- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Southeast Asia Used Cars Market: Current Analysis and Forecast (2025-2033)

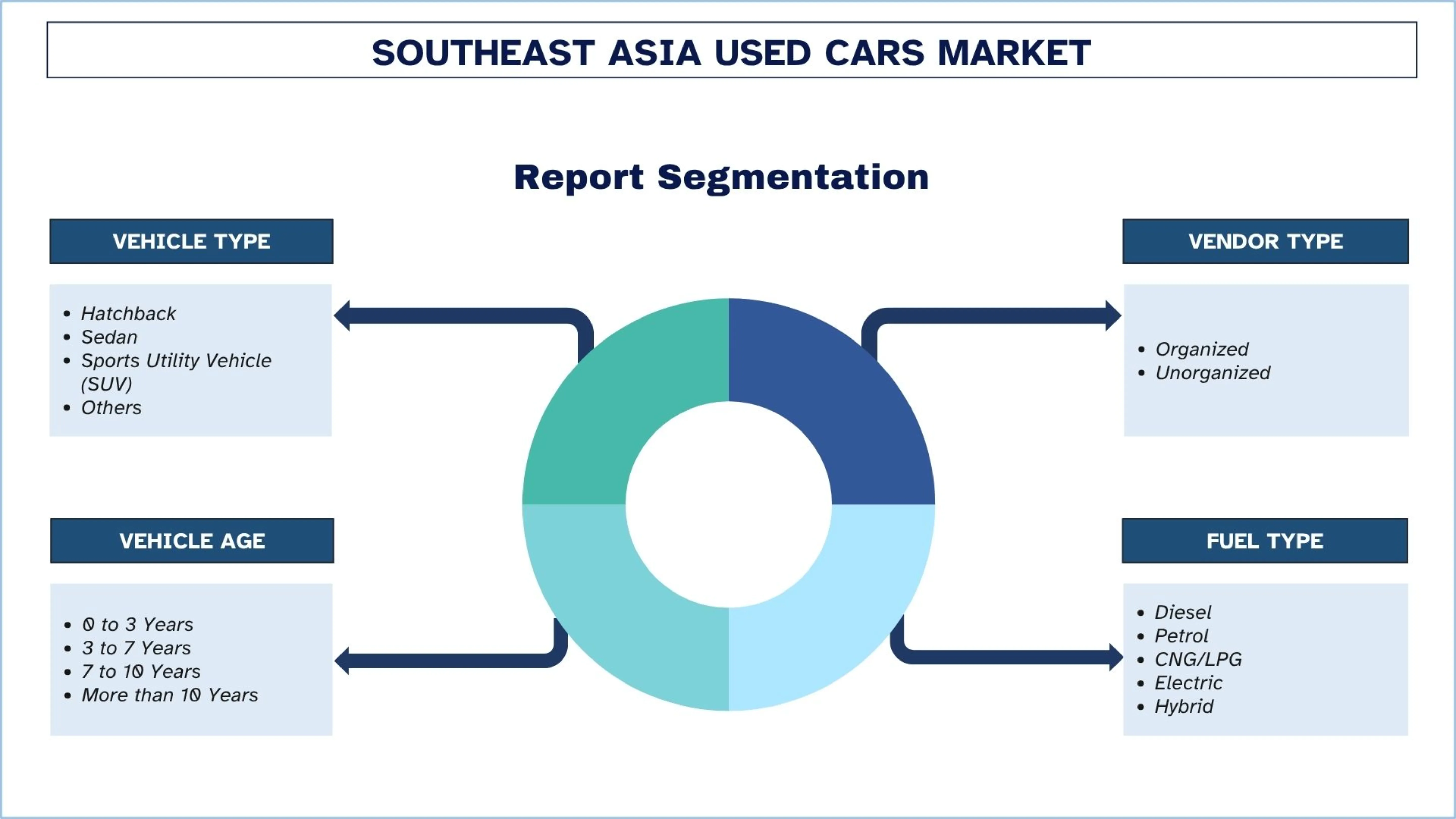

Emphasis on Vehicle Type (Hatchback, Sedan, Sports Utility Vehicle (SUV), Others); Vendor Type (Organized, Unorganized); Vehicle Age (0 to 3 Years, 3 to 7 Years, 7 to 10 Years, More than 10 Years); Fuel Type (Diesel, Petrol, CNG/LPG, Electric, Hybrid); Sales Channel (Online, Offline); and Country.

Southeast Asia Used Cars Market Size & Forecast

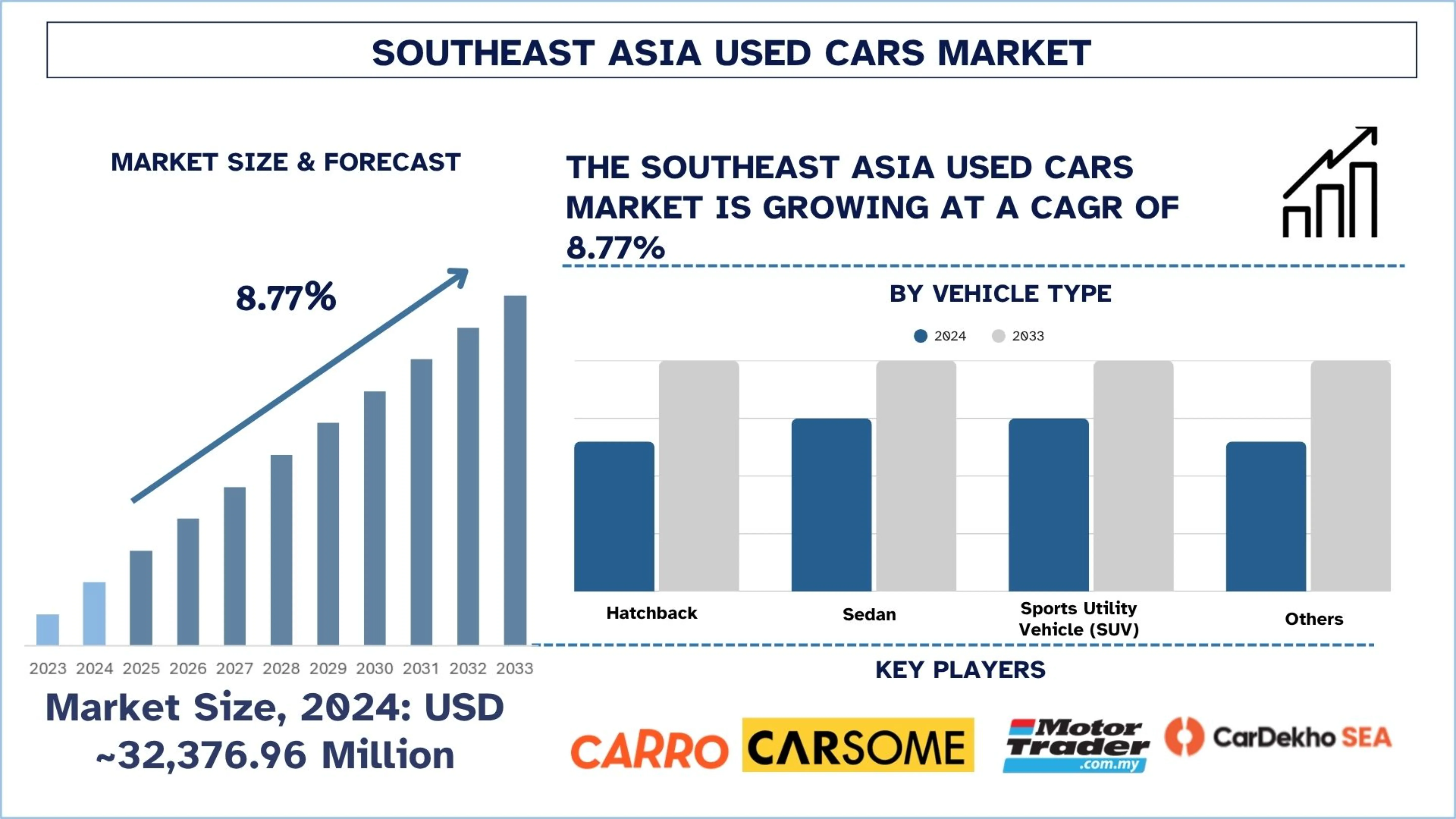

The Southeast Asia Used Cars Market was valued at ~USD 32,376.96 million in 2024 and is expected to grow at a strong CAGR of approximately 8.77% during the forecast period (2025-2033F), driven by a rising middle-income population expanding demand for affordable mobility.

Southeast Asia Used Cars Market Analysis

Used cars are vehicles that are owned by one or more previous owners and are resold by dealers, marketplaces, or individuals. It consists of a significant portion of the automobile market, offers more competitive prices, and provides more flexible financing and greater availability to consumers.

The used-car ecosystem in Southeast Asia is shifting towards structured, digital-first business models, where platforms combine reliability centers, refurbishment centers, financing offerings, and confirmed listings to enhance transparency. Adding to this, major players in the market are investing in AI-based pricing engines, diagnostic tools, and real-time valuation systems to standardize resale values. Additionally, increasing expansion of omni-store retail models through online booking, test drives at home, doorstep delivery, and extended service warranties. Moreover, increasing collaboration with banks, NBFCs, insurance companies, and roadside assistance networks is enhancing the reliability of end-to-end services. Certified pre-owned platforms are also scaled, offering buyback programs, subscription plans, and trade-in programs to expedite customer acquisition and resale.

On November 11, 2025, OneLot, the Philippines’ leading financing platform for used car dealers, raised USD3.3 million in seed funding, the country’s largest round of funding in 2025, to expand affordable financing and digital tools for independent dealerships. The round was co-led by Accion Ventures and 468 Capital, with new participation from Everywhere Ventures and Seedstars, and continued backing from Crestone Venture Capital, Kaya Founders, and notable angels, including Georg Steiger (BillEase) and Jojo Malolos (Paymongo). The fresh capital will accelerate OneLot’s mission to empower used car entrepreneurs with faster access to credit, AI-driven underwriting, and technology solutions that help them grow their businesses.

Southeast Asia Used Cars Market Trends

This section discusses the key market trends that are influencing the various segments of the Southeast Asia Used Cars market, as found by our team of research experts.

AI-Powered Pricing, Inspection, and Demand Forecasting

The use of AI in pricing, inspection, and demand forecasting is emerging as a trend in the used-car market in Southeast Asia, as platforms are turning to machine learning to provide more precise valuations and reduce pricing conflicts. The use of image-based inspection tools helps reveal hidden damage, enabling companies to standardize quality checks across extensive inventories. Predictive analytics is enhancing stock planning by determining which stock models will sell the quickest in each city. This automation transformation is saving time during operations, minimizing fraud, and improving trust among buyers. The more it is adopted, the more AI becomes a central capability, making the company more competitive and improving the customer experience across the ecosystem.

Southeast Asia Used Cars Industry Segmentation

This section provides an analysis of the key trends in each segment of the Southeast Asia Used Cars market, along with forecasts at the country level for 2025-2033.

The hatchback used cars market held the dominant share of the Used Cars market in 2024.

Based on vehicle type, the market is segmented into hatchback, sedan, sports utility vehicle (SUV), and others. Among these, the hatchback used cars market held the largest share in 2024. This is mainly due to the region's price-sensitive urban commuters, which makes it the simplest point of entry for first-time buyers. Additionally, reduced maintenance expenses and a good resale value enhance platform and dealer turnover. Moreover, a surge in high-volume, sustained demand helps companies scale inventory cycles and improve market penetration.

The electric segment is expected to grow at a significant CAGR during the forecast period (2025-2033).

Based on fuel type, the market is segmented into diesel, petrol, CNG/LPG, electric, and hybrid. Among these, the electric segment is expected to grow at a significant CAGR during the forecast period (2025-2033). The growing provision of used EVs serves as a long-term growth lever because consumers value cheaper running and cleaner mobility. Those companies that shift to EV-oriented inspection, battery health diagnostics, and warranty schemes have a competitive advantage from the outset. The increasing incentives from the government to use EVs also help drive buyer adoption quickly and increase the scale of the used-EV market. On September 17, 2025, Carro, Southeast Asia’s leading online car marketplace, raised USD 60 million in a round led by Cool Japan Fund (Japan’s sovereign wealth fund), with participation from several new investors. This investment will go towards bolstering the demand for Japanese cars across the Asia Pacific, where Carro has a presence. To increase the market share of Japanese Plug-in Hybrid Electric Vehicles (PHEV) in the time to come.

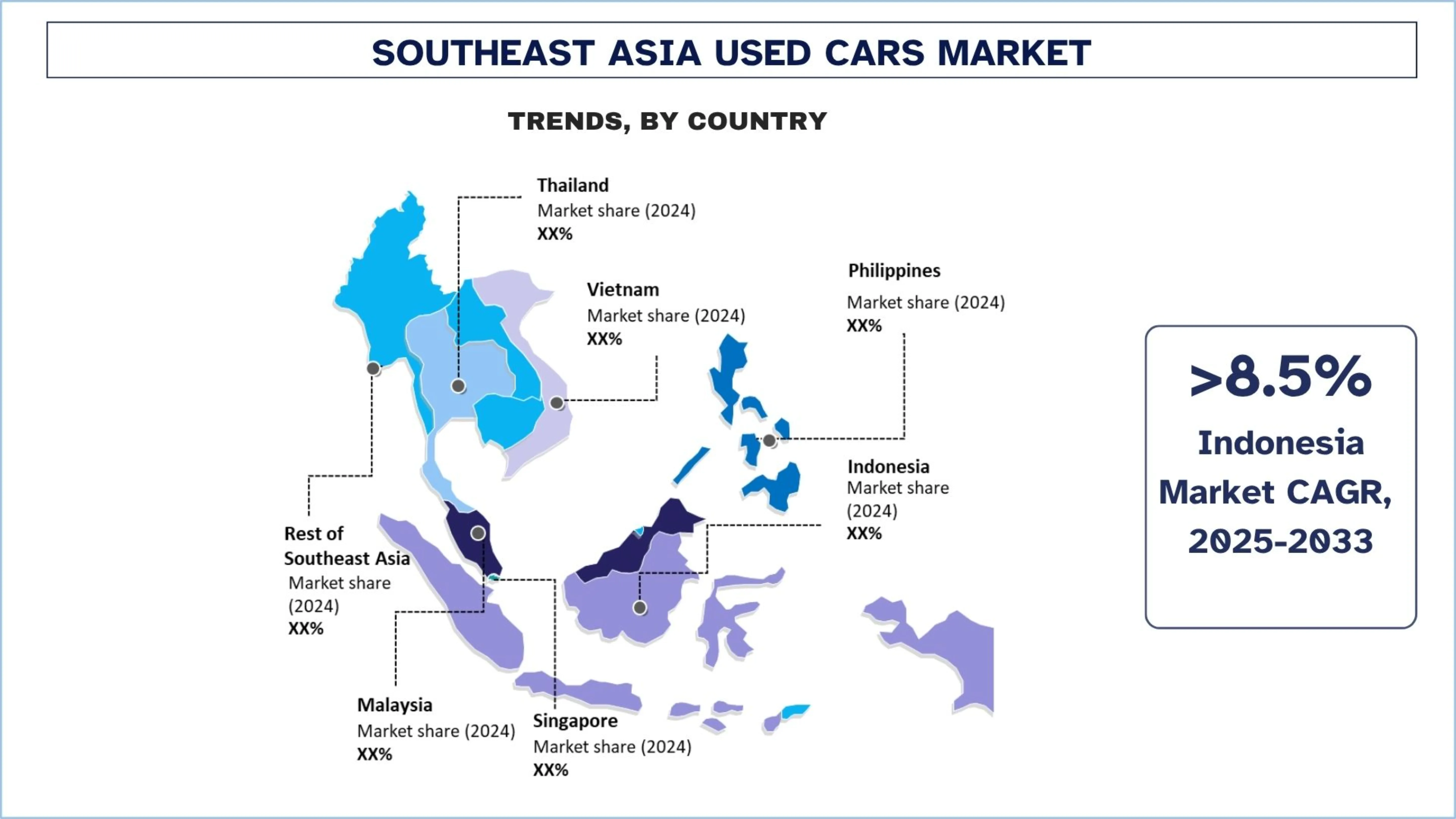

Indonesia held a dominant share of the Southeast Asian Used Cars market in 2024

The used-car market in Southeast Asia is dominated by Indonesia, driven by the region's highest vehicle count and high demand from an expanding middle-income group, which ensures a steady flow of transactions. The companies are increasingly expanding inspection centers, refurbishment hubs, and retail display rooms in upcoming Tier-2 cities to accommodate this scale. Moreover, the partnership with banks, fintech lenders, insurance companies, and fleet operators is enhancing end-to-end service and maintaining a constant stream of quality inventory. In addition, digital penetration is increasing rapidly, and platforms that combine online discovery with offline touch are driving rapid user adoption. The regulatory pressure for safer, more transparent transactions in Indonesia is accelerating the transition to organized players. Thus, Indonesia is the locus of used-car growth in Southeast Asia, driven by the explosion in adoption and partnerships.

On May 6, 2025, Astra and Toyota strengthened their strategic partnership and expanded collaboration in the used car business in Indonesia through a partnership in PT Astra Digital Mobil (ADMO). Toyota Motor Asia (Singapore) Pte. Ltd. (TMA) acquired 40% of ADMO. TMA’s acquisition was through a subscription of new shares and acquisition of existing shares, with a total value of USD 120 million, or approximately Rp 2.0 trillion. After this transaction, Astra, through PT Astra Digital Internasional (ADI), retained control over ADMO with a 60% share ownership.

Southeast Asia Used Cars Industry Competitive Landscape

The Southeast Asia Used Cars market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Southeast Asia Used Cars Companies

Some of the major players in the market are Carro, CARSOME Sdn Bhd, Motor Trader (MT Digital Sdn Bhd), Cardekho SEA (Cardekho Group), Mudah.my Sdn Bhd, OLX (Astra), AutoDeal (Sirqo Group Inc.), Sgcarmart, SBT CO., LTD., CHOBROD CO., LTD.

Recent Developments in the Southeast Asia Used Cars Market

On August 21, 2025, Carro, Asia Pacific's largest and fastest-growing online used car platform, signed a Memorandum of Understanding with fintech platform SY Holdings, entering a strategic partnership that will support Carro's expansion plans through tech-enabled financing solutions. This strategic partnership will leverage artificial intelligence, predictive analytics, and API-based integrations to optimise efficiency, accelerate funding cycles, and enhance scalability while maintaining governance and compliance.

On September 22, 2024, Schaeffler Manufacturing (Thailand) Co., Ltd., in collaboration with iCar Asia (Thailand) Co., Ltd., launched the ONE2CAR x REPXPERT Collaboration project. This initiative aims to enhance the skills of professional automotive mechanics by setting standards and improving repair and maintenance skills for used car service centers through the REPXPERT mobile training center. The goal is to elevate service quality and build consumer confidence in purchasing used cars from dealers. The first phase targets 80 professional automotive mechanics.

Southeast Asia Used Cars Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 8.77% |

Market size 2024 | ~USD 32,376.96 million |

Country analysis | Indonesia, Thailand, Philippines, Vietnam, Malaysia, Singapore, Rest of Southeast Asia |

Major contributing Country | Vietnam is expected to grow at the highest CAGR during the forecasted period. |

Companies profiled | Carro, CARSOME Sdn Bhd, Motor Trader (MT Digital Sdn Bhd), Cardekho SEA (Cardekho Group), Mudah.my Sdn Bhd, OLX (Astra), AutoDeal (Sirqo Group Inc.), Sgcarmart, SBT CO., LTD., CHOBROD CO., LTD. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Vehicle Type, By Vendor Type, By Vehicle Age, By Fuel Type, By Sales Channel, By Country |

Reasons to Buy the Southeast Asia Used Cars Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, product portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Customization Options:

The Southeast Asia Used Cars market can further be customized as per requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Southeast Asia Used Cars Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the Southeast Asian Used Cars market to assess its application in major countries. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Southeast Asian Used Cars value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the Southeast Asia Used Cars market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including vehicle type, vendor type, vehicle age, fuel type, sales channel, and country within the Southeast Asian Used Cars market.

The Main Objective of the Southeast Asia Used Cars Market Study

The study identifies current and future trends in the Southeast Asia Used Cars market, providing strategic insights for investors. It highlights market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current and forecast market size of the Southeast Asia Used Cars market and its segments in terms of value (USD).

Southeast Asia Used Cars Market Segmentation: Segments in the study include areas of vehicle type, vendor type, vehicle age, fuel type, sales channel, and country.

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Southeast Asia Used Cars industry.

Country Analysis: Conduct a detailed country analysis for key areas such as Indonesia, Thailand, the Philippines, Vietnam, Malaysia, Singapore, and the Rest of Southeast Asia.

Company Profiles & Growth Strategies: Company profiles of the Southeast Asia Used Cars market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Southeast Asia Used Cars market’s current market size and growth potential?

The Southeast Asia Used Cars market was valued at ~USD 32,376.96 million in 2024 and is projected to expand at a CAGR of 8.77% from 2025 to 2033. This growth is driven by rising consumer demand for affordable mobility, the rapid spread of online used-car marketplaces, and stronger financing options.

Q2: Which segment has the largest share of the Southeast Asia Used Cars market by vehicle type?

The Hatchback segment holds the largest market share across Southeast Asia. Its dominance stems from lower ownership costs, high fuel efficiency, and strong resale value, making hatchbacks the preferred choice among first-time buyers and urban commuters.

Q3: What are the driving factors for the growth of the Southeast Asia Used Cars market?

Market growth is supported by several structural drivers: rising middle-income populations seeking cost-effective mobility, rapid digitalization of used-car transactions, expansion of certified pre-owned programs, and improved access to vehicle financing. Increasing new-car prices are also pushing consumers toward high-quality used options.

Q4: What are the emerging technologies and trends in the Southeast Asia Used Cars market?

Key trends shaping the market include AI-based vehicle valuation tools, end-to-end digital inspection and verification, omnichannel sales models, embedded finance offerings, and growing demand for younger used vehicles (0–3 years). Platforms are also integrating 360-degree imaging and real-time pricing analytics to improve transparency.

Q5: What are the key challenges in the Southeast Asia Used Cars market?

The market faces several challenges, such as dominance of the unorganized sector, inconsistent vehicle history data, limited availability of quality used EVs, high refurbishment and logistics costs, and varying regulatory frameworks across ASEAN countries, which affect cross-border growth and standardization.

Q6: Which country dominates the Southeast Asia Used Cars market?

Indonesia currently leads the regional market owing to its large vehicle parc, strong demand for affordable mobility, and rapid expansion of organized used-car platforms. High urbanization and preference for online vehicle discovery also contribute to Indonesia’s dominance.

Q7: Who are the key players in the Southeast Asia Used Cars market?

Leading companies in the Southeast Asia Used Cars market include:

• Carro

• CARSOME Sdn Bhd

• Motor Trader (MT Digital Sdn Bhd)

• Cardekho SEA (Cardekho Group)

• Mudah.my Sdn Bhd

• OLX (Astra)

• AutoDeal (Sirqo Group Inc.)

• Sgcarmart

• SBT CO., LTD.

• CHOBROD CO., LTD

Q8: How is digitalization transforming the Southeast Asia Used Cars market?

Digitalization is reshaping purchasing behavior through online listings, AI-powered pricing, virtual inspections, and integrated financing. The shift to transparent, data-driven platforms is accelerating organized sector growth and improving transaction reliability for buyers and sellers.

Q9: What factors should businesses and investors evaluate before entering the Southeast Asia Used Cars market?

Key considerations include the region’s fragmented dealer ecosystem, regulatory variations across ASEAN, local consumer preferences, competition from established digital marketplaces, and the strength of logistics and refurbishment infrastructure. Evaluating demand for certified vehicles is critical for long-term profitability.

Related Reports

Customers who bought this item also bought