- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

North America Market Insights on Automotive Head-up Display: Current Analysis and Forecast (2019-2025)

Emphasis on Product Windshield HUD Combiner HUD Technology Conventional HUD Augmented Reality HUD Vehicle Type Luxury Cars Passenger Cars Commercial Vehicles

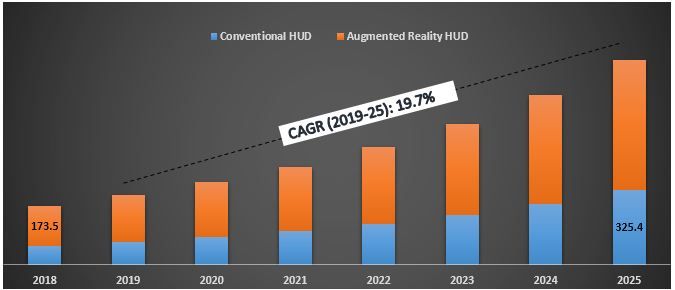

North America Automotive Head-Up Display was valued at US$ 253.04 Million in 2018 and is anticipated to reach US$ 892.20 Million by 2025 displaying reasonable CAGR of 19.7% over the forecast period (2019-2025). Rapid advancements in vehicle technology and increasing demands of high-end luxury and mid-sized vehicles are the key growth drivers for North America automotive head up display market. The use of display in automobiles is regarded as a luxury spec which is specifically reserved for high end vehicles. Moreover, the surging adoption of advance driver assistance system (ADAS) technology due to rising consumer interest and stringent government regulations is also stimulating the market growth in North America. However, the excessive cost of the system, emergence of alternate options and growing concern over distracted driving are the major restraining factors for the market growth.

In recent years, there have been a rapid advancement in vehicle technology wherein several innovative technologies have been introduced, including cellular connectivity, tracking technology, autonomous vehicles, infotainment, advanced telematics for safety and better driving experience. Automotive manufacturing is growing at a rapid pace due to rising disposable income & changing lifestyle of people in developed as well as in developing economies.

“Windshield HUD expected to dominate during the analyzed period.”

Based on product, the North America Automotive Head-Up Display market is bifurcated into Windshield HUD and Combiners HUD. Windshield HUD dominated the market in 2018, with the maximum share in terms of revenue and is expected to maintain its dominance throughout the forecast period, owing to its increased application in high-end vehicles. Combiner HUD on the other hand is expected to register the fastest growth during the forecast period.

“Augmented Reality HUD held the largest market share in 2018 and are expected to dominate the market in 2025.”

The study further bifurcates the Automotive Head-Up display market into different technology including, Conventional HUD and Augmented Reality HUD wherein Augmented Reality HUD held the largest market share in 2018 and is expected to dominate the market by 2025, owing to its increased application in high-end vehicles

North America Automotive Head-Up Display Market Size by Technology, 2018-25 (US$ Mn)

“Amongst Sales Channel, Aftersales channel is projected to hold the largest market share and will dominate the Automotive Head-Up Display market by 2025.”

The market based on sales channel is bifurcated into OEMs and Aftersales market. Market of OEMs is expected to grow tremendously, due to the surging demand over the years and is projected to dominate the market in 2025.

“Amongst vehicle types, premium car segment is anticipated to dominate Automotive Head-Up display market by 2025.”

Luxury car, premium car and SUVs are the major vehicle types being considered in Automotive Head-Up display market. In 2018, premium car segment dominated the North America Automotive Head-Up Display vehicle type market. Luxury segment on the other hand is expected to register the fastest growth during the forecast period.

“United States represents as one of the largest markets of North America Automotive Head-Up display.”

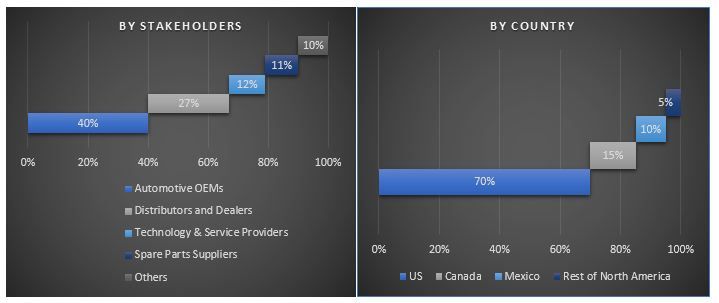

For a deep dive analysis of the industry, the market is analysed in different countries including the United States, Canada, Mexico and the rest of North America. The United States is considered as the largest market in the region. The growth in the market is mainly attributed to the increasing stringent regulations on driver alertness, presence of several Tier 1 and OEMs and rise in focus towards ADAS and autonomous vehicles.

Competitive Landscape-Top 10 Market Players

Aptiv Plc, AUDI AG, Continental AG, Daimler AG, Denso Corporation, Harman International Industries, Inc., Robert Bosch GmbH, TomTom NV, Visteon Corporation, and Yazaki Corporation are some of the prominent players operating in the Automotive Head-Up Display industry. The United States has captured the major share in Automotive Head-Up Display market. Several M&A’s along with partnerships have been undertaken by these players to facilitate costumers with hi-tech and innovative products.

Reasons to buy:

- Current and future market size from 2018 to 2025 in terms of value (US$)

- Combined analysis of deep dive secondary research and input from primary research through Key Opinion Leaders of the industry

- Country level details of the overall market of Automotive Head-Up Display

- A quick review of overall industry performance at a glance

- An In-depth analysis of key industry players

- A detailed analysis of regulatory framework, drivers, restraints, key trends and opportunities prevailing in the industry

- Examination of industry attractiveness with the help of Porter’s Five Forces analysis

- The study comprehensively covers the market across different segments and sub-segments of the technology

- Countries Covered: The United States, Canada, Mexico and the rest of North America

Customization Options:

UMI understands that you may have your own business need, hence we also provide fully customized solutions to clients. The Automotive Head-Up Display Market can be customized to country level or any other market segment.

Table of Content

Analyzing historical market, estimation of the current market and forecasting the future market of the North America Automotive Head-up Display market were the three major steps undertaken to create and analyze the overall adoption of Automotive Head-up Display in the North American automotive sector. Exhaustive secondary research was conducted to collect the historical market of the product/technology and overall estimation of the current market. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were conducted with industry experts across value chain of the head-up display market. After all the assumption, market engineering and validation of market numbers through primary interviews, top-down approach was employed to forecast the complete market size of the North American automotive head-up display market. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the market. Detailed research methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of the North American Automotive Head-up Display technology through company internal sources such as annual report & financial statements, performance presentations, press releases, inventory records, sales figures etc. and external sources including trade journals, news & articles, government publications, International Organization of Motor Vehicle Manufacturers, competitor publications, sector reports, regulatory bodies publications, safety standard organizations, third-party database and other creditable publications.

Step 2: Market Segmentation:

After obtaining historical market size of the overall market, detailed secondary analysis was conducted to gather historical market insights and share for different segments & sub-segments of the North American Automotive Head-up Display market. Major segments included in the report are product type, technology type and vehicle type.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, detailed factor analysis was conducted to estimate the current market size of the North American Automotive Head-up Display technology. Factor analysis was conducted using dependent and independent variable such as purchasing power, government initiatives, penetration of head-up display, government regulations in different country in the North America region. Historical trends of the North American Automotive Head-up Display market and their year-on-year impact on the market size and share in the recent past were analyzed. Demand and supply side scenario was also thoroughly studied.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrived at current market size, key players in market, market share of these players, industry’s supply chain, and value chain of the industry. All the required percentage shares, splits, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weightage was assigned to different factors including drivers & trends, restraints, and opportunities available in the market. After analyzing these factors, relevant forecasting techniques i.e. Bottom-up/Top-down was applied to arrive at the market forecast pertaining to 2025 for different segment and sub-segments in major country in the North American region. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size and rate of adoption of Automotive Head-up Display in major countries in the North American region in value terms (US$)

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players across different technologies and markets as well as market share of each player. Also, the growth strategies adopted by these players to compete in the rapidly growing North American automotive head-up display market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head etc.). Primary research findings were summarized, and statistical analysis was performed to prove the stated hypothesis. Input from primary research were consolidated with secondary findings, hence turning information into actionable insights.

Split of Primary Participants

Market Engineering

Data triangulation technique was employed to complete the overall market engineering process and to arrive at precise statistical numbers of each segment and sub-segment pertaining to the North American automotive head-up display market. Data was split into several segments & sub-segments post studying several parameters and trends in the areas of Windshield HUD and Combiner HUD. Further, based on the technology type, Conventional HUD and Augmented Reality HUD were also taken into consideration in the evaluation of North American Automotive Head-up Display market and by vehicle type; the market is segmented into Luxury Cars, Passenger Cars and Commercial Vehicles.

Main objective of the North American Automotive Head-up Display Market Study

The current & future market trends of the North American Automotive Head-up Display are pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends would determine the overall attractiveness of the market, providing a platform for the industrial participant to exploit the untapped market to benefit as first mover advantage. Other quantitative goal of the studies includes:

- Analyse the current and forecast market size of the North American Automotive Head-up Display in terms of value (US$)

- Analyse the current and forecast market size of different segments and sub-segments of the North American Automotive Head-up Display. Segments in the study include technology type, product type and vehicle type

- Define and describe the technologies and protocols used in the Automotive Head-up Display

- Anticipate potential risk present within the industry along with customer and competitor analysis

- Define and analysis of the government regulations for the Automotive Head-up Display in different countries in the North American region

- Analyse the current and forecast market size of the North American Automotive Head-up Display, for countries including US, Canada, Mexico and Rest of North America

- Define and analyse the competitive landscape for the North American Automotive Head-up Display Market and the growth strategies adopted by the market players to sustain in the rapidly growing market

Related Reports

Customers who bought this item also bought