- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

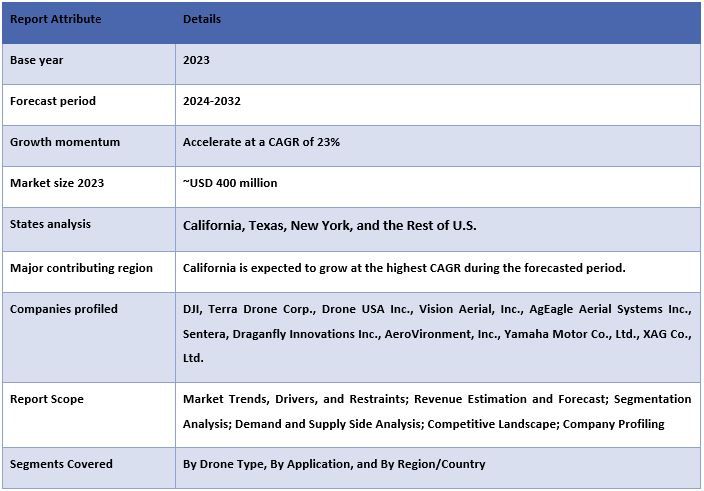

US Agricultural Drone Market: Current Analysis and Forecast (2024-2032)

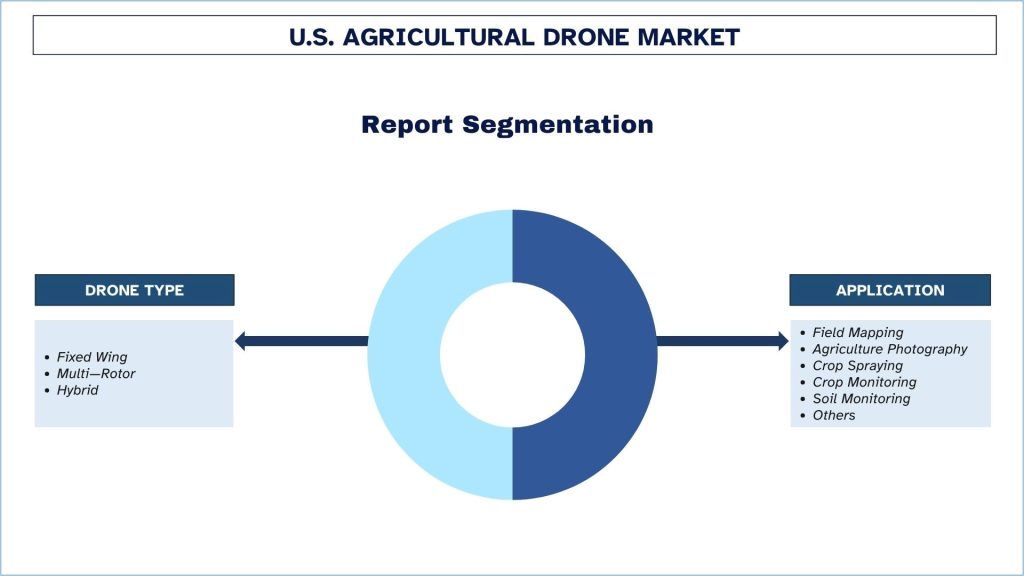

Emphasis on Drone Type (Fixed-Wing, Multi-Rotor, Hybrid), Application (Field Mapping, Crop Spraying, Agricultural Photography, Crop Monitoring, Soil Monitoring) and Region (Mid-West, South, Northeast, West)

U.S. Agricultural Drone Market Size & Forecast

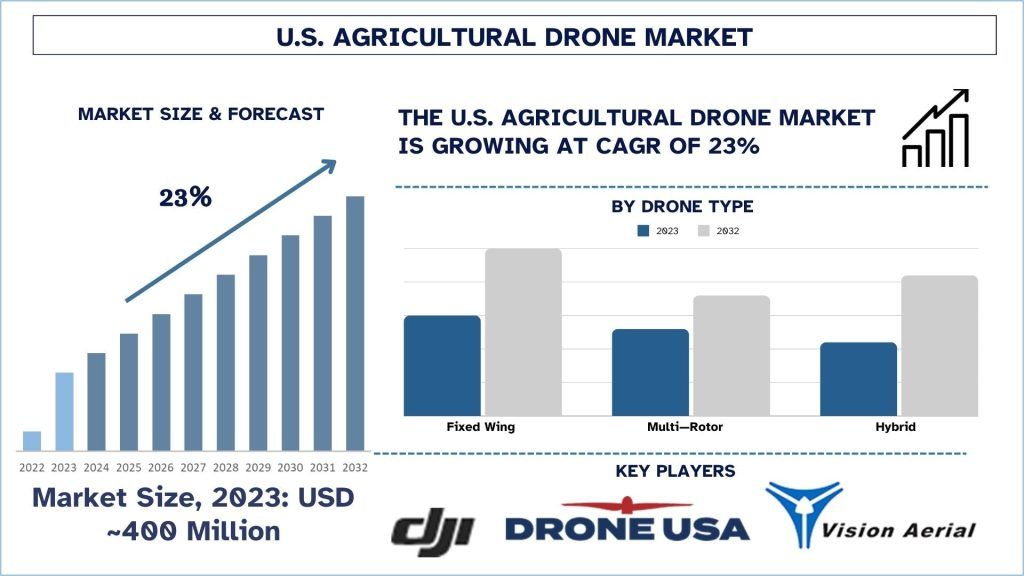

The market size of the U.S. Agricultural Drone market in 2023 was USD approximately 400 million and this market is expected to grow at a CAGR of approximately 23% throughout the forecast of 2024-2032 due to the growing use of precision farming and adoption of agricultural drone.

U.S. Agricultural Drone Market Analysis

The use of UAVs for various agricultural activities is defined as the agricultural drone market. They are fitted with enhanced sensors, cameras, and applications with AI and machine learning skills which enable farmers to access accurate data to monitor crop productivity, use assets effectively, and expel input expenditures. The use of agricultural drones is, however, particularly state in some of the biggest agricultural markets where issues, including shortage of workers supplies, water ration, and high demand for production and productivity of crops steer the use of technology-driven drones.

In this sector, major companies in the U.S. agricultural drone market are implementing growth strategies such as DaaS, taking regional distribution partnerships, and including AI technology in precision farming agriculture drone solutions. They are also partnering with governments to take advantage of subsidies and favorable regulations as well as designing versatile equipment that includes both spraying, monitoring, and seeding equipment to attract both large-scale and small-scale farmers. In February 2024, Volatus Aerospace Corp. announced that it had received authorization from the Federal Aviation Administration (FAA) in the USA for Commercial Agricultural Aircraft Operations using drones. They are attracting access and scalability which is the key to the spread of these approaches all over the region.

U.S. Agricultural Drone Market Trends

This section discusses the key market trends influencing the U.S. Agricultural Drone segments as identified by our research experts.

Field Mapping Transforming Industry

Field Mapping is one of the significant segments promoting the advancement of the agricultural drone market; this segment helps farmers obtain extensive information on crop conditions, soil opportunities, and differences in the field. Producers can use multispectral and thermal sensors mounted on drones to generate detailed chemical and thermal maps that help them determine where their attention is required be it water stress nutrient deficiencies or possible pest infestation. This is a more quantitative way of arranging resources to flow where they are most needed and to help crops grow better faster and more efficiently. The increasing significance of precision agriculture to food security and sustainability in the U.S. region is creating a higher demand for field mapping drones, which is driving the market.

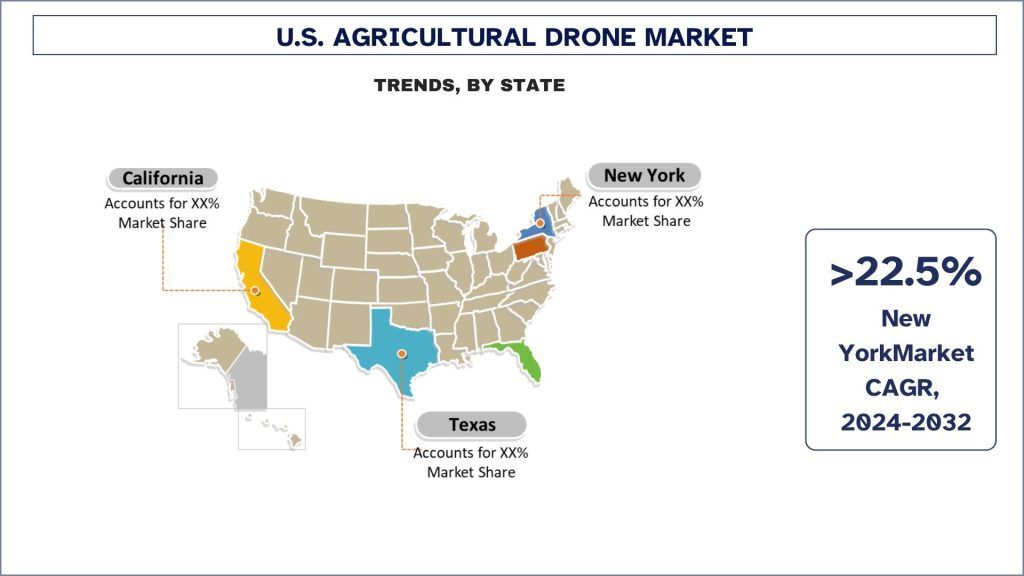

New York Dominated the Market in 2023

New York influences the way agricultural drones evolve by offering technological support from its innovation centres and universities. The state favors drone technology and sometimes funds its initiatives, including precision agriculture, through its universities and partnering agritech startups. Apple, grape, and dairy farming are among a few of the large varieties of crops that are grown in New York that are positively impacted by the use of drones in monitoring and management. The state government also promotes environmental conservation in farming and thus the need to adopt sustainable farming practices hence the growing use of these drones to monitor the use of water, pests, and the general crops’ health. Besides, favorable FAA regulations and investment in rural broadband advance drone use across the region.

U.S. Agricultural Drone Industry Overview

U.S. Agricultural Drone is competitive, with several U.S. and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions. Some of the major players operating in the market are DJI, Terra Drone Corp., Drone USA Inc., Vision Aerial, Inc., AgEagle Aerial Systems Inc., Sentera, Draganfly Innovations Inc., AeroVironment, Inc., Yamaha Motor Co., Ltd., XAG Co., Ltd.

U.S. Agricultural Drone Market News

- On September 18, 2024 – The new Sprayhawk drone, designed by Rotor Technologies Inc. in New Hampshire, is the world’s largest agricultural drone. With a 110-gallon (500 liters) capacity and a spray rate of 240 acres per hour, it offers unmatched efficiency. Recently launched for USD 900,000, this UAV is set to revolutionize large-scale farming.

U.S. Agricultural Drone Market Report Coverage

Reasons to buy this report:

- The study includes market sizing and forecasting analysis validated by authenticated key industry experts.

- The report presents a quick review of overall industry performance at one glance.

- The report covers an in-depth analysis of prominent industry peers with a primary focus on key business financials, product portfolios, expansion strategies, and recent developments.

- Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

- The study comprehensively covers the market across different segments.

- Deep dive regional level analysis of the industry.

Customization Options:

U.S. Agricultural Drone can further be customized as per the requirement or any other market segment. Besides this, UMI understands that you may have your own business needs; hence, feel free to connect with us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the U.S. Agricultural Drone Market Analysis (2022-2032)

Analyzing the historical market, estimating the current market, and forecasting the future market of the U.S. Agricultural Drone market were the three major steps undertaken to create and analyze the adoption of U.S. Agricultural Drones in major regions. Exhaustive secondary research was conducted to collect the historical market numbers and estimate the current market size. Secondly, numerous findings and assumptions were taken into consideration to validate these insights. Moreover, exhaustive primary interviews were also conducted, with industry experts across the value chain of the U.S. Agricultural Drone market. Post assumption and validation of market numbers through primary interviews, we employed a top-down/bottom-up approach to forecasting the complete market size. Thereafter, market breakdown and data triangulation methods were adopted to estimate and analyze the market size of segments and sub-segments of the industry. Detailed methodology is explained below:

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

A detailed secondary study was conducted to obtain the historical market size of the U.S. Agricultural Drone market through company internal sources such as annual reports & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database, and other credible publications.

Step 2: Market Segmentation:

After obtaining the historical market size of U.S. Agricultural Drone, we conducted a detailed secondary analysis to gather historical market insights and share for different segments & sub-segments for major regions. Major segments are included in the report, such as drone type, application, and country. Further country-level analyses were conducted to evaluate the overall adoption of testing models in that region.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, we conducted a detailed factor analysis to estimate the current market size of the U.S. Agricultural Drone market. Further, we conducted factor analysis using dependent and independent variables such as drone type, application, and U.S. Agricultural Drone regions. A thorough analysis was conducted of demand and supply-side scenarios considering top partnerships, mergers and acquisitions, business expansion, and product launches in the U.S. Agricultural Drone market sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above three steps, we arrived at the current market size, key players in the U.S. Agricultural Drone market, and market shares of the segments. All the required percentage shares split and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weights were assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e., the top-down/bottom-up approach were applied to arrive at the market forecast for 2032 for different segments and sub-segments across the major markets. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of revenue (USD) and the adoption rate of the U.S. Agricultural Drone across the major markets domestically

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the S. Agricultural Drone in terms of products offered. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs), including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, Regional Head, Country Head, etc.) across major regions. Primary research findings were then summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

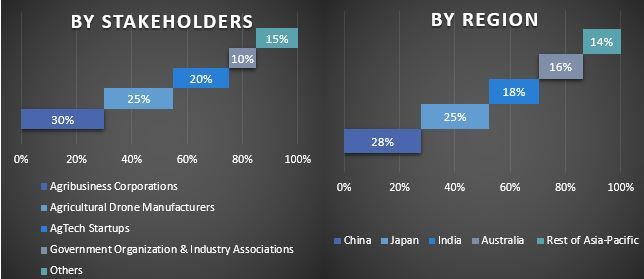

Split of Primary Participants in Different Regions

Market Engineering

The data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers for each segment and sub-segment of the U.S. Agricultural Drone. Data was split into several segments and sub-segments after studying various parameters and trends in the drone type, application, and country of the U.S. Agricultural Drone market.

The main objective of the U.S. Agricultural Drone Market Study

The current & future market trends of the U.S. Agricultural Drone were pinpointed in the study. Investors can gain strategic insights to base their discretion for investments on the qualitative and quantitative analysis performed in the study. Current and future market trends determined the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit from a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the S. Agricultural Drone market in terms of value (USD). Also, analyze the current and forecast market size of different segments and sub-segments.

- Segments in the study include areas of drone type, application, and country.

- Define and analyze the regulatory framework for the S. Agricultural Drone industry.

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors of the industry.

- Analyze the current and forecast market size of the S. Agricultural Drone market for the major regions.

- Major regions studied in the report include California, Texas, New York, and the Rest of U.S.

- Company profiles of the S. Agricultural Drone market and the growth strategies adopted by the market players to sustain in the fast-growing market.

- Deep dive regional level analysis of the industry

Frequently Asked Questions FAQs

Q1: What is the U.S. Agricultural Drone's current size and growth potential?

Q2: What are the driving factors for the growth of U.S. Agricultural Drone?

Q3: Which segment has the largest share of U.S. Agricultural Drone by application?

Q4: What are the emerging technologies and trends in U.S. Agricultural Drones?

Q5: Which state will dominate the U.S. Agricultural Drone Market?

Related Reports

Customers who bought this item also bought