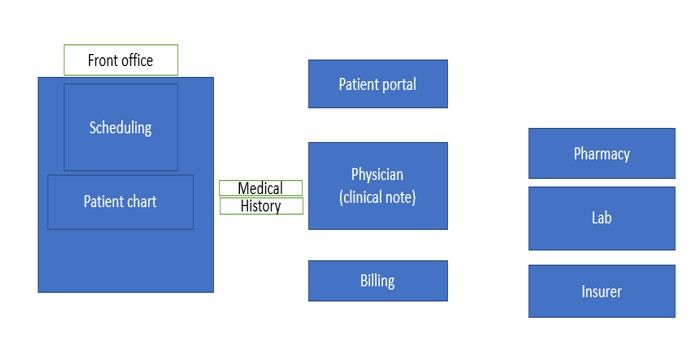

Value chain analysis of Healthcare IT

Some of the operating in the market include McKesson Corporation, Optum Health, International Business Machine Corporation (IBM), Allscripts Healthcare Solutions, Inc., Athenahealth, Inc., Epic Systems Corporation, Dell Technologies Inc., GE Healthcare, Cerner Corporation, Oracle Corporation, Cognizant Technology Solutions Corporation, Nuance Communications, Inc.

Insights Presented in the Report

“Amongst Product Type, HER segment holds the major share.”

Based on product type, healthcare IT are segmented into EHR, mHealth, PHM, RIS, PACS, RCM, Healthcare Analytics, Telehealth, SCM. The electronic health record segment accounted for market share of XX % in 2019 due to initiation of several favorable policies and programs by the government to integrate EHR systems. For instance, The New Health Information System (NSIS) implemented in Italy, aimed at establishing EHR system across the country to connect each level of care. Owing to the tactical plans by diverse companies in the market, rising alertness plus the acceptance of EHR in healthcare amenities, along with an escalating figure of plans sustaining its implementation, the section is expected to develop by a stable CAGR, during forecast period.

“Amongst Delivery mode, Web segment dominated the market during the forecast period.”

Based on Delivery mode, the healthcare IT market is segmented into web and cloud. Web & cloud-based solutions accounted for the largest share of the overall healthcare IT market in 2019 and is expected to grow at the double digit CAGR during the forecast period owing to its benefits such as on lower upfront cost, no maintenance cost, excessive storage flexibility, and greater security in private clouds.

“Amongst End-User, Healthcare providers segment dominated the market during the forecast period.”

Based on End-user, the Healthcare IT market is segmented into Healthcare Providers (Hospitals, Pharmacies, Diagnostic & Imaging Centers, Ambulatory Care Centers, Others); Healthcare Payers (Private Payer, Public Payer). The Healthcare Providers segment held the largest share in the Healthcare Information Technology Market in 2019 owing to the increasing chronic disease and increasing healthcare infrastructure. Healthcare providers is set to be the fastest growing segment and is poised to register a highest CAGR during the forecast period 2020-2025.

“North America represents one of the largest markets of Healthcare IT market.”

For a better understanding of the market dynamics of the Healthcare IT market, a detailed analysis was conducted for different regions across the globe including North America (the U.S, Canada, and the Rest of North America), Europe (Germany, France, Spain, United Kingdom, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, and Rest of APAC), Rest of World has been conducted. North America dominated the market and generated revenue of US$ XX million in 2020 owing to the rising per capita income.

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts

- The report presents a quick review of overall industry performance at one glance

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolio, expansion strategies, and recent developments

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry

- The study comprehensively covers the market across different segments

- Deep dive regional level analysis of the industry

Customization Options:

The Healthcare IT Market can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs, hence feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Analyzing the historical market, estimation of the current market, and forecasting the future market of the Global Healthcare IT Market were the three major steps undertaken to create and analyze the adoption of Healthcare IT across major regions globally. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the Healthcare IT sector. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecast the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments the industry pertains to. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detailed secondary study was conducted to obtain the historical market size of the Healthcare IT through company internal sources such as annual report & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of the Healthcare IT market, we conducted a detailed secondary analysis to gather historical market insights and share for different technologies & Equipment types for major regions. Major segments included in the report are Product type, Delivery mode, End-User and regions. Further country-level analyses were conducted to evaluate the overall adoption of Healthcare IT in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of Healthcare IT. Further, we conducted factor analysis using dependent and independent variables such as the surging demand for Digital health. A thorough analysis was conducted for demand and supply-side scenarios considering top partnerships, merger and acquisition, business expansion, and product launches in the Healthcare IT industry across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at the current market size, key players in the Healthcare IT market, and market shares of the segments. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weightage was assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., top-down/bottom-up approach was applied to arrive at the market forecast about 2027 for different segments and subsegments across the major markets globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (US$) and the adoption rate of Healthcare IT across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the Healthcare IT market in terms of services offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

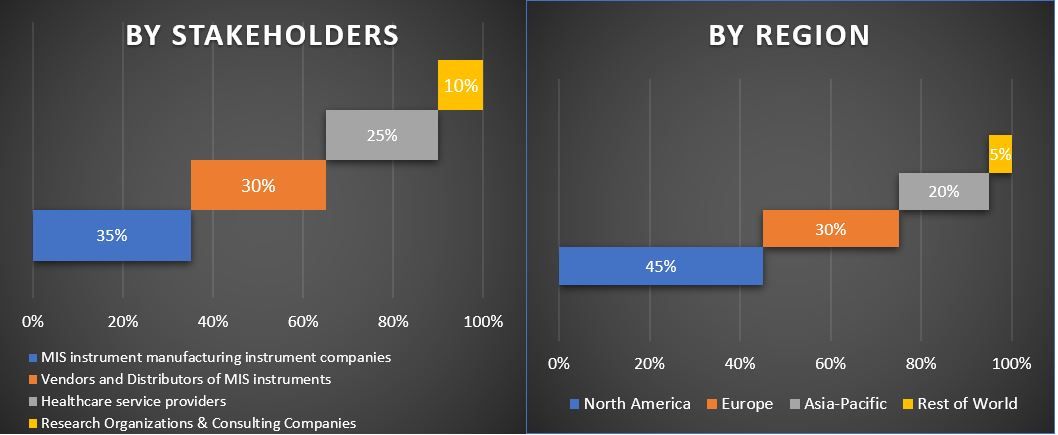

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment of the Healthcare IT market. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of type and product type of the Healthcare IT market.

Main Objective of the Healthcare IT Market Study

The current & future market trends of Healthcare IT were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends were determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of Healthcare IT in terms of value (US$). Also, analyze the current and forecast market size of different segments and sub-segments

- Segments in the study include areas of application, product type and end-user sector.

- Define and analysis of the regulatory framework for the Healthcare IT industry

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry

- Analyze the current and forecast market size of the Healthcare IT market for the major region.

- Major regions studied in the report include North America (the U.S and Canada), Europe (Germany, France, U.K Spain, and Italy), Asia-Pacific (China, Japan, Australia, and India), Rest of the World

- Company profiles of the Healthcare IT market and the growth strategies adopted by the market players to sustain in the fast-growing market.

- Deep dive regional level analysis of the industry

Related Reports

Customers who bought this item also bought